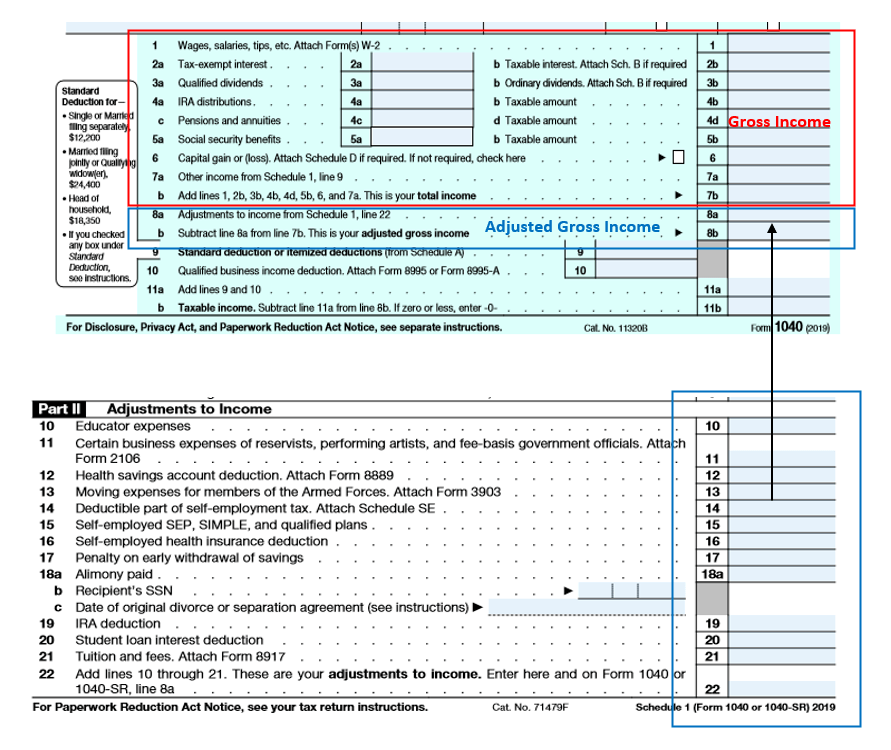

Most Recent Federal Agi - You can use the printed or electronic version. Last year's federal tax return (form 1040) will give you your agi. Your adjusted gross income (agi) is your total (gross) income from all sources minus certain adjustments such as educator. Look no further than line 11 on form 1040 for tax year 2023. Learn how to locate and verify your agi on the 1040 form and understand its changes with amendments. Get a copy of last year’s tax return. Find the line that reads, “adjusted gross income.” on form 1040. So, where exactly do you find agi on form 1040. An individual's agi encompasses earned wages, dividends, capital gains,.

Learn how to locate and verify your agi on the 1040 form and understand its changes with amendments. Last year's federal tax return (form 1040) will give you your agi. Get a copy of last year’s tax return. Find the line that reads, “adjusted gross income.” on form 1040. An individual's agi encompasses earned wages, dividends, capital gains,. You can use the printed or electronic version. Your adjusted gross income (agi) is your total (gross) income from all sources minus certain adjustments such as educator. So, where exactly do you find agi on form 1040. Look no further than line 11 on form 1040 for tax year 2023.

Look no further than line 11 on form 1040 for tax year 2023. Learn how to locate and verify your agi on the 1040 form and understand its changes with amendments. You can use the printed or electronic version. An individual's agi encompasses earned wages, dividends, capital gains,. Get a copy of last year’s tax return. Your adjusted gross income (agi) is your total (gross) income from all sources minus certain adjustments such as educator. Last year's federal tax return (form 1040) will give you your agi. So, where exactly do you find agi on form 1040. Find the line that reads, “adjusted gross income.” on form 1040.

Summary of the Latest Federal Tax Data Tax Foundation

So, where exactly do you find agi on form 1040. Find the line that reads, “adjusted gross income.” on form 1040. Look no further than line 11 on form 1040 for tax year 2023. You can use the printed or electronic version. Learn how to locate and verify your agi on the 1040 form and understand its changes with amendments.

