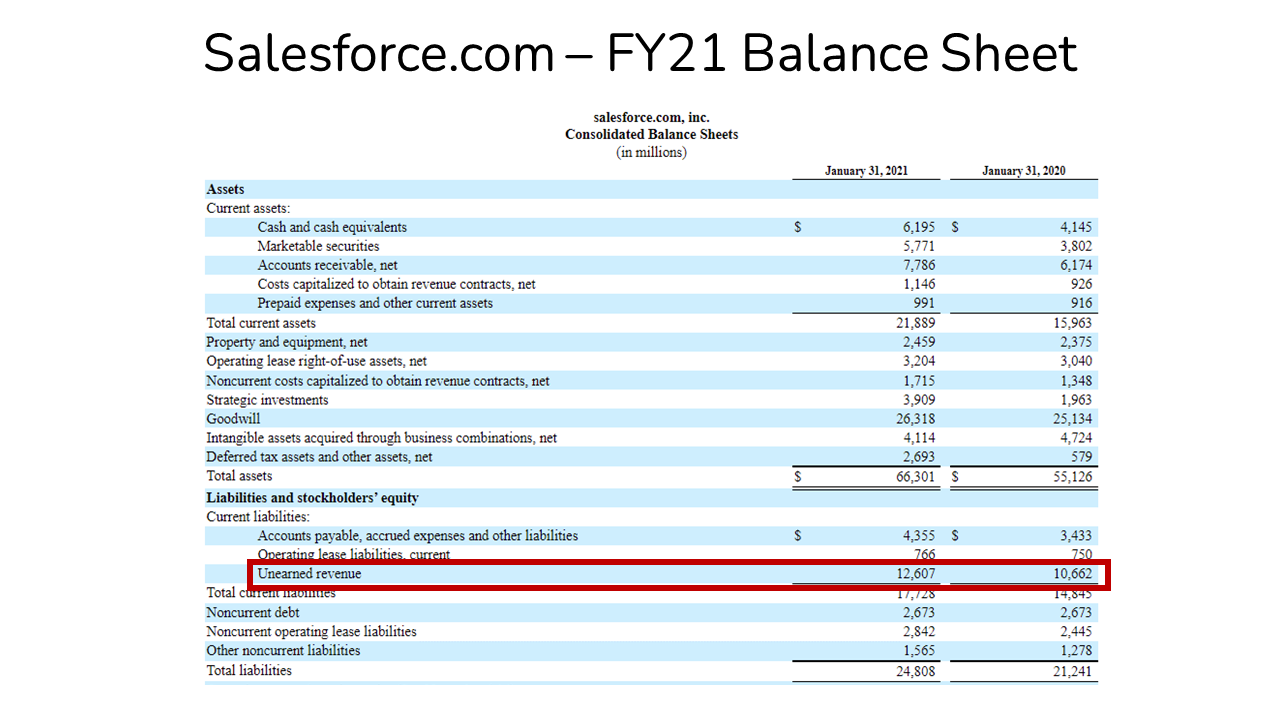

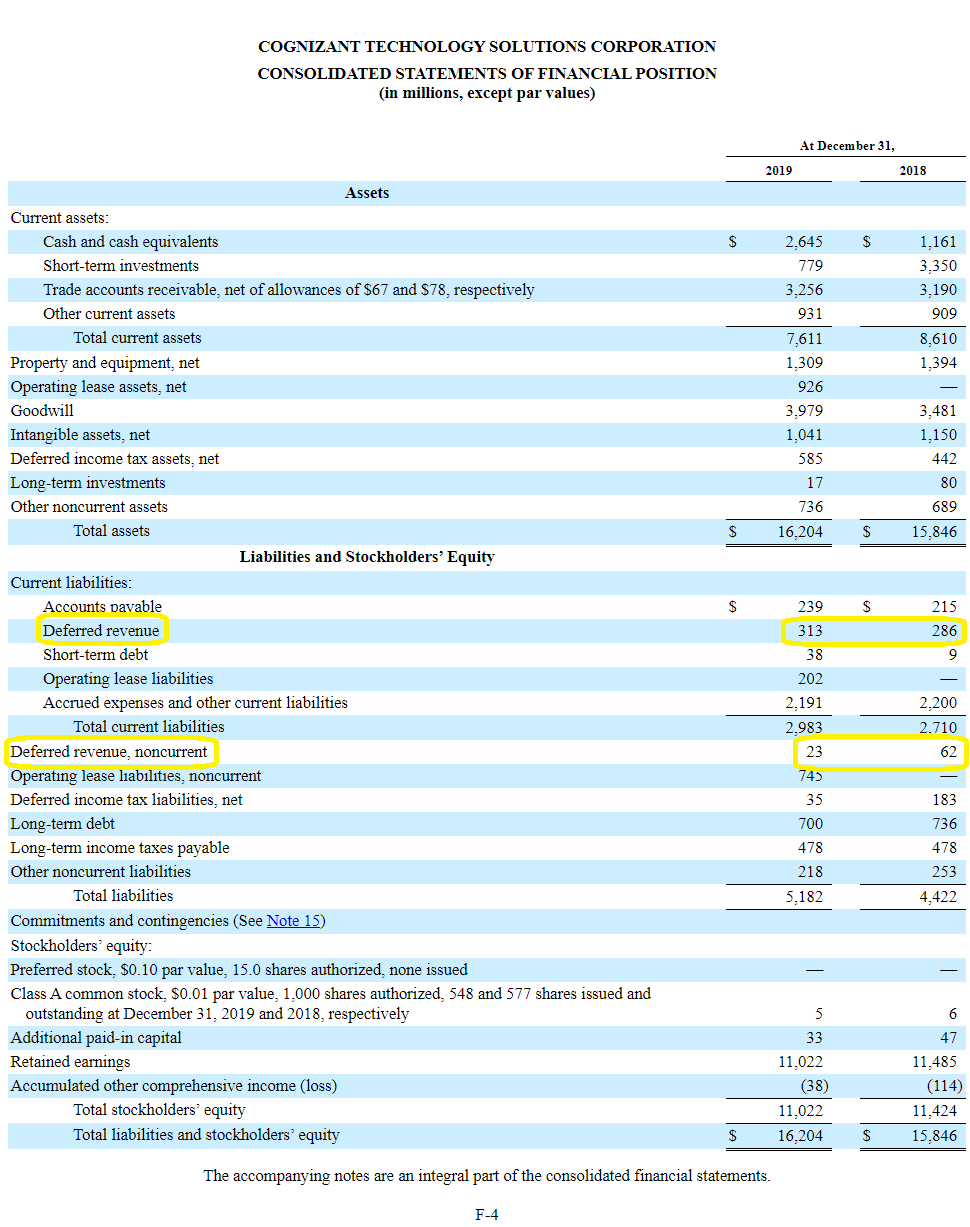

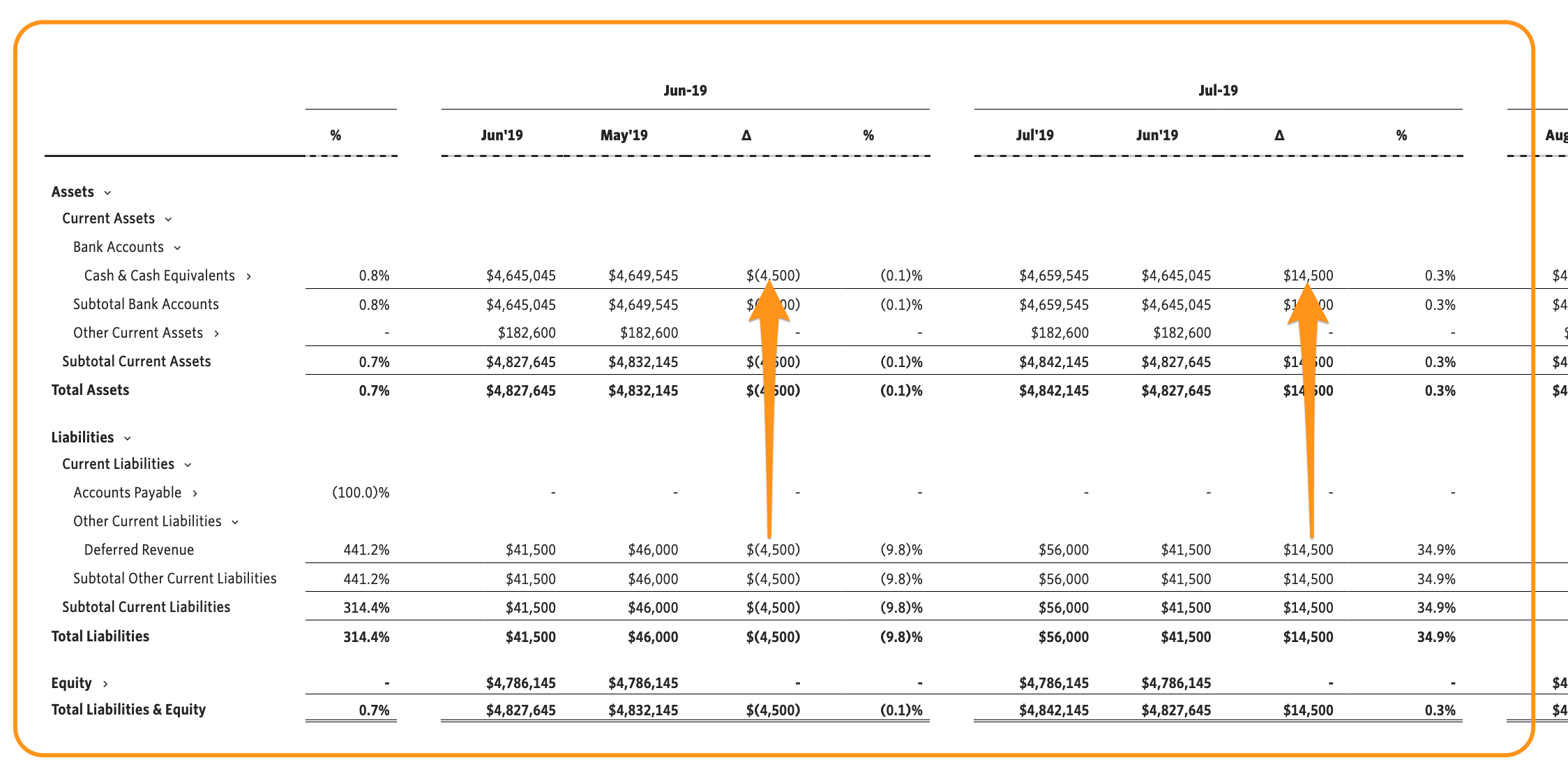

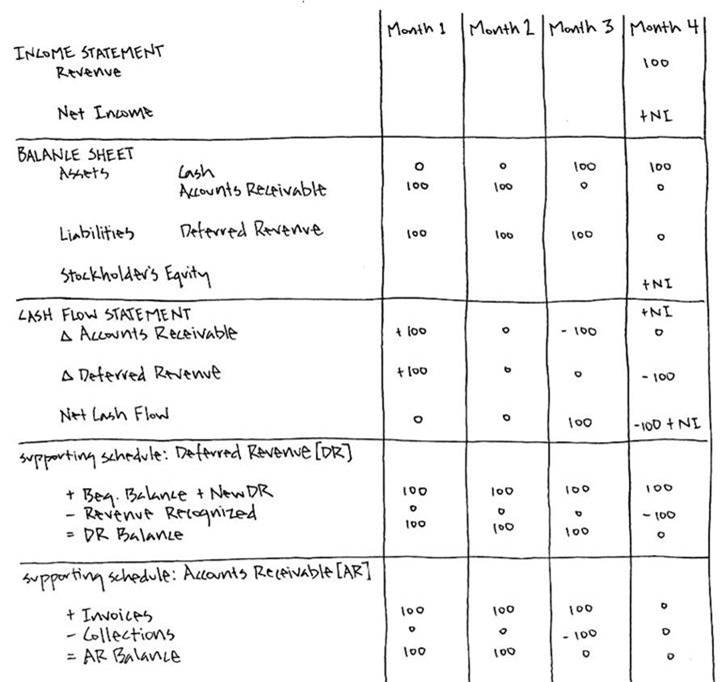

Deferred Revenue On Balance Sheet - Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. Also called unearned revenue, it appears as a liability on. Deferred revenue, also sometimes called “unearned” revenue or deferred income, is any revenue that you collect from your customers before earning it—a prepayment on a big web. On the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until the product or service is delivered. On august 31, the company would record revenue of $100 on the.

