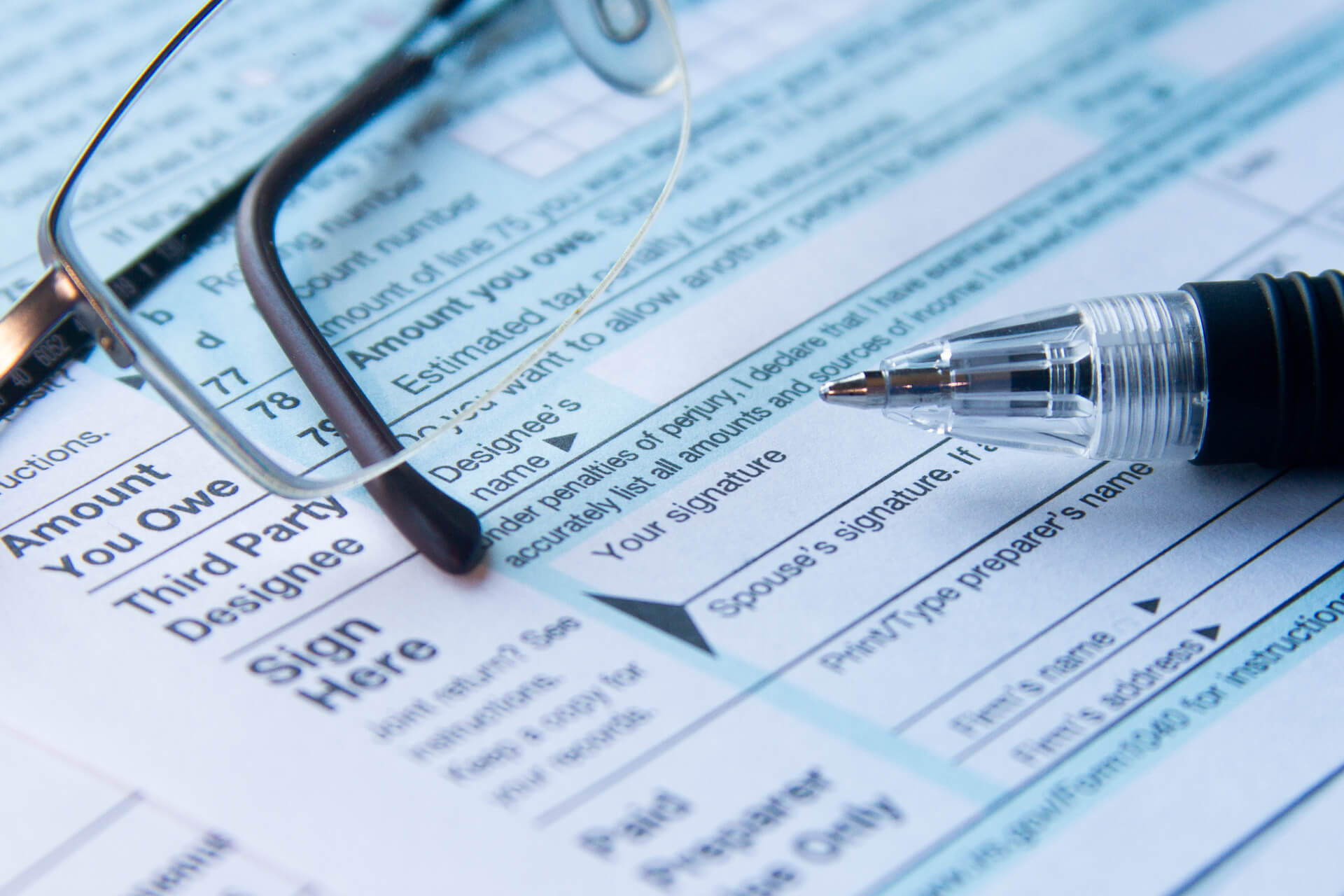

1040 Signature Page - Or, include the tax preparer’s stamped, typed,. Individual income tax return keywords: If someone is asking you for a signed. On irs form 1040, the signature line appears on the second page, below the section calculating total tax liability. You didn't sign the tax return when you filed it. Review return signature and pin guidelines in the volunteer resource guide (tab 12), for detailed guidelines for obtaining taxpayer signatures. The signature must be on the line on the tax return designated for the signature of the tax filer.