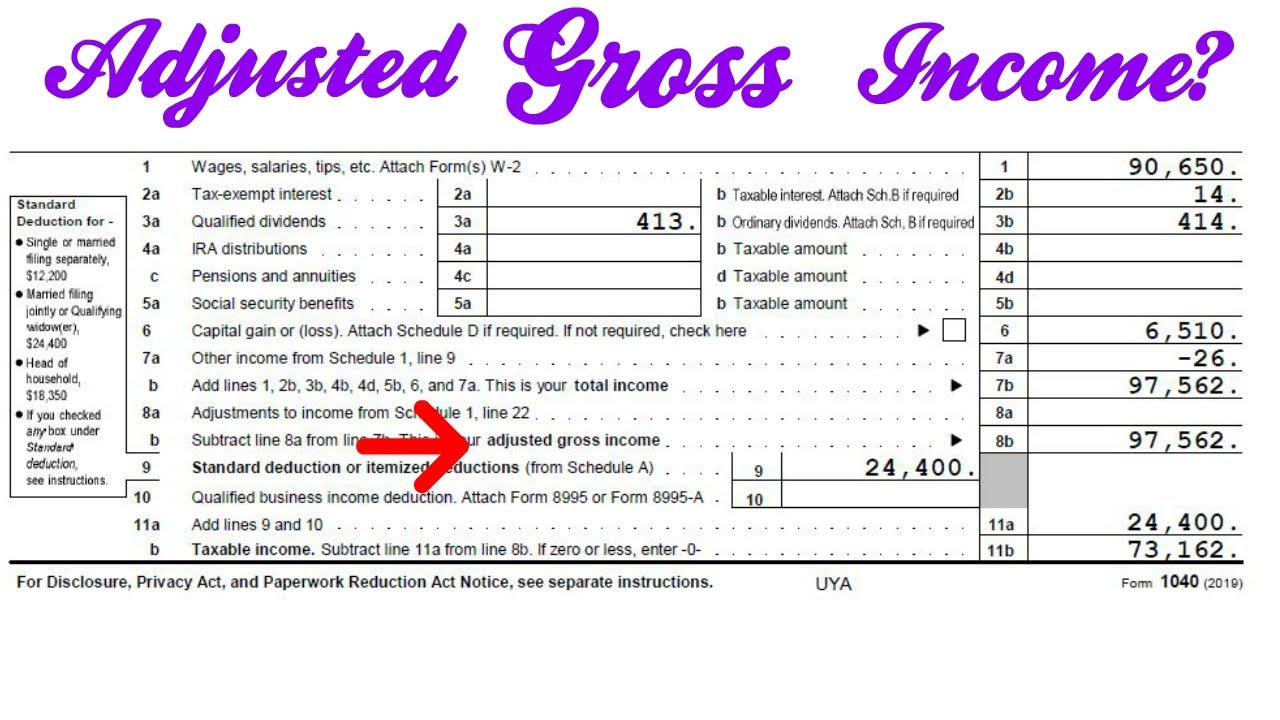

Adjusted Gross (AGI) Overview, Deductions, Form 1040

Look no further than line 11 on form 1040 for tax year 2023. Last year's federal tax return (form 1040) will give you your agi. Find the line that reads, “adjusted gross income.” on form 1040. Learn how to locate and verify your agi on the 1040 form and understand its changes with amendments. An individual's agi encompasses earned wages,.

Adjusted Gross (AGI) Calculation & Examples Hourly, Inc.

So, where exactly do you find agi on form 1040. Learn how to locate and verify your agi on the 1040 form and understand its changes with amendments. Your adjusted gross income (agi) is your total (gross) income from all sources minus certain adjustments such as educator. Last year's federal tax return (form 1040) will give you your agi. You.

What is Adjusted Gross Qualify for the Coronavirus Economic

Get a copy of last year’s tax return. Your adjusted gross income (agi) is your total (gross) income from all sources minus certain adjustments such as educator. You can use the printed or electronic version. Learn how to locate and verify your agi on the 1040 form and understand its changes with amendments. Look no further than line 11 on.

