Du Page County Property Tax - You can access public records by searching by. Additionally, 1,344 tax bills were emailed to owners. In cook county, property tax regulations are a bit trickier. Classification rules apply different rates to residential, commercial,. Explore our comprehensive guide on dupage county property tax. The dupage county clerk's office is responsible for calculating property tax rates for all taxing districts in dupage county. This site provides access to the dupage county property records database. Understand the tax rates, exemptions, and payment process to. If you would like to. Search our database of free dupage county residential property tax assessment records, tax assessment history, land & improvement.

This site provides access to the dupage county property records database. The dupage county clerk's office is responsible for calculating property tax rates for all taxing districts in dupage county. In cook county, property tax regulations are a bit trickier. Additionally, 1,344 tax bills were emailed to owners. Classification rules apply different rates to residential, commercial,. Understand the tax rates, exemptions, and payment process to. Explore our comprehensive guide on dupage county property tax. Search our database of free dupage county residential property tax assessment records, tax assessment history, land & improvement. You can access public records by searching by. If you would like to.

This site provides access to the dupage county property records database. Explore our comprehensive guide on dupage county property tax. Understand the tax rates, exemptions, and payment process to. Classification rules apply different rates to residential, commercial,. Search our database of free dupage county residential property tax assessment records, tax assessment history, land & improvement. You can access public records by searching by. Additionally, 1,344 tax bills were emailed to owners. If you would like to. The dupage county clerk's office is responsible for calculating property tax rates for all taxing districts in dupage county. In cook county, property tax regulations are a bit trickier.

