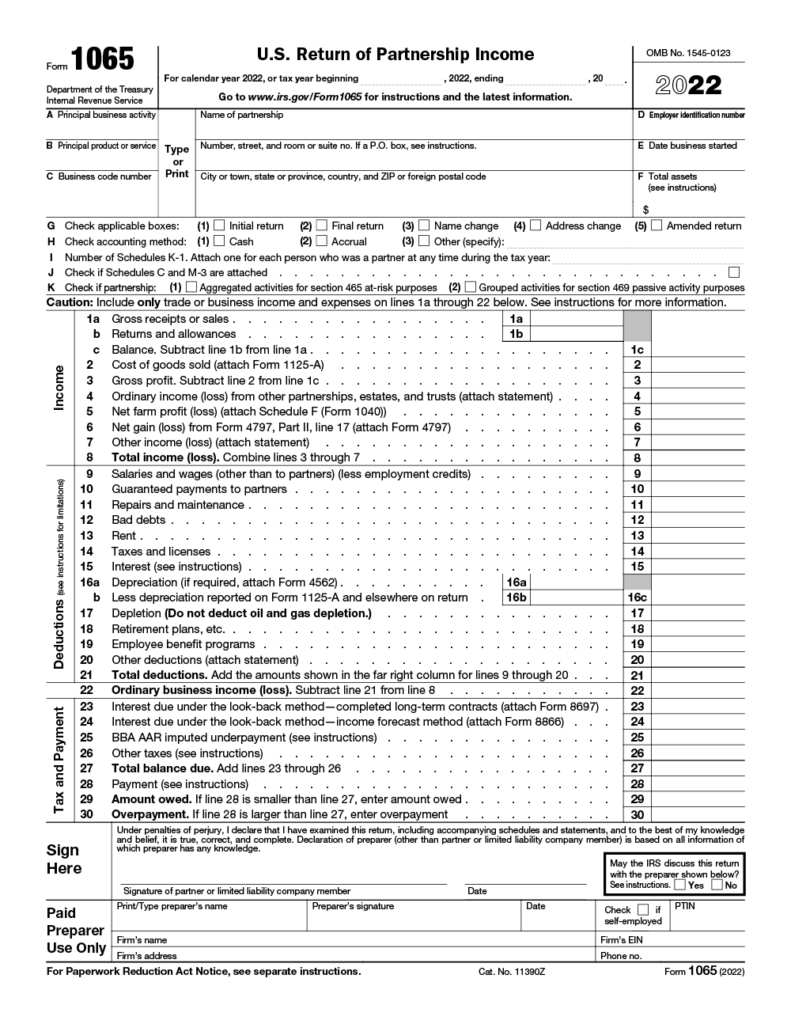

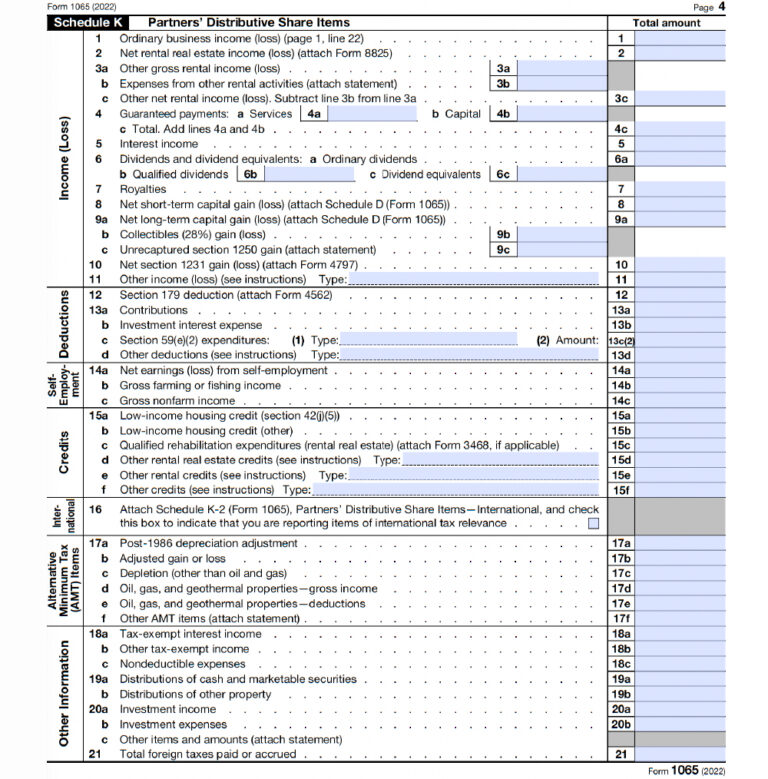

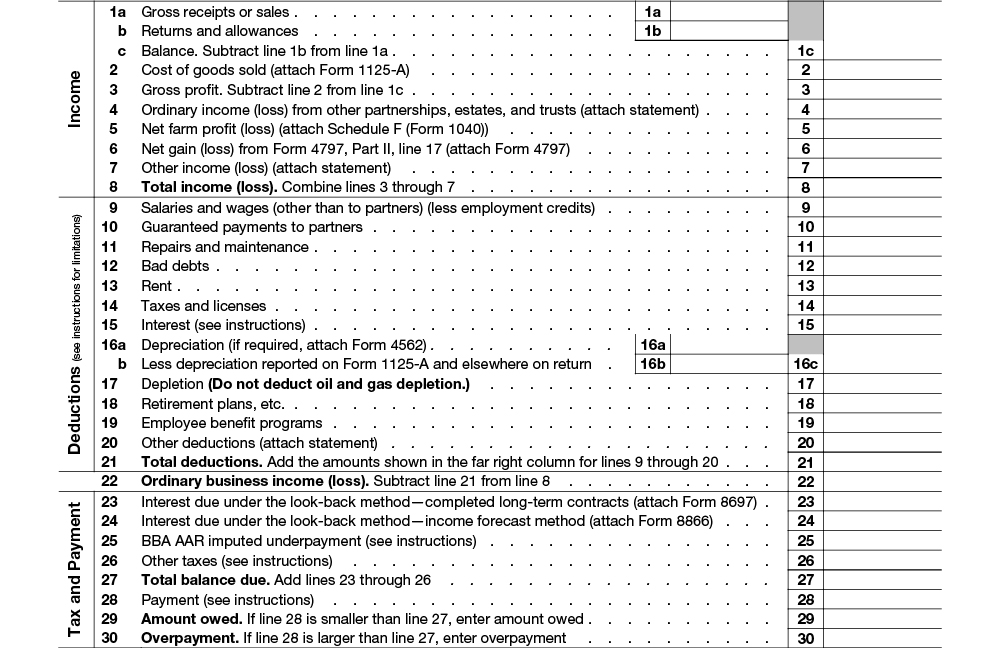