If someone is asking you for a signed. On irs form 1040, the signature line appears on the second page, below the section calculating total tax liability. You didn't sign the tax return when you filed it. Review return signature and pin guidelines in the volunteer resource guide (tab 12), for detailed guidelines for obtaining taxpayer signatures. Individual income tax return keywords: Or, include the tax preparer’s stamped, typed,. The signature must be on the line on the tax return designated for the signature of the tax filer.

Or, include the tax preparer’s stamped, typed,. On irs form 1040, the signature line appears on the second page, below the section calculating total tax liability. If someone is asking you for a signed. Individual income tax return keywords: You didn't sign the tax return when you filed it. Review return signature and pin guidelines in the volunteer resource guide (tab 12), for detailed guidelines for obtaining taxpayer signatures. The signature must be on the line on the tax return designated for the signature of the tax filer.

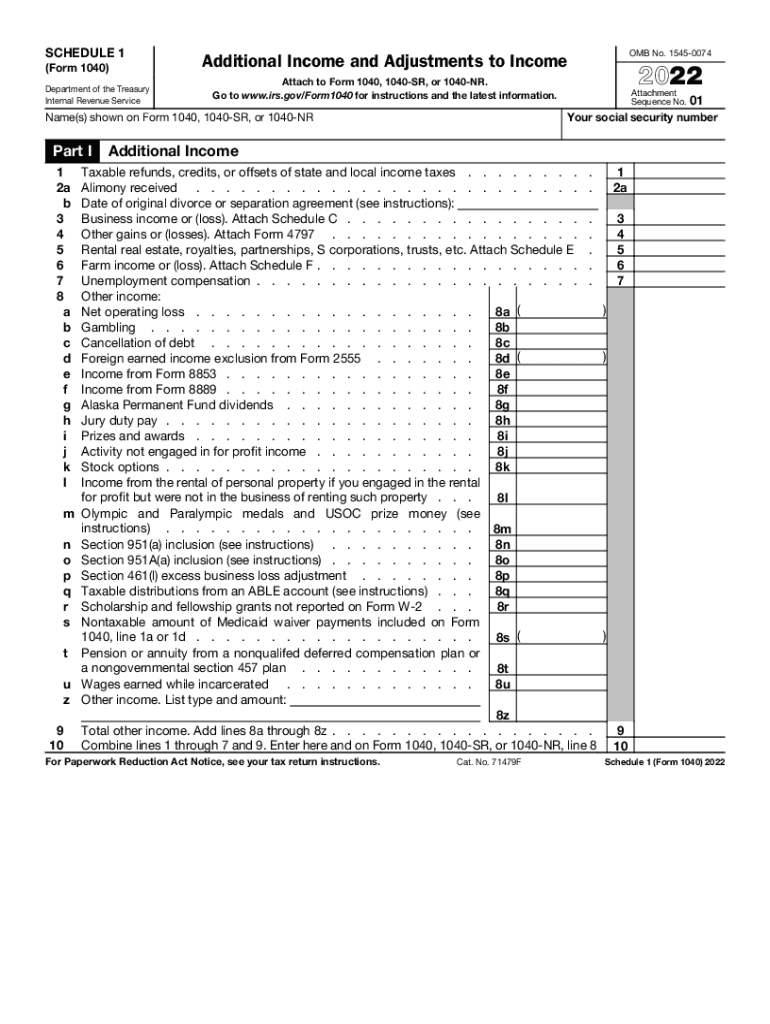

A1O04 Form 1040 Schedule A Itemized Deductions

Individual income tax return keywords: Review return signature and pin guidelines in the volunteer resource guide (tab 12), for detailed guidelines for obtaining taxpayer signatures. If someone is asking you for a signed. On irs form 1040, the signature line appears on the second page, below the section calculating total tax liability. The signature must be on the line on.