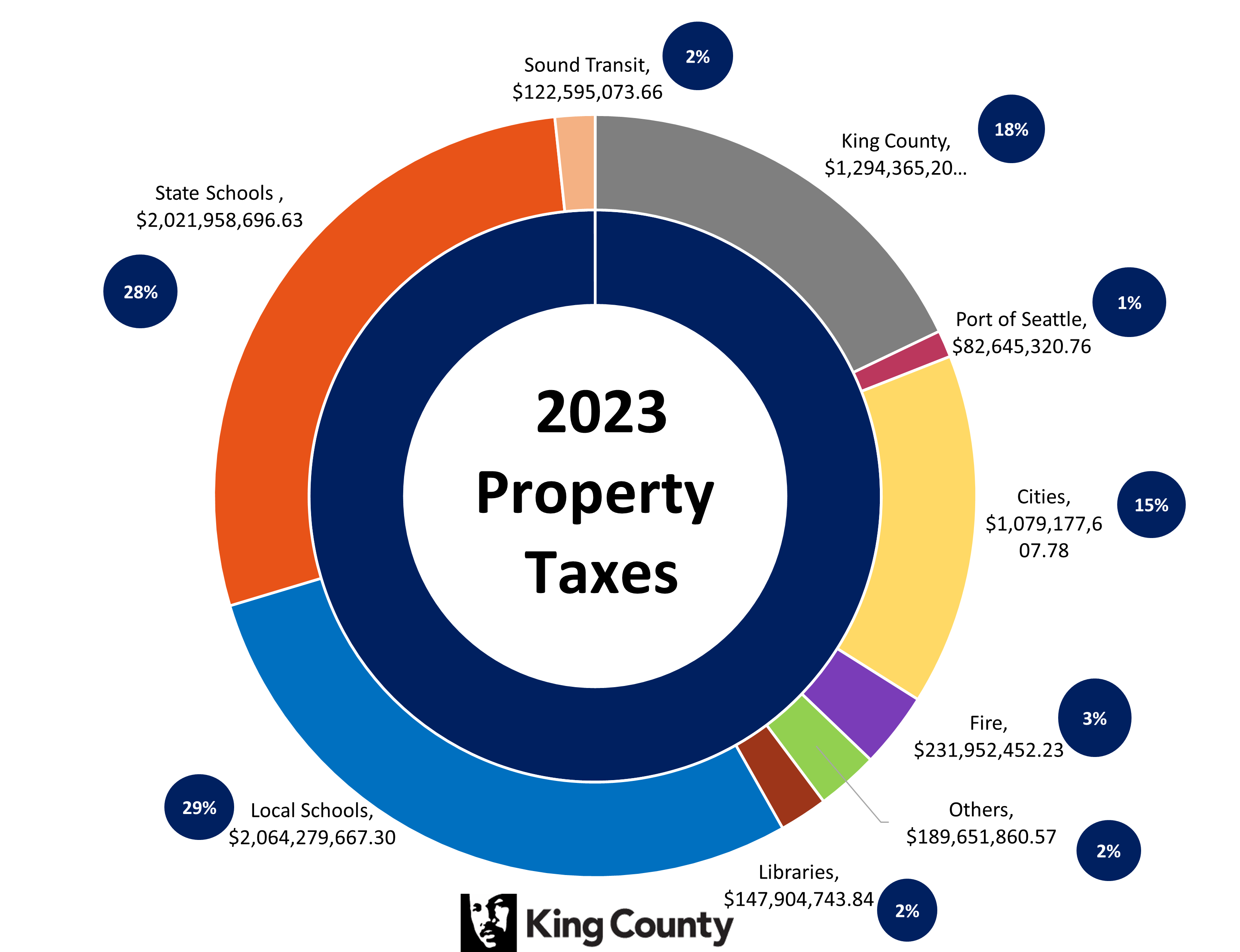

2024 King County Property Tax Lidia Ottilie

You can access public records by searching by. Additionally, 1,344 tax bills were emailed to owners. The dupage county clerk's office is responsible for calculating property tax rates for all taxing districts in dupage county. This site provides access to the dupage county property records database. Classification rules apply different rates to residential, commercial,.

Dupage County Property Tax Due Dates 2024 Deina Eveline

If you would like to. The dupage county clerk's office is responsible for calculating property tax rates for all taxing districts in dupage county. This site provides access to the dupage county property records database. In cook county, property tax regulations are a bit trickier. Classification rules apply different rates to residential, commercial,.