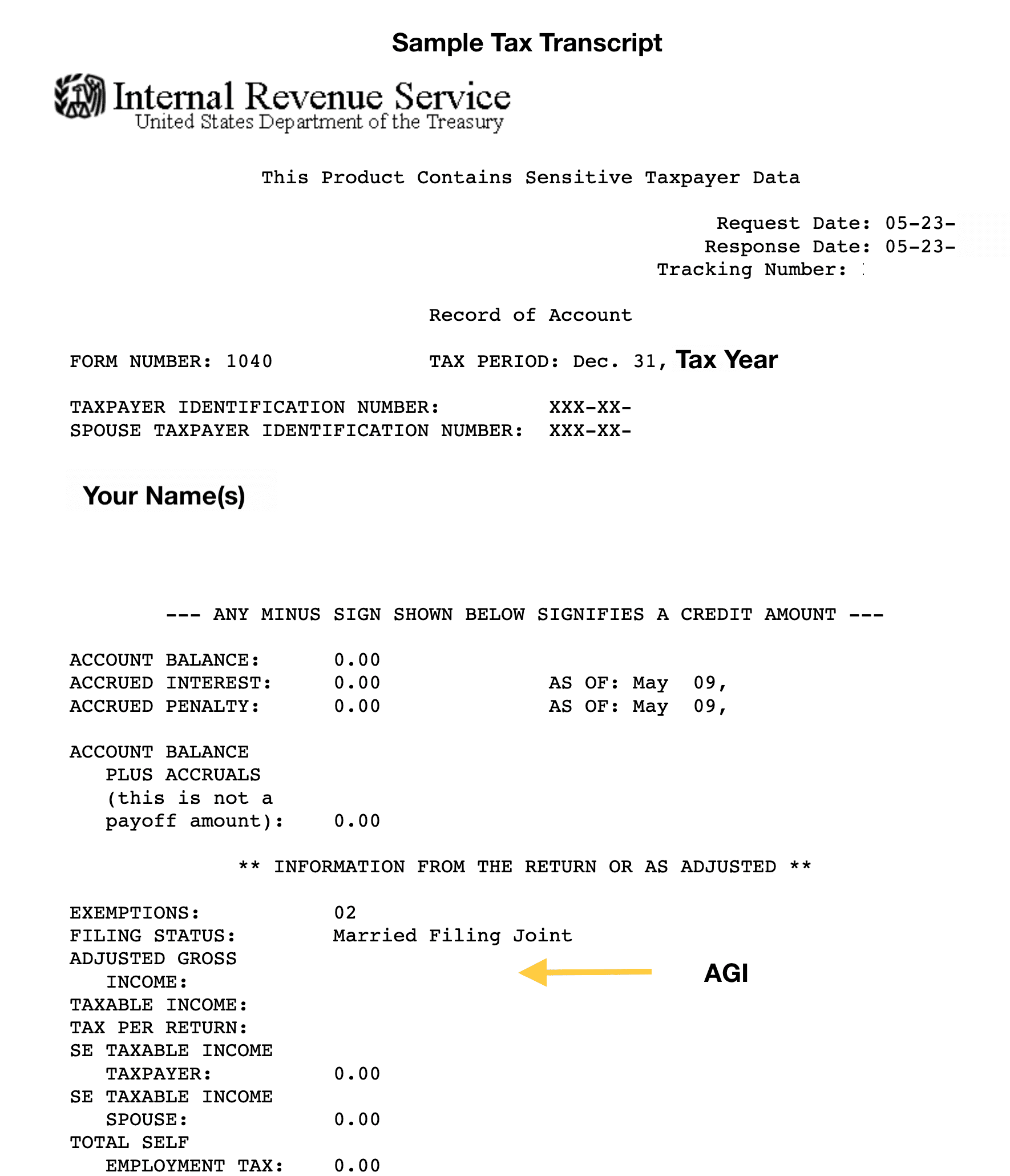

2022 Irs Tax Transcript

An individual's agi encompasses earned wages, dividends, capital gains,. Learn how to locate and verify your agi on the 1040 form and understand its changes with amendments. So, where exactly do you find agi on form 1040. Find the line that reads, “adjusted gross income.” on form 1040. Get a copy of last year’s tax return.

