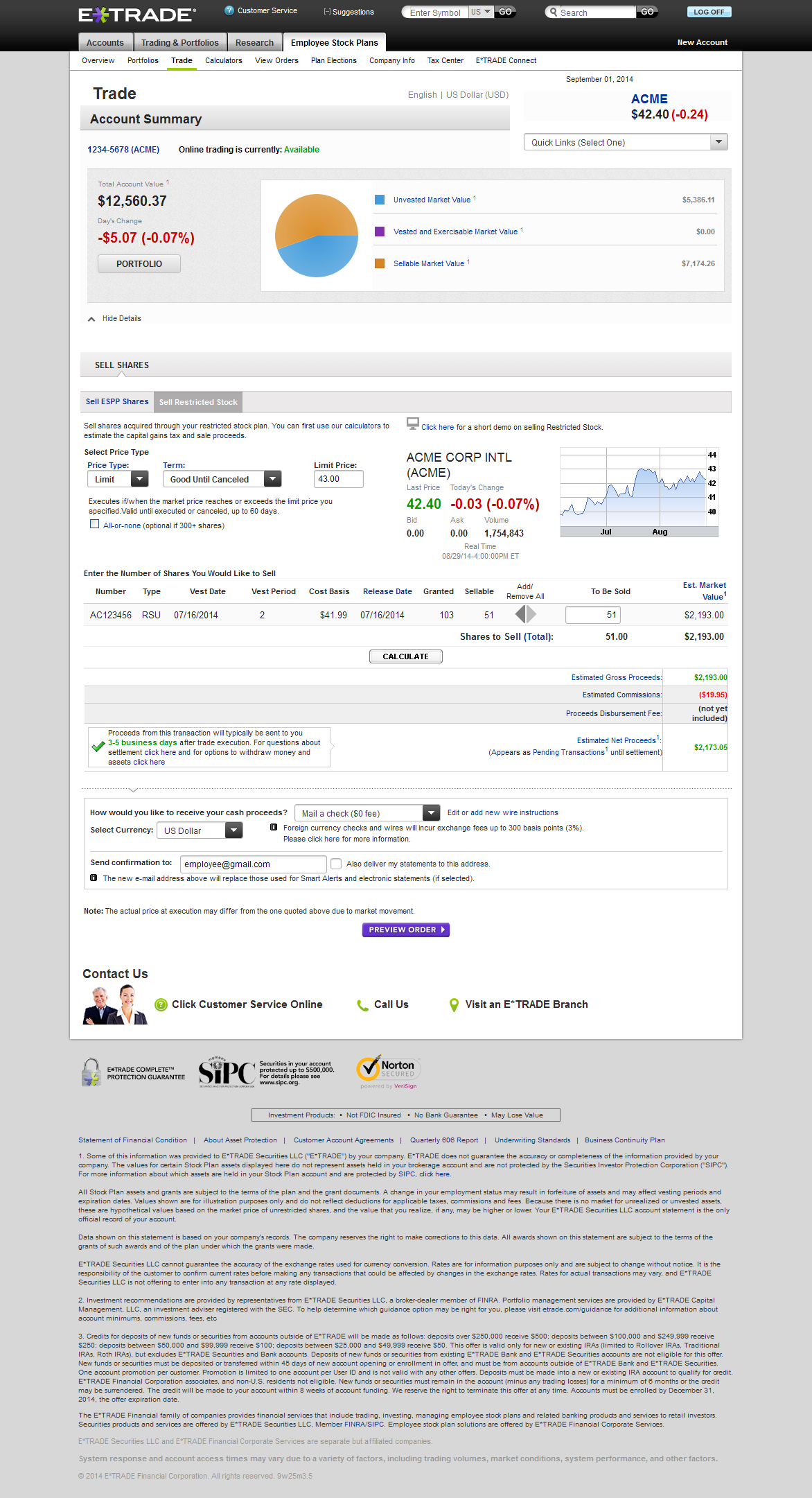

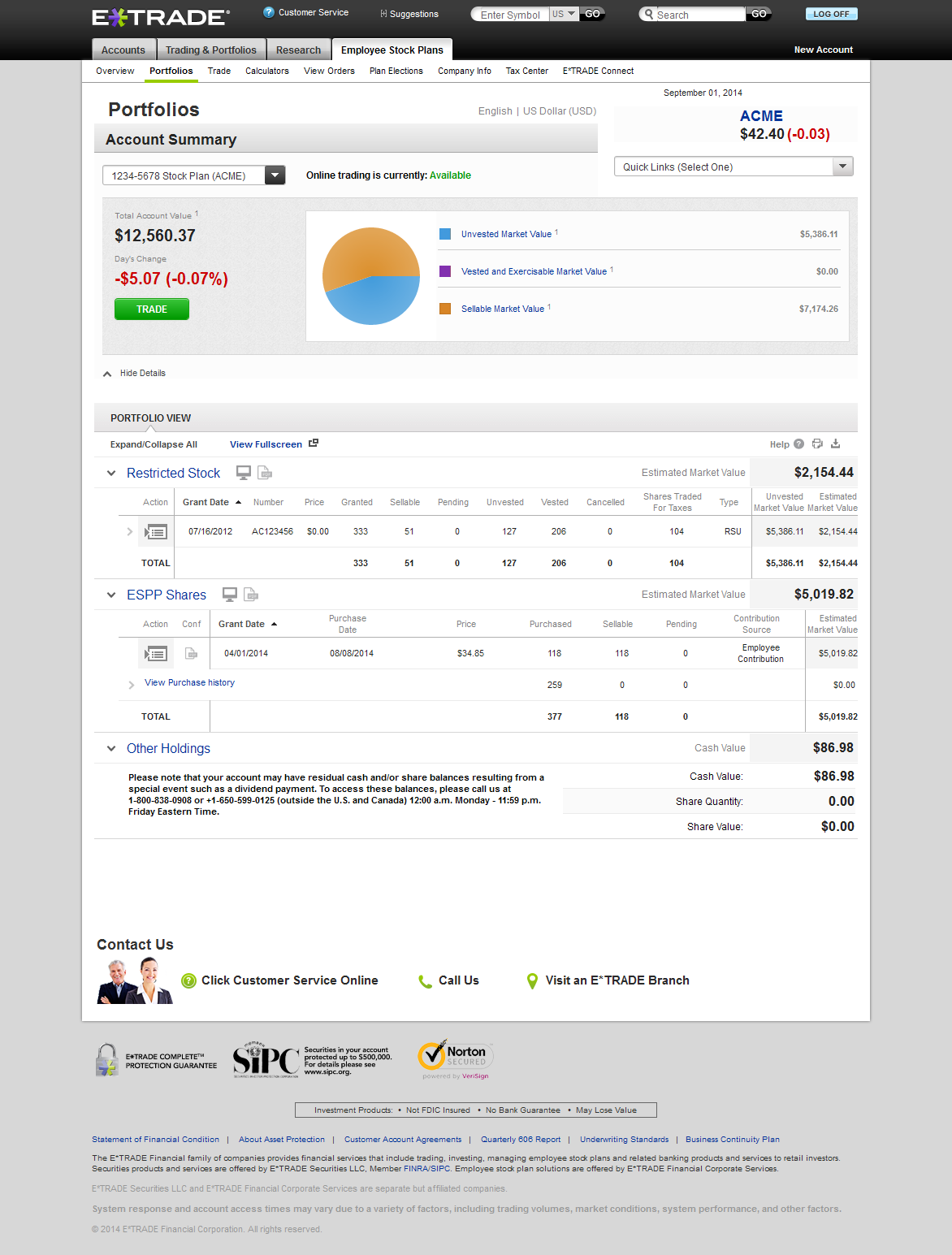

Etrade Gains And Losses Page - When the portfolios are shown, there is a link on the top (same line as positions, etc) called gains and losses. Select the proper tax year (e.g. Selling an investment typically has tax consequences. The portfolios, watchlists, gains & losses, and estimated income webpages on etrade.com are provided as tools to assist you with your. To figure out whether you need to report a gain—or can claim a loss—you need. To view gains and losses, simply go to the gains & losses page on etrade.com where you can find historical information for the. Go to stock plan > my account > gains & losses. How much you’ve gained or lost. 2022) then find the download button towards.

When the portfolios are shown, there is a link on the top (same line as positions, etc) called gains and losses. Selling an investment typically has tax consequences. To figure out whether you need to report a gain—or can claim a loss—you need. The portfolios, watchlists, gains & losses, and estimated income webpages on etrade.com are provided as tools to assist you with your. Go to stock plan > my account > gains & losses. 2022) then find the download button towards. Select the proper tax year (e.g. How much you’ve gained or lost. To view gains and losses, simply go to the gains & losses page on etrade.com where you can find historical information for the.