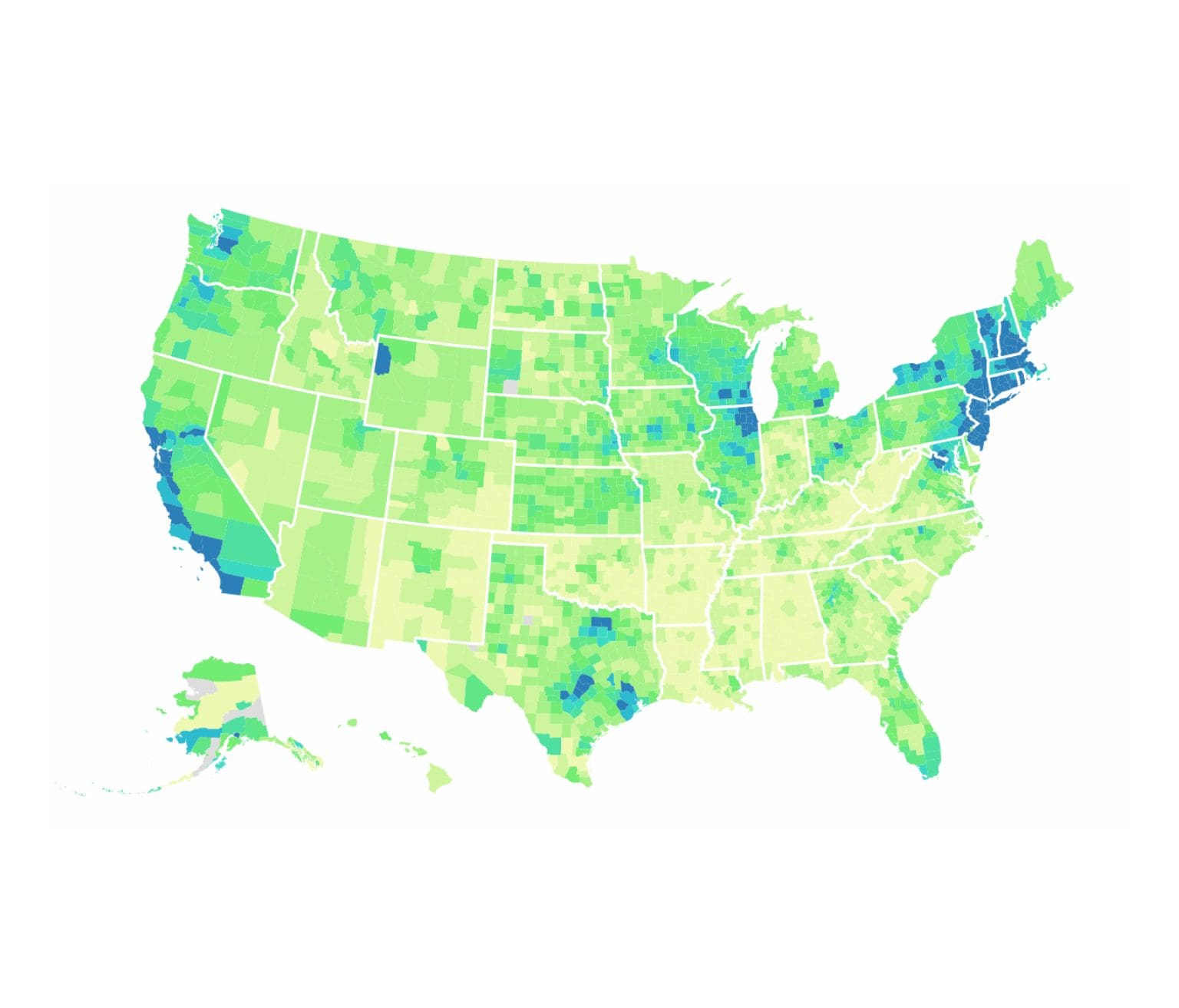

Ulster County Property Tax Maps

This site provides access to the dupage county property records database. In cook county, property tax regulations are a bit trickier. Explore our comprehensive guide on dupage county property tax. Additionally, 1,344 tax bills were emailed to owners. Understand the tax rates, exemptions, and payment process to.

County Property Tax Portals

Additionally, 1,344 tax bills were emailed to owners. In cook county, property tax regulations are a bit trickier. You can access public records by searching by. Classification rules apply different rates to residential, commercial,. This site provides access to the dupage county property records database.