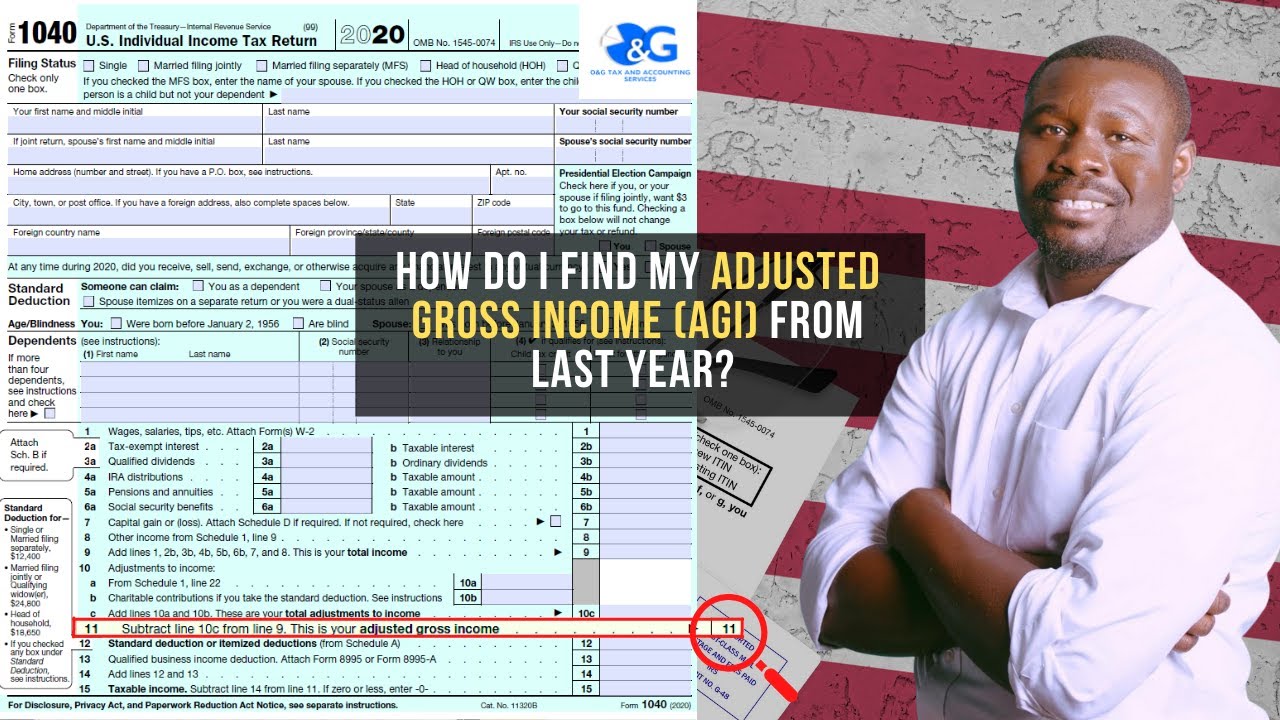

How do I find my Adjusted Gross (AGI) from last year? YouTube

Get a copy of last year’s tax return. Your adjusted gross income (agi) is your total (gross) income from all sources minus certain adjustments such as educator. Find the line that reads, “adjusted gross income.” on form 1040. You can use the printed or electronic version. An individual's agi encompasses earned wages, dividends, capital gains,.

This is your federal adjusted gross 915,729,293

Your adjusted gross income (agi) is your total (gross) income from all sources minus certain adjustments such as educator. An individual's agi encompasses earned wages, dividends, capital gains,. Look no further than line 11 on form 1040 for tax year 2023. Find the line that reads, “adjusted gross income.” on form 1040. You can use the printed or electronic version.

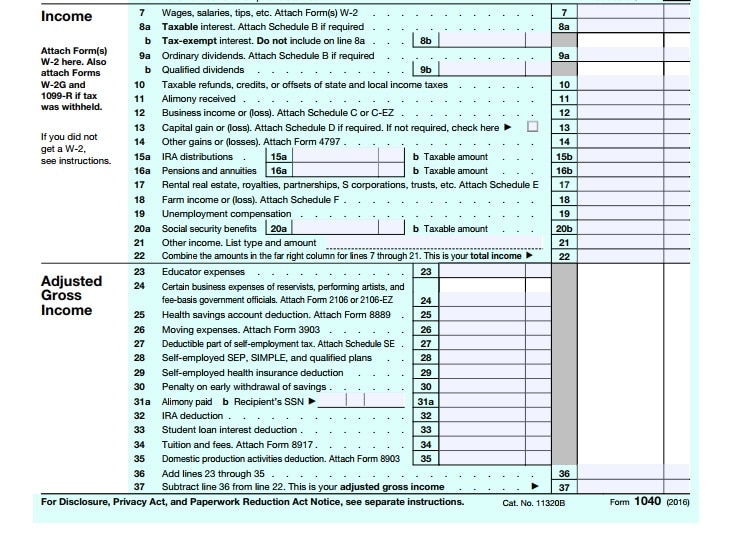

What is AGI Adjusted Gross ExcelDataPro

Look no further than line 11 on form 1040 for tax year 2023. Get a copy of last year’s tax return. You can use the printed or electronic version. An individual's agi encompasses earned wages, dividends, capital gains,. So, where exactly do you find agi on form 1040.

Summary of the Latest Federal Tax Data, 2022 Update Etrust

Find the line that reads, “adjusted gross income.” on form 1040. Last year's federal tax return (form 1040) will give you your agi. Get a copy of last year’s tax return. So, where exactly do you find agi on form 1040. You can use the printed or electronic version.