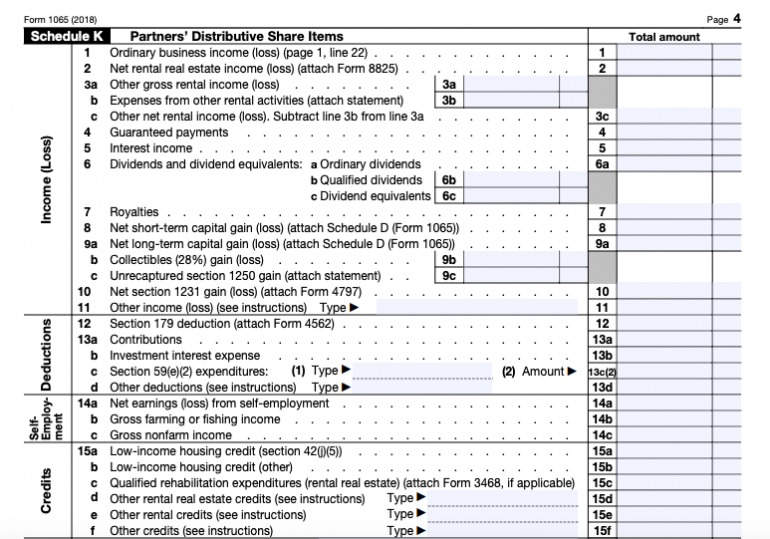

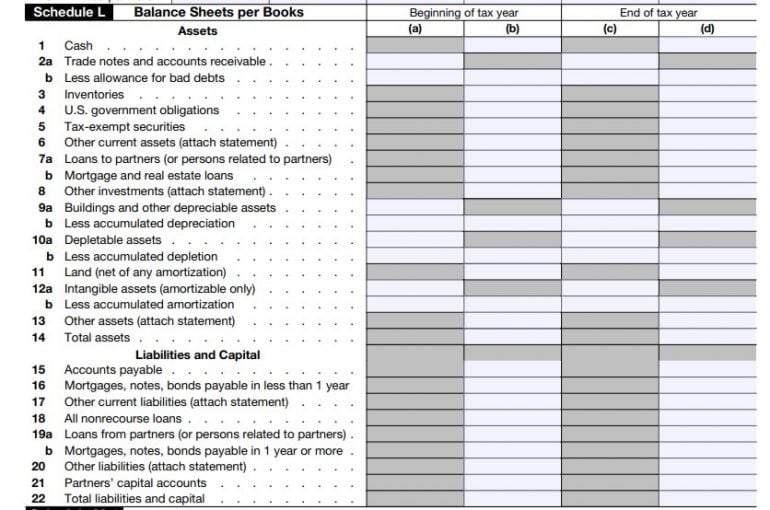

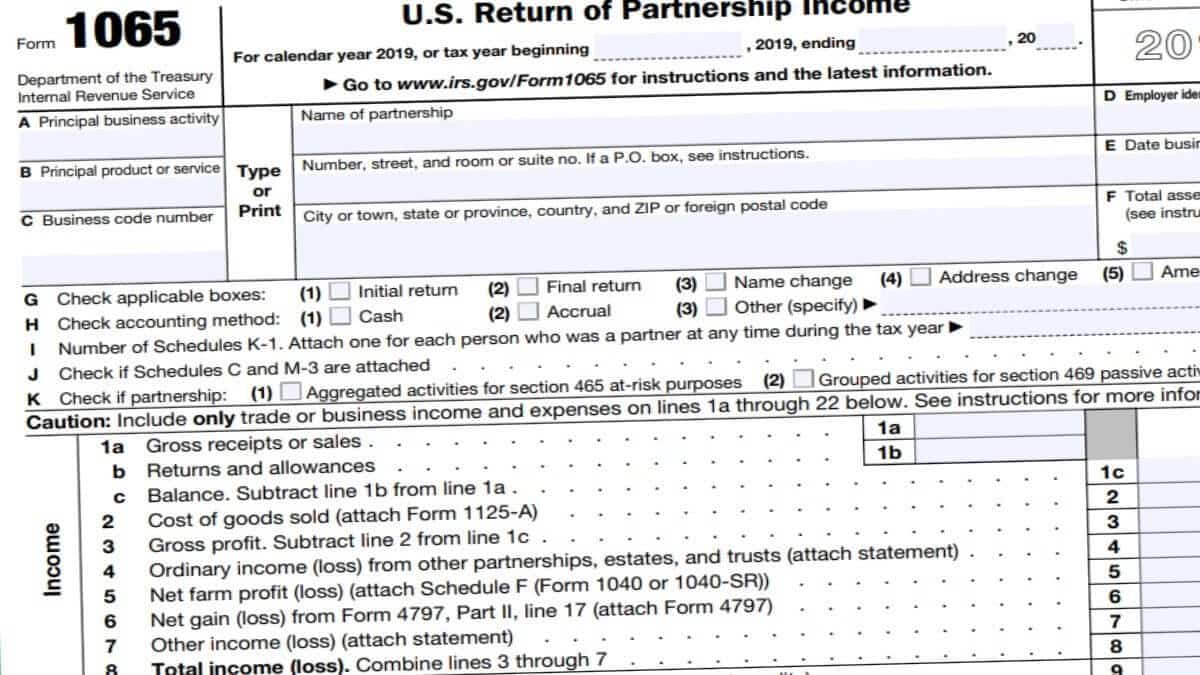