Also called unearned revenue, it appears as a liability on. On the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until the product or service is delivered. Deferred revenue, also sometimes called “unearned” revenue or deferred income, is any revenue that you collect from your customers before earning it—a prepayment on a big web. On august 31, the company would record revenue of $100 on the.

When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income. On august 31, the company would record revenue of $100 on the. Also called unearned revenue, it appears as a liability on. On the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created. Deferred revenue, also sometimes called “unearned” revenue or deferred income, is any revenue that you collect from your customers before earning it—a prepayment on a big web. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until the product or service is delivered. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered.

Deferred Revenue Accounting, Definition, Example

Also called unearned revenue, it appears as a liability on. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until the product or service is delivered. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. Deferred revenue, also.

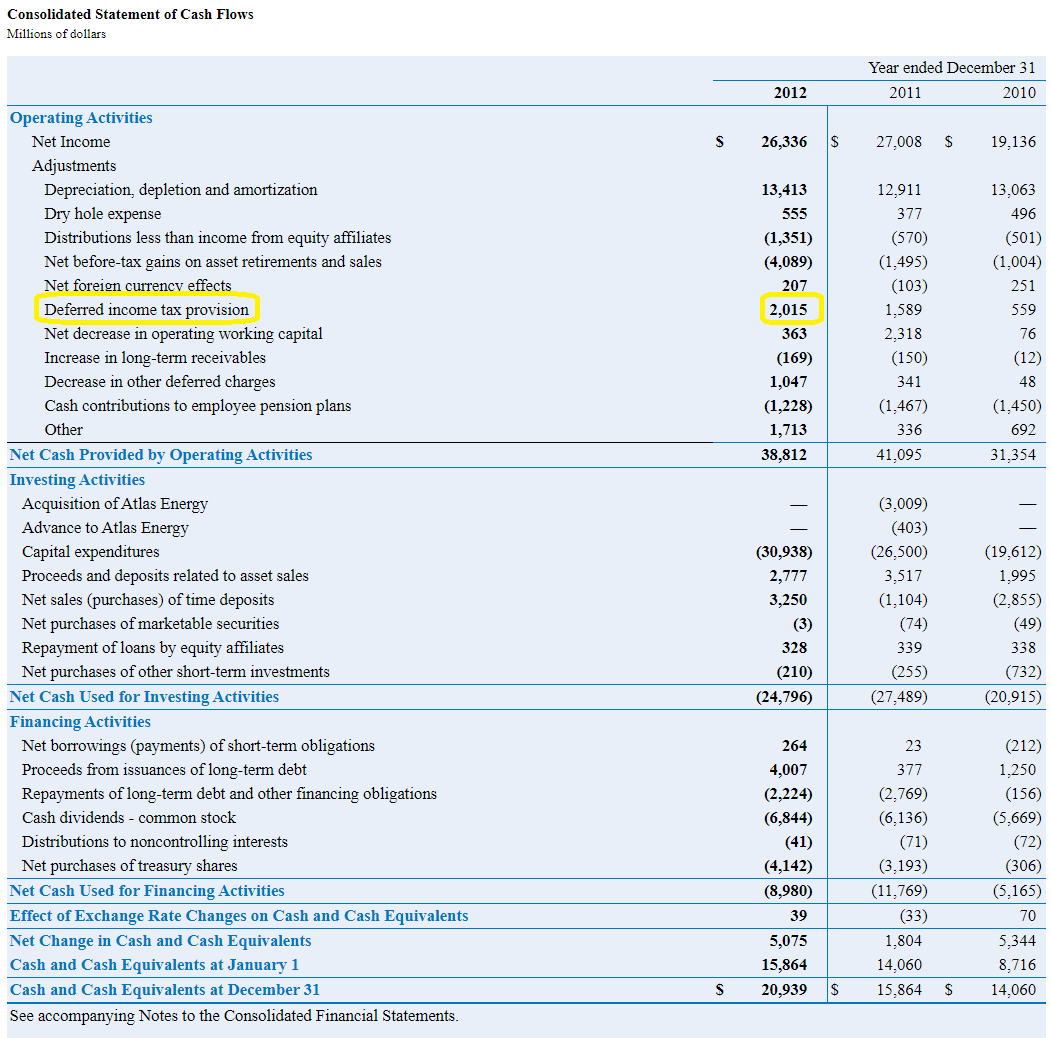

Deferred Tax Liabilities Explained (with RealLife Example in a

Also called unearned revenue, it appears as a liability on. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to.