To figure out whether you need to report a gain—or can claim a loss—you need. To view gains and losses, simply go to the gains & losses page on etrade.com where you can find historical information for the. Selling an investment typically has tax consequences. 2022) then find the download button towards. How much you’ve gained or lost. Go to stock plan > my account > gains & losses. When the portfolios are shown, there is a link on the top (same line as positions, etc) called gains and losses. The portfolios, watchlists, gains & losses, and estimated income webpages on etrade.com are provided as tools to assist you with your. Select the proper tax year (e.g.

ETrade An expensive, rigid brokerage

How much you’ve gained or lost. To figure out whether you need to report a gain—or can claim a loss—you need. Go to stock plan > my account > gains & losses. To view gains and losses, simply go to the gains & losses page on etrade.com where you can find historical information for the. 2022) then find the download.

ETrade An expensive, rigid brokerage

Selling an investment typically has tax consequences. To figure out whether you need to report a gain—or can claim a loss—you need. To view gains and losses, simply go to the gains & losses page on etrade.com where you can find historical information for the. The portfolios, watchlists, gains & losses, and estimated income webpages on etrade.com are provided as.

Yearly Financial Statement Of Gains And Losses Excel Template And

The portfolios, watchlists, gains & losses, and estimated income webpages on etrade.com are provided as tools to assist you with your. How much you’ve gained or lost. To view gains and losses, simply go to the gains & losses page on etrade.com where you can find historical information for the. Select the proper tax year (e.g. To figure out whether.