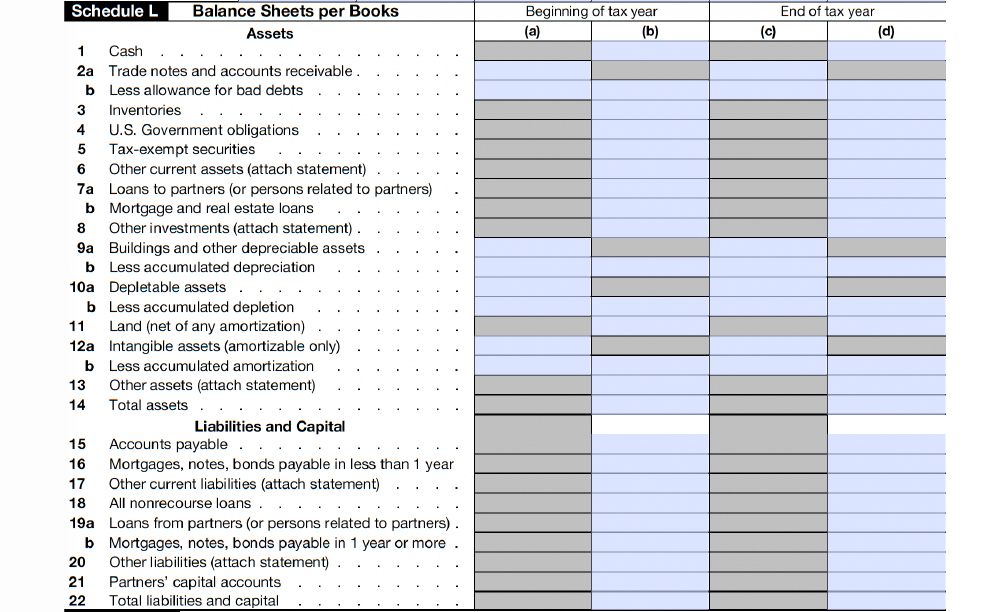

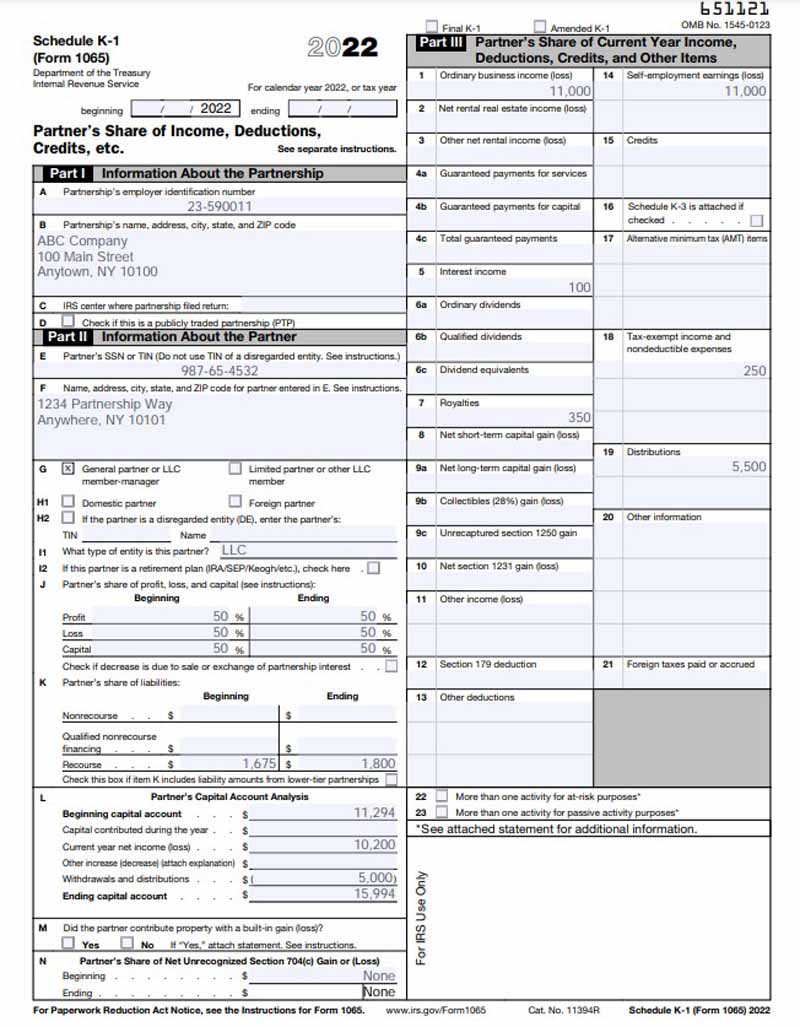

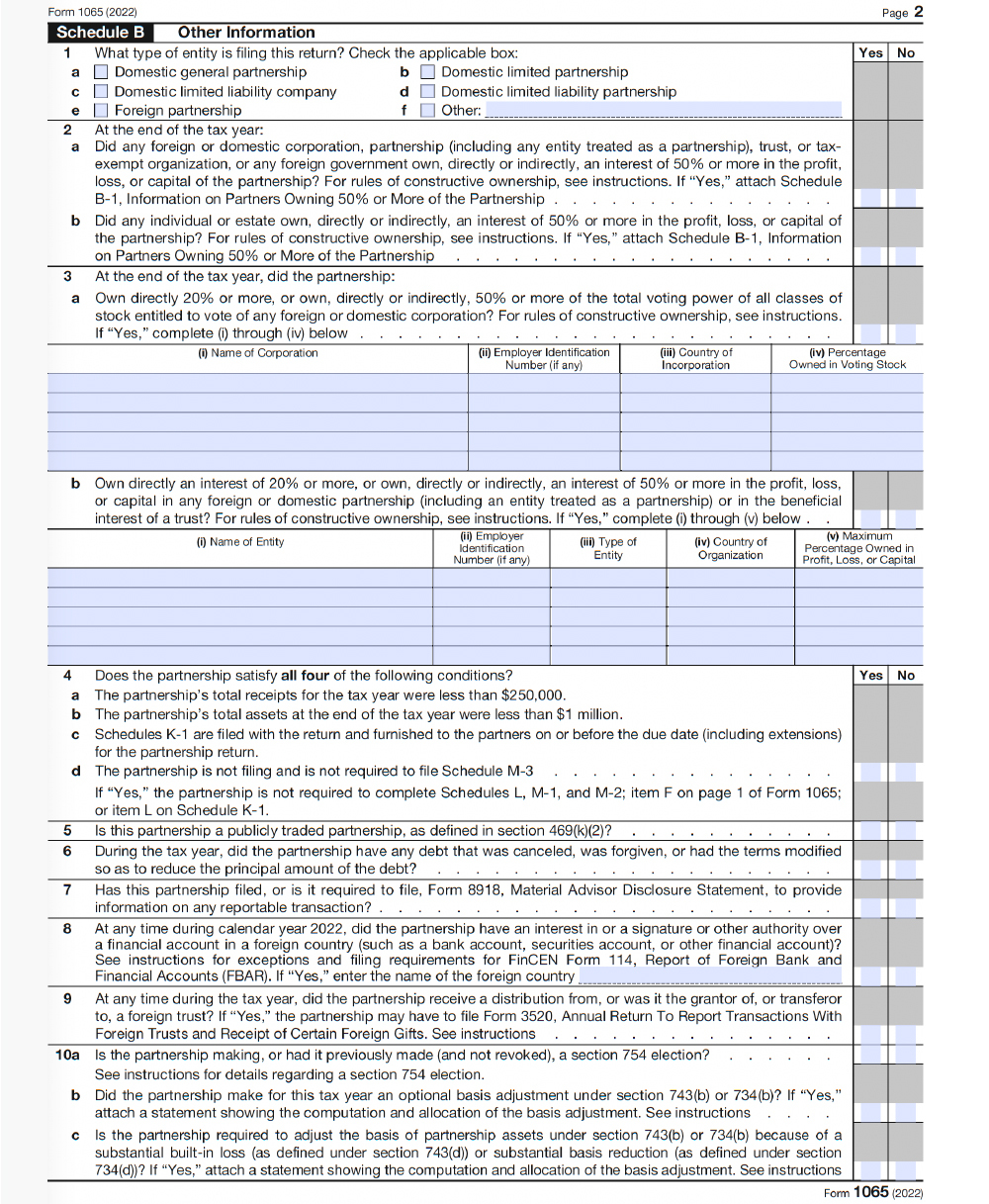

1065 Page 1 - Item f on page 1 of form 1065; Accrued tax is added to line 14 and any detail entries made in the taxes and licenses section are adjusted by the accrued tax. Irs form 1065 is used by partnerships to report their income, gains, losses, deductions, and credits for federal tax purposes.