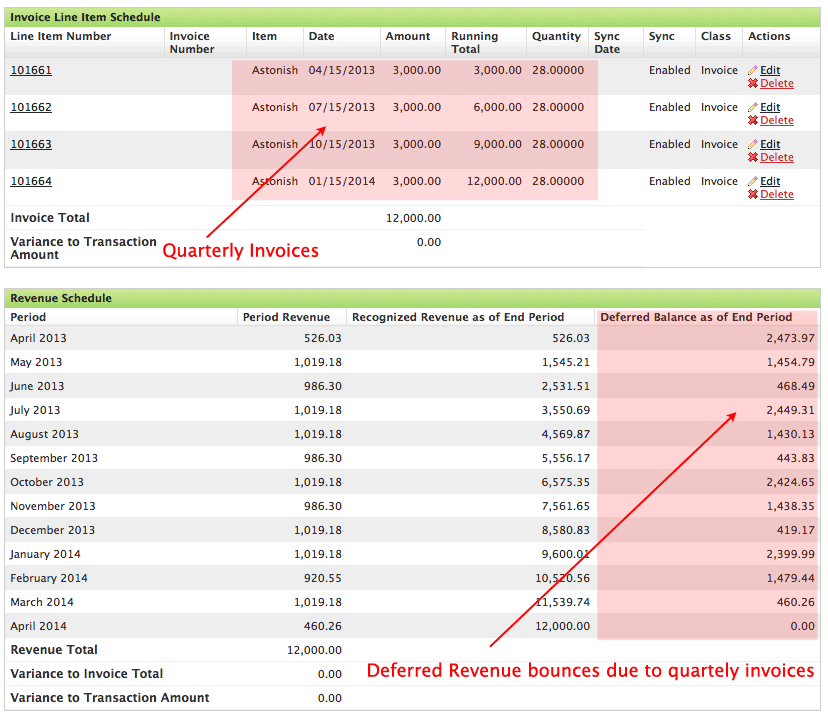

What is Deferred Revenue in a SaaS Business? SaaSOptics

On august 31, the company would record revenue of $100 on the. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. Deferred revenue, also sometimes called “unearned” revenue or deferred income, is any revenue that you collect from your customers before earning it—a prepayment on a big web. On the.

How To Record SaaS Deferred Revenue? FreeCashFlow.io

Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. On august 31, the company would record revenue of $100 on the. Deferred revenue, also sometimes called “unearned” revenue or deferred income, is any revenue that you collect from your customers before earning it—a prepayment on a big web. When a.

What is Deferred Revenue? The Ultimate Guide (2022)

Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until the product or service is delivered. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. Deferred revenue, also sometimes called “unearned” revenue or deferred income, is any revenue.

How To Record SaaS Deferred Revenue? FreeCashFlow.io

Also called unearned revenue, it appears as a liability on. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until the product or service is delivered. On august 31, the company would record revenue of $100 on the. Deferred revenue is a payment a company receives in advance.

Deferred Revenue Debit or Credit and its Flow Through the Financials

On august 31, the company would record revenue of $100 on the. Also called unearned revenue, it appears as a liability on. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until the product or service is delivered. When a customer prepays for goods or services, the business.

Simple Deferred Revenue with Jirav Pro

Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income. On the balance sheet, cash would increase by $1,200, and.

What Is Deferred Revenue? Complete Guide Pareto Labs

Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until the product or service is delivered. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income. Also.

Deferred Revenue A Simple Model

On august 31, the company would record revenue of $100 on the. Also called unearned revenue, it appears as a liability on. Deferred revenue, also sometimes called “unearned” revenue or deferred income, is any revenue that you collect from your customers before earning it—a prepayment on a big web. Deferred revenue is a payment a company receives in advance for.

Deferred Revenue, Also Sometimes Called “Unearned” Revenue Or Deferred Income, Is Any Revenue That You Collect From Your Customers Before Earning It—A Prepayment On A Big Web.

When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income. On august 31, the company would record revenue of $100 on the. Also called unearned revenue, it appears as a liability on. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered.

Deferred Revenue Is Recorded As A Liability On The Balance Sheet, Since The Company Has An Unmet Obligation To The Customer Until The Product Or Service Is Delivered.

On the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created.