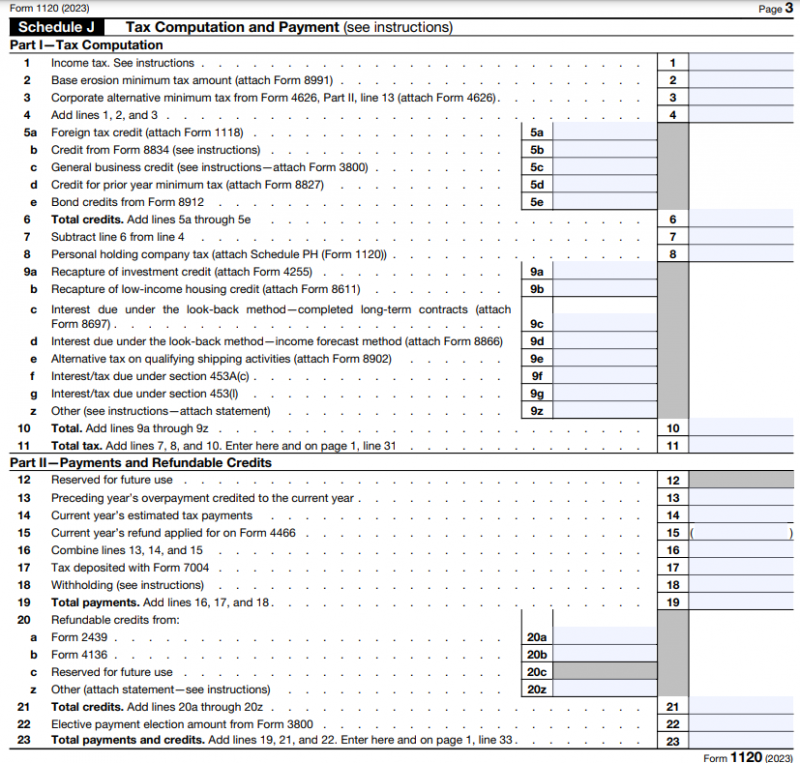

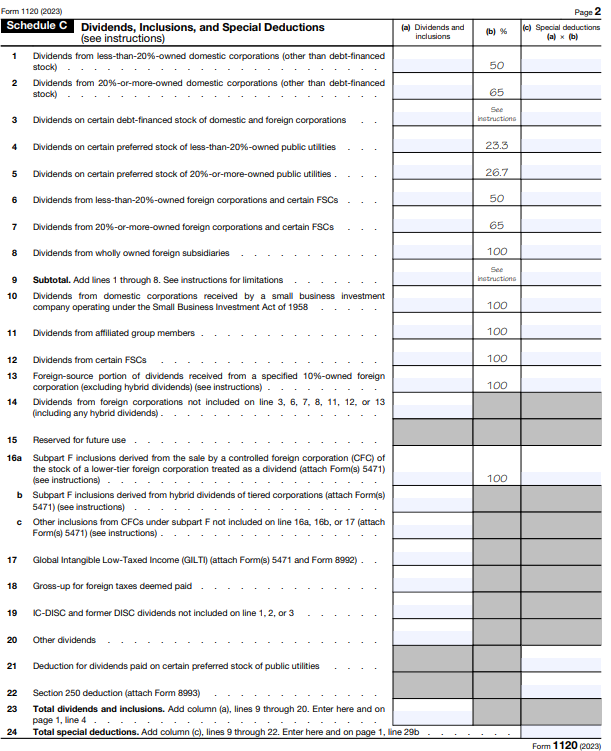

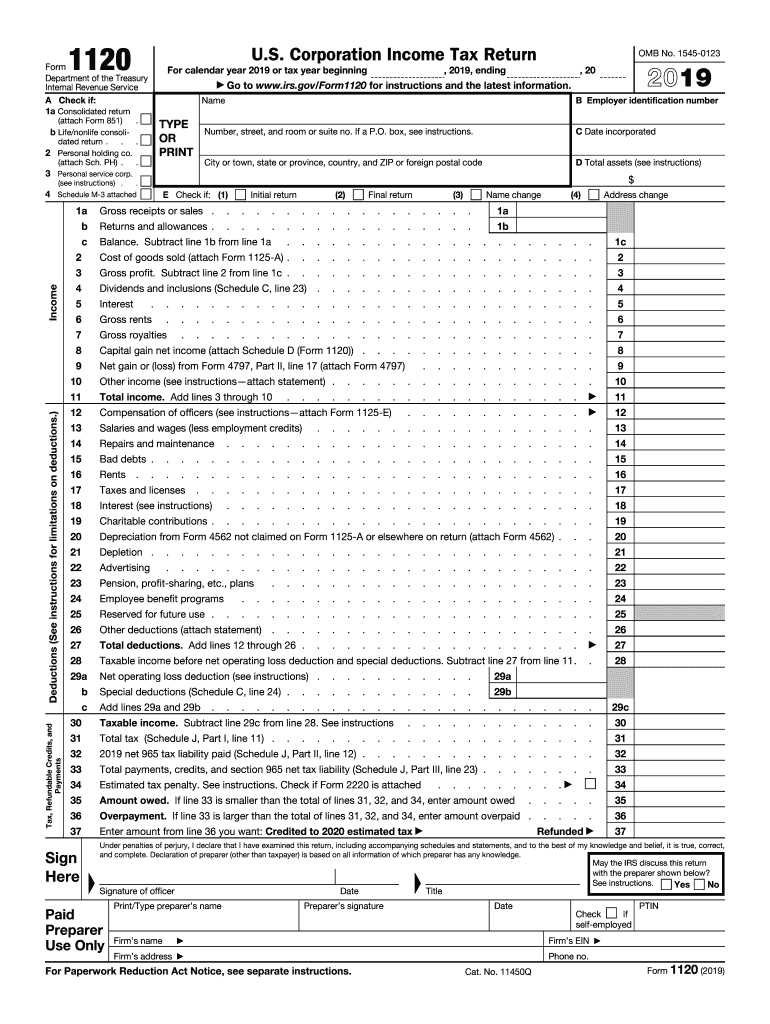

Form 1120 Page 1 - C corporations (c corps) and some limited liability companies (llcs) must file this form to report their taxable income, gains,. Corporation income tax return, is used to report a corporation’s income, gains, losses, deductions, and credits, and to calculate how. Form 1120 is the u.s. Corporations, including certain organizations such as banks, insurance companies, and other financial institutions, must file form 1120 to report their annual income, deductions, gains, losses,. 2 schedule c dividends, inclusions, and special deductions (see instructions) (a) dividends and inclusions (b) % Form 1120, which is known as the u.s.

Corporation income tax return, is used to report a corporation’s income, gains, losses, deductions, and credits, and to calculate how. Form 1120, which is known as the u.s. Form 1120 is the u.s. 2 schedule c dividends, inclusions, and special deductions (see instructions) (a) dividends and inclusions (b) % C corporations (c corps) and some limited liability companies (llcs) must file this form to report their taxable income, gains,. Corporations, including certain organizations such as banks, insurance companies, and other financial institutions, must file form 1120 to report their annual income, deductions, gains, losses,.

Form 1120, which is known as the u.s. Corporations, including certain organizations such as banks, insurance companies, and other financial institutions, must file form 1120 to report their annual income, deductions, gains, losses,. 2 schedule c dividends, inclusions, and special deductions (see instructions) (a) dividends and inclusions (b) % C corporations (c corps) and some limited liability companies (llcs) must file this form to report their taxable income, gains,. Corporation income tax return, is used to report a corporation’s income, gains, losses, deductions, and credits, and to calculate how. Form 1120 is the u.s.