Item f on page 1 of form 1065; Irs form 1065 is used by partnerships to report their income, gains, losses, deductions, and credits for federal tax purposes. Accrued tax is added to line 14 and any detail entries made in the taxes and licenses section are adjusted by the accrued tax.

Accrued tax is added to line 14 and any detail entries made in the taxes and licenses section are adjusted by the accrued tax. Irs form 1065 is used by partnerships to report their income, gains, losses, deductions, and credits for federal tax purposes. Item f on page 1 of form 1065;

Form 1065 Instructions U.S. Return of Partnership

Item f on page 1 of form 1065; Accrued tax is added to line 14 and any detail entries made in the taxes and licenses section are adjusted by the accrued tax. Irs form 1065 is used by partnerships to report their income, gains, losses, deductions, and credits for federal tax purposes.

Form 1065 Instructions U.S. Return of Partnership

Accrued tax is added to line 14 and any detail entries made in the taxes and licenses section are adjusted by the accrued tax. Item f on page 1 of form 1065; Irs form 1065 is used by partnerships to report their income, gains, losses, deductions, and credits for federal tax purposes.

Form 1065 Instructions U.S. Return of Partnership

Item f on page 1 of form 1065; Accrued tax is added to line 14 and any detail entries made in the taxes and licenses section are adjusted by the accrued tax. Irs form 1065 is used by partnerships to report their income, gains, losses, deductions, and credits for federal tax purposes.

1065 tax form 2020 boostvsera

Item f on page 1 of form 1065; Accrued tax is added to line 14 and any detail entries made in the taxes and licenses section are adjusted by the accrued tax. Irs form 1065 is used by partnerships to report their income, gains, losses, deductions, and credits for federal tax purposes.

1065 Instructions 2024 Schedule M1 Schedule C 2024

Item f on page 1 of form 1065; Irs form 1065 is used by partnerships to report their income, gains, losses, deductions, and credits for federal tax purposes. Accrued tax is added to line 14 and any detail entries made in the taxes and licenses section are adjusted by the accrued tax.

1065 Form 2024 2025

Irs form 1065 is used by partnerships to report their income, gains, losses, deductions, and credits for federal tax purposes. Item f on page 1 of form 1065; Accrued tax is added to line 14 and any detail entries made in the taxes and licenses section are adjusted by the accrued tax.

Form 1065 Instructions U.S. Return of Partnership

Item f on page 1 of form 1065; Irs form 1065 is used by partnerships to report their income, gains, losses, deductions, and credits for federal tax purposes. Accrued tax is added to line 14 and any detail entries made in the taxes and licenses section are adjusted by the accrued tax.

2023 Form 1065 Printable Forms Free Online

Irs form 1065 is used by partnerships to report their income, gains, losses, deductions, and credits for federal tax purposes. Item f on page 1 of form 1065; Accrued tax is added to line 14 and any detail entries made in the taxes and licenses section are adjusted by the accrued tax.

Form 1065 Instructions U.S. Return of Partnership

Accrued tax is added to line 14 and any detail entries made in the taxes and licenses section are adjusted by the accrued tax. Item f on page 1 of form 1065; Irs form 1065 is used by partnerships to report their income, gains, losses, deductions, and credits for federal tax purposes.

Form 1065 Instructions U.S. Return of Partnership

Accrued tax is added to line 14 and any detail entries made in the taxes and licenses section are adjusted by the accrued tax. Item f on page 1 of form 1065; Irs form 1065 is used by partnerships to report their income, gains, losses, deductions, and credits for federal tax purposes.

Item F On Page 1 Of Form 1065;

Irs form 1065 is used by partnerships to report their income, gains, losses, deductions, and credits for federal tax purposes. Accrued tax is added to line 14 and any detail entries made in the taxes and licenses section are adjusted by the accrued tax.