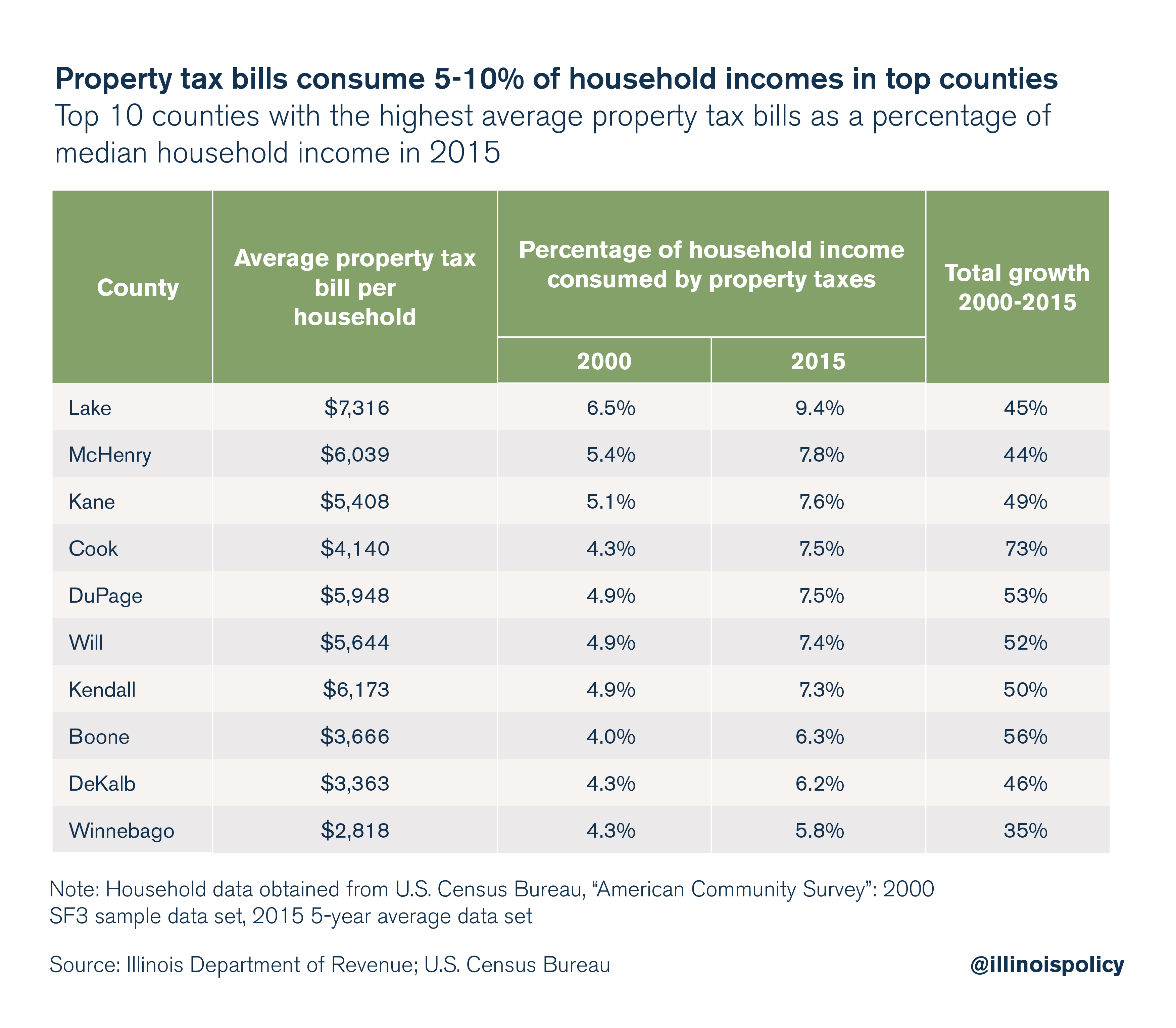

DuPage County Property Taxes 🎯 2024 Ultimate Guide & What You Need to

The dupage county clerk's office is responsible for calculating property tax rates for all taxing districts in dupage county. If you would like to. You can access public records by searching by. Explore our comprehensive guide on dupage county property tax. In cook county, property tax regulations are a bit trickier.

County Property Taxes Archives Tax Foundation

Classification rules apply different rates to residential, commercial,. You can access public records by searching by. The dupage county clerk's office is responsible for calculating property tax rates for all taxing districts in dupage county. Search our database of free dupage county residential property tax assessment records, tax assessment history, land & improvement. In cook county, property tax regulations are.

Peoria County Property Tax

Understand the tax rates, exemptions, and payment process to. Classification rules apply different rates to residential, commercial,. Additionally, 1,344 tax bills were emailed to owners. In cook county, property tax regulations are a bit trickier. If you would like to.

County Property Tax Rate Going Up! WJLE Radio

Understand the tax rates, exemptions, and payment process to. Search our database of free dupage county residential property tax assessment records, tax assessment history, land & improvement. The dupage county clerk's office is responsible for calculating property tax rates for all taxing districts in dupage county. Explore our comprehensive guide on dupage county property tax. In cook county, property tax.

DuPage County Property Taxes 🎯 2024 Ultimate Guide & What You Need to

In cook county, property tax regulations are a bit trickier. The dupage county clerk's office is responsible for calculating property tax rates for all taxing districts in dupage county. Additionally, 1,344 tax bills were emailed to owners. Classification rules apply different rates to residential, commercial,. If you would like to.

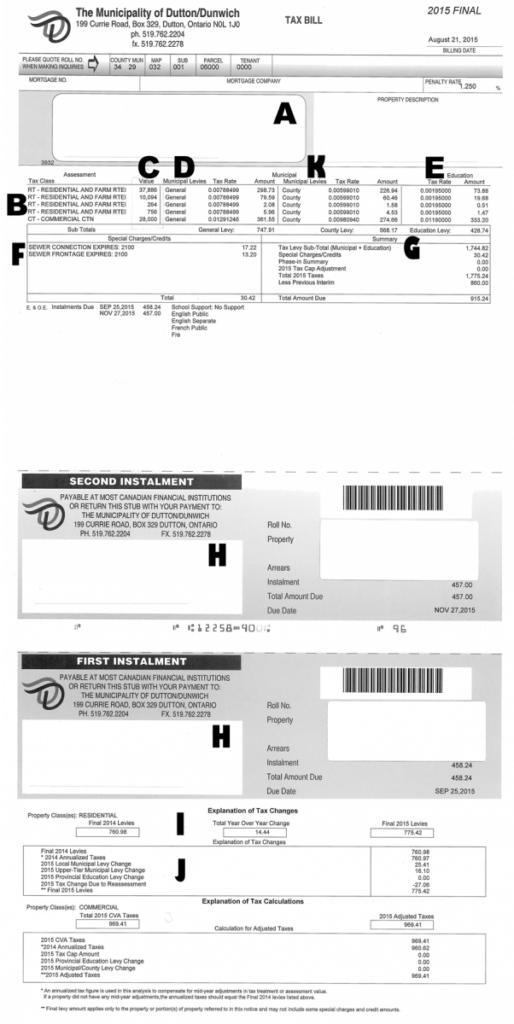

Property Tax Statement Explained Hall County Tax Commissioner GA

Search our database of free dupage county residential property tax assessment records, tax assessment history, land & improvement. Classification rules apply different rates to residential, commercial,. If you would like to. You can access public records by searching by. This site provides access to the dupage county property records database.

Understand The Tax Rates, Exemptions, And Payment Process To.

The dupage county clerk's office is responsible for calculating property tax rates for all taxing districts in dupage county. You can access public records by searching by. In cook county, property tax regulations are a bit trickier. Explore our comprehensive guide on dupage county property tax.

Additionally, 1,344 Tax Bills Were Emailed To Owners.

If you would like to. Search our database of free dupage county residential property tax assessment records, tax assessment history, land & improvement. This site provides access to the dupage county property records database. Classification rules apply different rates to residential, commercial,.