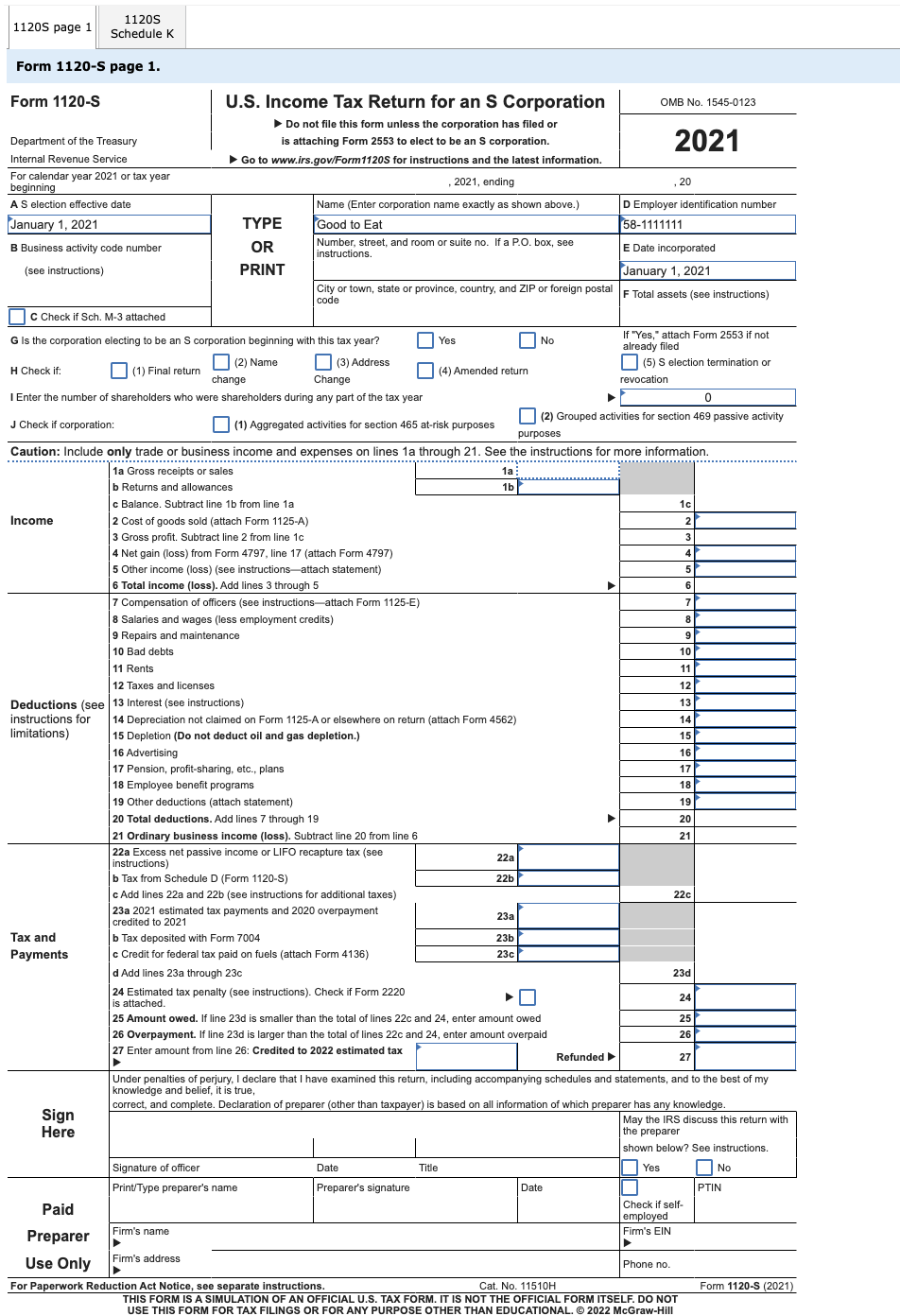

Schedule K1 Form 1120s Instructions 2025 Layla Hannah

C corporations (c corps) and some limited liability companies (llcs) must file this form to report their taxable income, gains,. Corporation income tax return, is used to report a corporation’s income, gains, losses, deductions, and credits, and to calculate how. Corporations, including certain organizations such as banks, insurance companies, and other financial institutions, must file form 1120 to report their.