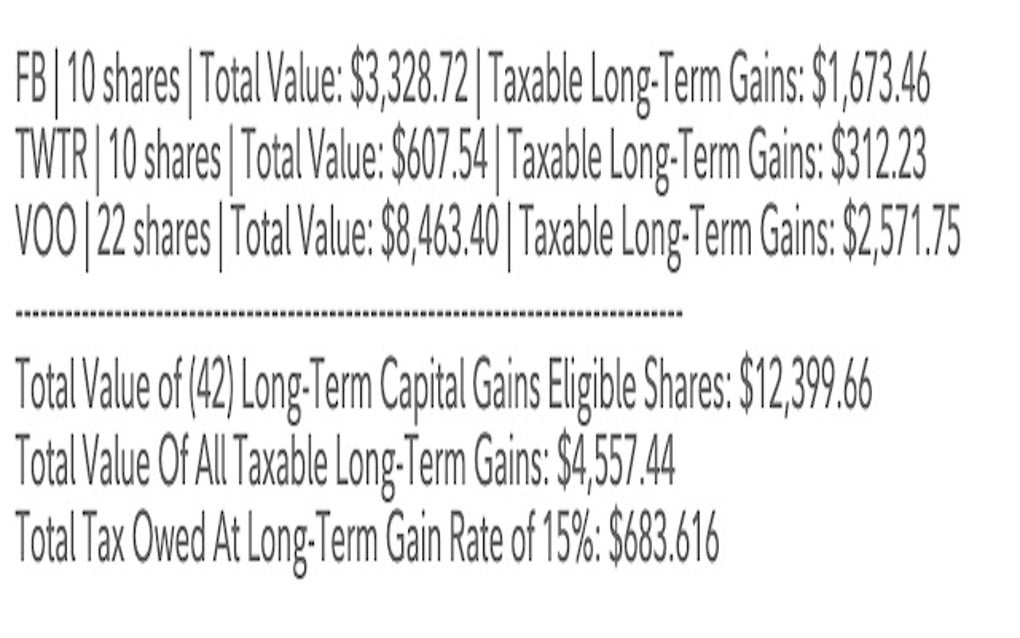

Gains vs. Losses r/StockMarket

How much you’ve gained or lost. When the portfolios are shown, there is a link on the top (same line as positions, etc) called gains and losses. Selling an investment typically has tax consequences. Select the proper tax year (e.g. The portfolios, watchlists, gains & losses, and estimated income webpages on etrade.com are provided as tools to assist you with.

Deferred Losses Please help! Does my total gain include the deferred

To view gains and losses, simply go to the gains & losses page on etrade.com where you can find historical information for the. Select the proper tax year (e.g. To figure out whether you need to report a gain—or can claim a loss—you need. Selling an investment typically has tax consequences. 2022) then find the download button towards.

Schedule D How To Report Your Capital Gains (Or Losses) To The IRS

Selling an investment typically has tax consequences. 2022) then find the download button towards. Go to stock plan > my account > gains & losses. The portfolios, watchlists, gains & losses, and estimated income webpages on etrade.com are provided as tools to assist you with your. To figure out whether you need to report a gain—or can claim a loss—you.

Help me understand why these are showing as gains when I sold them for

To view gains and losses, simply go to the gains & losses page on etrade.com where you can find historical information for the. Go to stock plan > my account > gains & losses. Selling an investment typically has tax consequences. The portfolios, watchlists, gains & losses, and estimated income webpages on etrade.com are provided as tools to assist you.

Fidelity Gains for Google Chrome Extension Download

2022) then find the download button towards. To figure out whether you need to report a gain—or can claim a loss—you need. The portfolios, watchlists, gains & losses, and estimated income webpages on etrade.com are provided as tools to assist you with your. Go to stock plan > my account > gains & losses. When the portfolios are shown, there.

eTrade Pro more glitches, more losses thank you etrade r/etrade

To view gains and losses, simply go to the gains & losses page on etrade.com where you can find historical information for the. When the portfolios are shown, there is a link on the top (same line as positions, etc) called gains and losses. Selling an investment typically has tax consequences. To figure out whether you need to report a.

U.S. banks' unrealized gains or losses on investment securities

How much you’ve gained or lost. To view gains and losses, simply go to the gains & losses page on etrade.com where you can find historical information for the. Selling an investment typically has tax consequences. Go to stock plan > my account > gains & losses. Select the proper tax year (e.g.

When The Portfolios Are Shown, There Is A Link On The Top (Same Line As Positions, Etc) Called Gains And Losses.

The portfolios, watchlists, gains & losses, and estimated income webpages on etrade.com are provided as tools to assist you with your. To figure out whether you need to report a gain—or can claim a loss—you need. Selling an investment typically has tax consequences. Go to stock plan > my account > gains & losses.

Select The Proper Tax Year (E.g.

2022) then find the download button towards. To view gains and losses, simply go to the gains & losses page on etrade.com where you can find historical information for the. How much you’ve gained or lost.