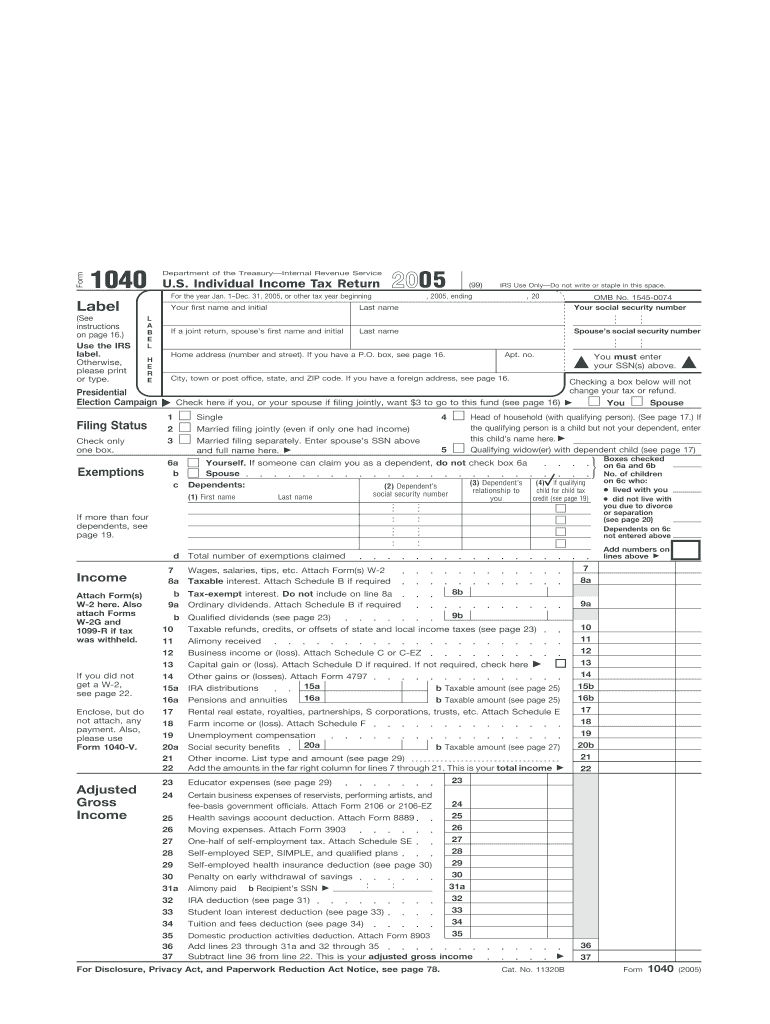

Tax Form 1040 Page 1 at Elmer Pritchard blog

On irs form 1040, the signature line appears on the second page, below the section calculating total tax liability. Individual income tax return keywords: Or, include the tax preparer’s stamped, typed,. Review return signature and pin guidelines in the volunteer resource guide (tab 12), for detailed guidelines for obtaining taxpayer signatures. If someone is asking you for a signed.

Schedule 1 1040 2025 Tax Form Jean S. Pagan

If someone is asking you for a signed. Or, include the tax preparer’s stamped, typed,. On irs form 1040, the signature line appears on the second page, below the section calculating total tax liability. You didn't sign the tax return when you filed it. Individual income tax return keywords:

Form 1040 US Individual Tax Return 2024

You didn't sign the tax return when you filed it. On irs form 1040, the signature line appears on the second page, below the section calculating total tax liability. The signature must be on the line on the tax return designated for the signature of the tax filer. Review return signature and pin guidelines in the volunteer resource guide (tab.

Page for individual images •

Or, include the tax preparer’s stamped, typed,. Review return signature and pin guidelines in the volunteer resource guide (tab 12), for detailed guidelines for obtaining taxpayer signatures. On irs form 1040, the signature line appears on the second page, below the section calculating total tax liability. If someone is asking you for a signed. Individual income tax return keywords:

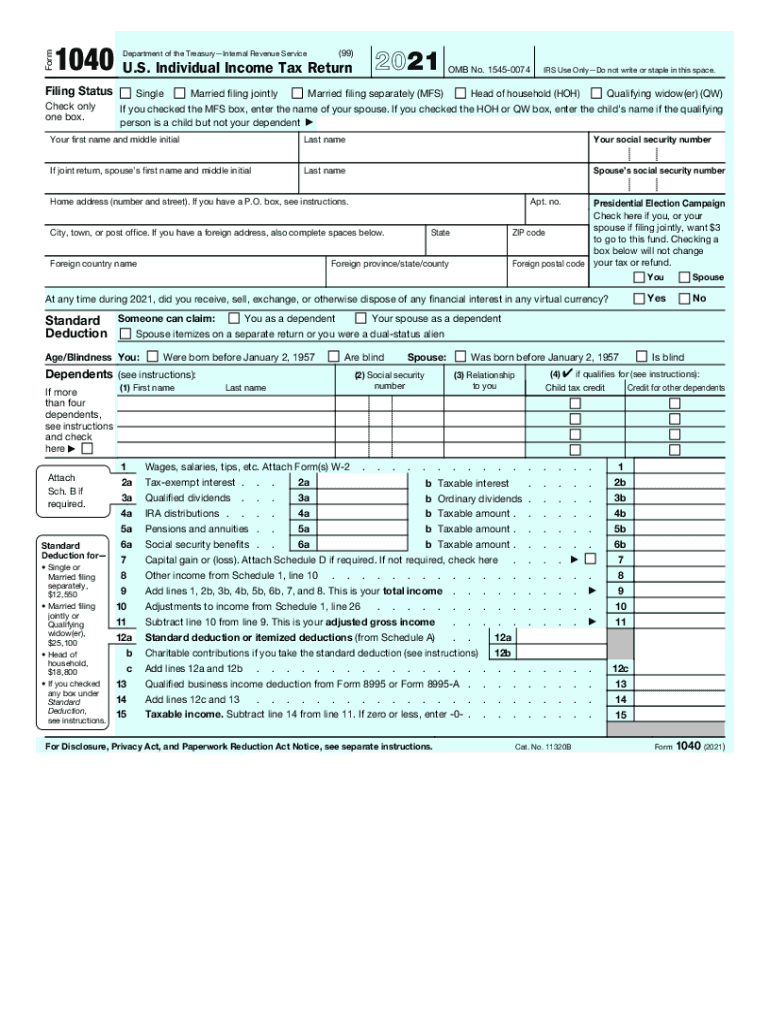

Printable IRS Form 1040 For Tax Year 2021 CPA Practice, 52 OFF

On irs form 1040, the signature line appears on the second page, below the section calculating total tax liability. The signature must be on the line on the tax return designated for the signature of the tax filer. Individual income tax return keywords: If someone is asking you for a signed. You didn't sign the tax return when you filed.

1040 Tax Table Instructions Matttroy

The signature must be on the line on the tax return designated for the signature of the tax filer. Review return signature and pin guidelines in the volunteer resource guide (tab 12), for detailed guidelines for obtaining taxpayer signatures. Individual income tax return keywords: If someone is asking you for a signed. On irs form 1040, the signature line appears.

2021 Form IRS 1040 Fill Online, Printable, Fillable, Blank pdfFiller

The signature must be on the line on the tax return designated for the signature of the tax filer. You didn't sign the tax return when you filed it. Review return signature and pin guidelines in the volunteer resource guide (tab 12), for detailed guidelines for obtaining taxpayer signatures. Or, include the tax preparer’s stamped, typed,. On irs form 1040,.

IRS 1040 2025 Form Printable Blank PDF Online

You didn't sign the tax return when you filed it. If someone is asking you for a signed. Or, include the tax preparer’s stamped, typed,. The signature must be on the line on the tax return designated for the signature of the tax filer. Review return signature and pin guidelines in the volunteer resource guide (tab 12), for detailed guidelines.

Form 1040 AOTM

You didn't sign the tax return when you filed it. The signature must be on the line on the tax return designated for the signature of the tax filer. On irs form 1040, the signature line appears on the second page, below the section calculating total tax liability. Or, include the tax preparer’s stamped, typed,. Individual income tax return keywords:

The Signature Must Be On The Line On The Tax Return Designated For The Signature Of The Tax Filer.

Review return signature and pin guidelines in the volunteer resource guide (tab 12), for detailed guidelines for obtaining taxpayer signatures. Or, include the tax preparer’s stamped, typed,. You didn't sign the tax return when you filed it. If someone is asking you for a signed.

Individual Income Tax Return Keywords:

On irs form 1040, the signature line appears on the second page, below the section calculating total tax liability.

:max_bytes(150000):strip_icc()/Form10402copy-054425ef8a5a4ca29b183c856f7e7133.jpg)