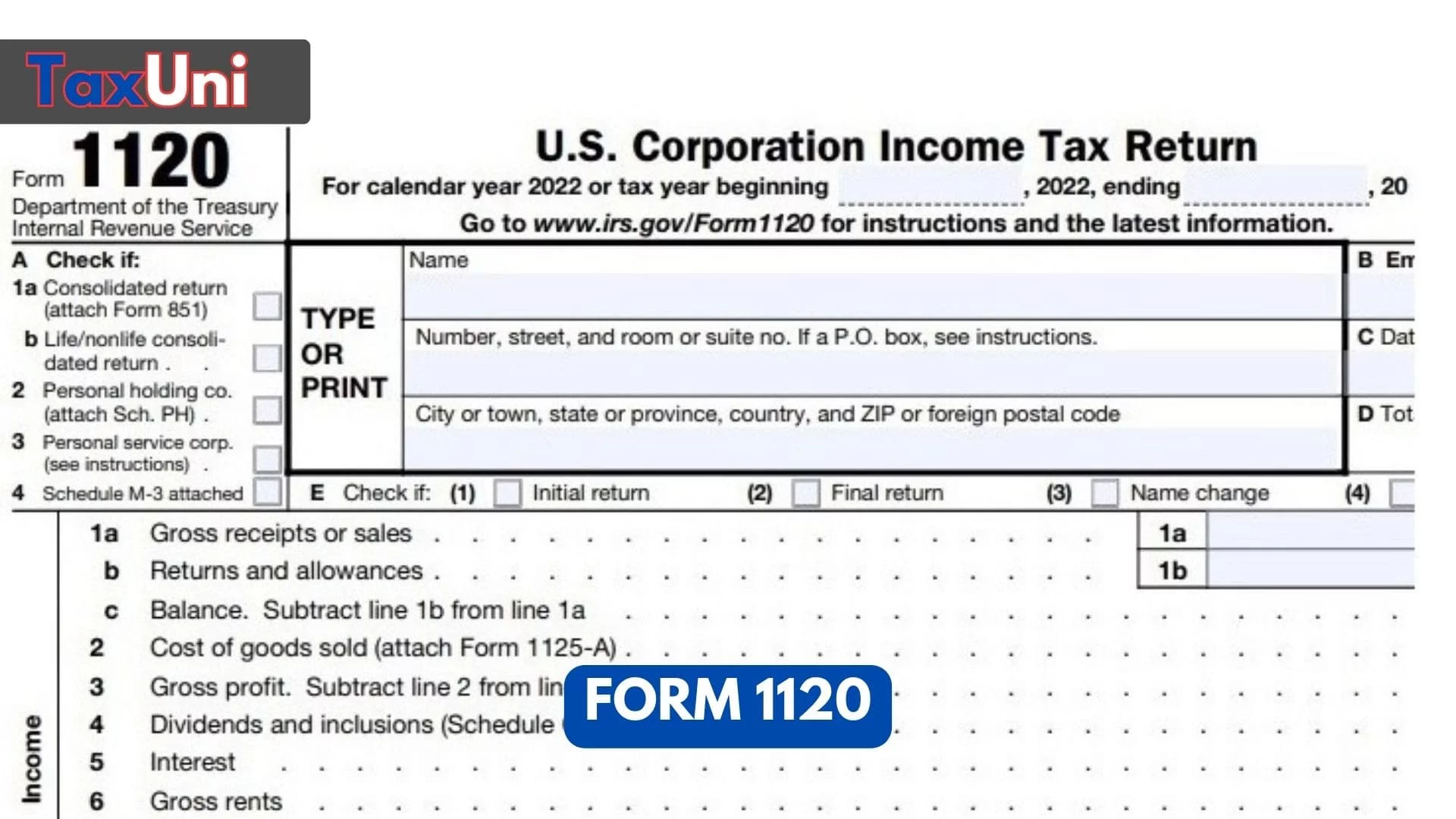

Form 1120 How to Complete and File 1120 Tax Form

Form 1120, which is known as the u.s. Form 1120 is the u.s. 2 schedule c dividends, inclusions, and special deductions (see instructions) (a) dividends and inclusions (b) % C corporations (c corps) and some limited liability companies (llcs) must file this form to report their taxable income, gains,. Corporations, including certain organizations such as banks, insurance companies, and other.