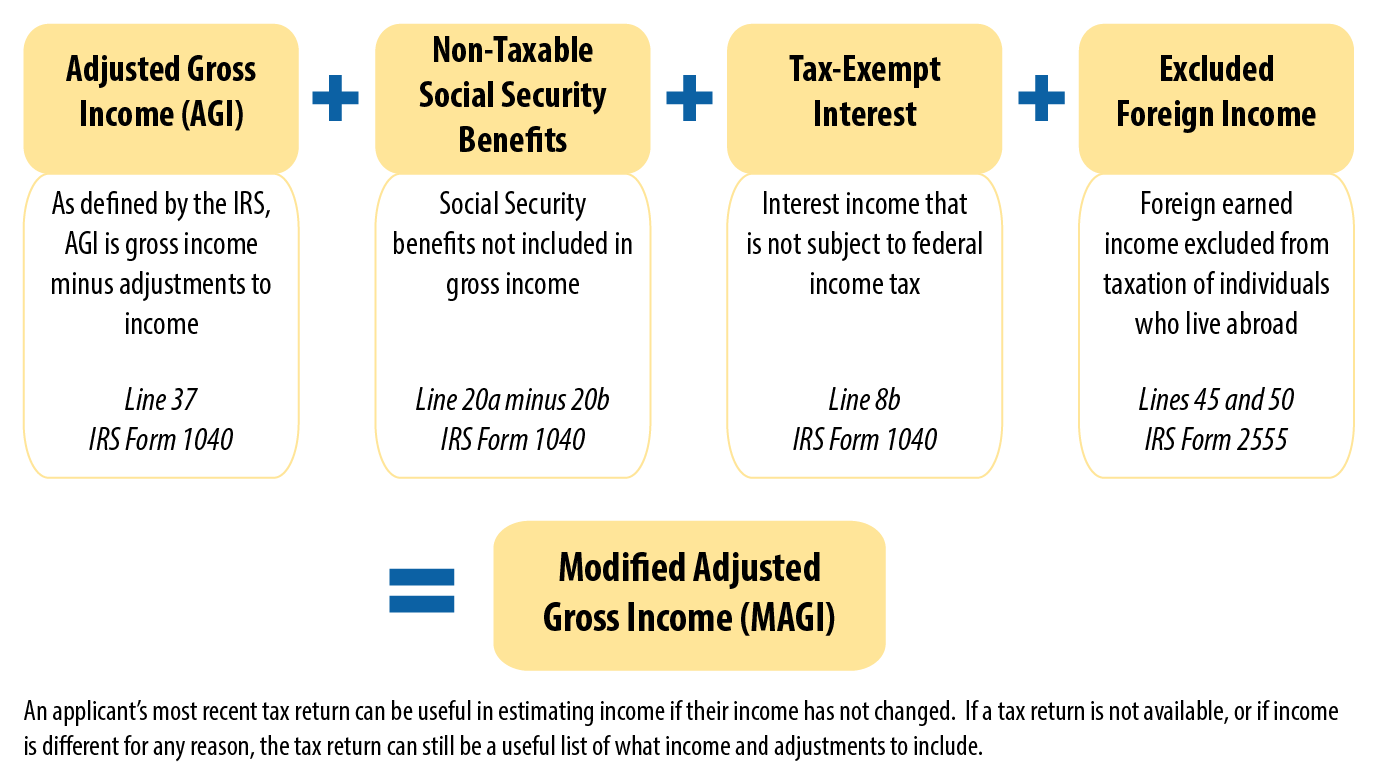

Modified Adjusted Gross (MAGI)

Last year's federal tax return (form 1040) will give you your agi. So, where exactly do you find agi on form 1040. Get a copy of last year’s tax return. Look no further than line 11 on form 1040 for tax year 2023. Learn how to locate and verify your agi on the 1040 form and understand its changes with.

An Individual's Agi Encompasses Earned Wages, Dividends, Capital Gains,.

Look no further than line 11 on form 1040 for tax year 2023. You can use the printed or electronic version. Find the line that reads, “adjusted gross income.” on form 1040. Your adjusted gross income (agi) is your total (gross) income from all sources minus certain adjustments such as educator.

Learn How To Locate And Verify Your Agi On The 1040 Form And Understand Its Changes With Amendments.

Last year's federal tax return (form 1040) will give you your agi. Get a copy of last year’s tax return. So, where exactly do you find agi on form 1040.

.png)