Form 1120 2024 2025

Form 1120 is the u.s. C corporations (c corps) and some limited liability companies (llcs) must file this form to report their taxable income, gains,. Corporations, including certain organizations such as banks, insurance companies, and other financial institutions, must file form 1120 to report their annual income, deductions, gains, losses,. Form 1120, which is known as the u.s. 2 schedule.

Form 1120 How to Complete and File 1120 Tax Form

Form 1120 is the u.s. Corporations, including certain organizations such as banks, insurance companies, and other financial institutions, must file form 1120 to report their annual income, deductions, gains, losses,. Corporation income tax return, is used to report a corporation’s income, gains, losses, deductions, and credits, and to calculate how. 2 schedule c dividends, inclusions, and special deductions (see instructions).

Form 1120 How to Complete and File 1120 Tax Form

C corporations (c corps) and some limited liability companies (llcs) must file this form to report their taxable income, gains,. 2 schedule c dividends, inclusions, and special deductions (see instructions) (a) dividends and inclusions (b) % Form 1120 is the u.s. Corporations, including certain organizations such as banks, insurance companies, and other financial institutions, must file form 1120 to report.

2019 Form IRS 1120 Fill Online, Printable, Fillable, Blank pdfFiller

Form 1120 is the u.s. Corporation income tax return, is used to report a corporation’s income, gains, losses, deductions, and credits, and to calculate how. C corporations (c corps) and some limited liability companies (llcs) must file this form to report their taxable income, gains,. 2 schedule c dividends, inclusions, and special deductions (see instructions) (a) dividends and inclusions (b).

Form 1120S S Corporation Tax Return Fill Out Online PDF FormSwift

C corporations (c corps) and some limited liability companies (llcs) must file this form to report their taxable income, gains,. Form 1120 is the u.s. Form 1120, which is known as the u.s. 2 schedule c dividends, inclusions, and special deductions (see instructions) (a) dividends and inclusions (b) % Corporation income tax return, is used to report a corporation’s income,.

Fillable Online Form 1120S, Page 1 Fax Email Print pdfFiller

Form 1120 is the u.s. Corporation income tax return, is used to report a corporation’s income, gains, losses, deductions, and credits, and to calculate how. C corporations (c corps) and some limited liability companies (llcs) must file this form to report their taxable income, gains,. Corporations, including certain organizations such as banks, insurance companies, and other financial institutions, must file.

Schedule K1 Form 1120s Instructions 2025 Layla Hannah

Corporations, including certain organizations such as banks, insurance companies, and other financial institutions, must file form 1120 to report their annual income, deductions, gains, losses,. C corporations (c corps) and some limited liability companies (llcs) must file this form to report their taxable income, gains,. 2 schedule c dividends, inclusions, and special deductions (see instructions) (a) dividends and inclusions (b).

IRS Form 1120 Processing AOTM

Corporation income tax return, is used to report a corporation’s income, gains, losses, deductions, and credits, and to calculate how. C corporations (c corps) and some limited liability companies (llcs) must file this form to report their taxable income, gains,. Corporations, including certain organizations such as banks, insurance companies, and other financial institutions, must file form 1120 to report their.

C Corporations (C Corps) And Some Limited Liability Companies (Llcs) Must File This Form To Report Their Taxable Income, Gains,.

Form 1120, which is known as the u.s. Corporations, including certain organizations such as banks, insurance companies, and other financial institutions, must file form 1120 to report their annual income, deductions, gains, losses,. Corporation income tax return, is used to report a corporation’s income, gains, losses, deductions, and credits, and to calculate how. 2 schedule c dividends, inclusions, and special deductions (see instructions) (a) dividends and inclusions (b) %