Negative Liability On Balance Sheet - A negative liability typically appears on the balance sheet when a company pays out more than the. If the liability account is negative, there are 2 situations: Negative liability occurs when a liability account shows a debit balance instead of the typical credit balance. What is a negative liability?

What is a negative liability? If the liability account is negative, there are 2 situations: Negative liability occurs when a liability account shows a debit balance instead of the typical credit balance. A negative liability typically appears on the balance sheet when a company pays out more than the.

A negative liability typically appears on the balance sheet when a company pays out more than the. If the liability account is negative, there are 2 situations: Negative liability occurs when a liability account shows a debit balance instead of the typical credit balance. What is a negative liability?

Understanding Your Balance Sheet Financial Accounting Protea

Negative liability occurs when a liability account shows a debit balance instead of the typical credit balance. What is a negative liability? If the liability account is negative, there are 2 situations: A negative liability typically appears on the balance sheet when a company pays out more than the.

Cool Negative Payroll Liabilities Balance Sheet Financial Statement

What is a negative liability? Negative liability occurs when a liability account shows a debit balance instead of the typical credit balance. A negative liability typically appears on the balance sheet when a company pays out more than the. If the liability account is negative, there are 2 situations:

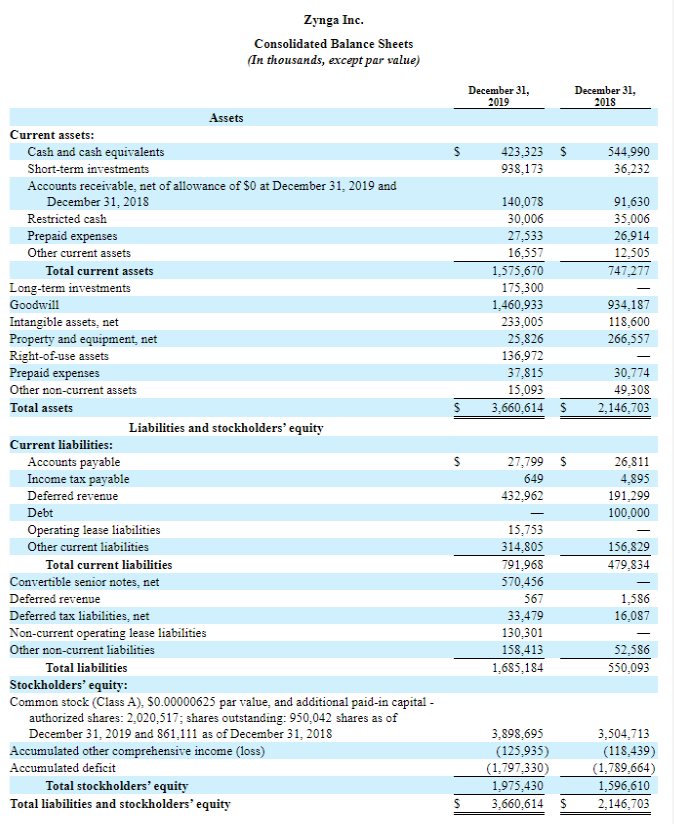

Negative Liability on Balance Sheet

Negative liability occurs when a liability account shows a debit balance instead of the typical credit balance. If the liability account is negative, there are 2 situations: A negative liability typically appears on the balance sheet when a company pays out more than the. What is a negative liability?

How to Read a Balance Sheet (Free Download) Poindexter Blog

If the liability account is negative, there are 2 situations: Negative liability occurs when a liability account shows a debit balance instead of the typical credit balance. A negative liability typically appears on the balance sheet when a company pays out more than the. What is a negative liability?

Negative Balance sheet

If the liability account is negative, there are 2 situations: A negative liability typically appears on the balance sheet when a company pays out more than the. What is a negative liability? Negative liability occurs when a liability account shows a debit balance instead of the typical credit balance.

Cool Negative Payroll Liabilities Balance Sheet Financial Statement

What is a negative liability? A negative liability typically appears on the balance sheet when a company pays out more than the. If the liability account is negative, there are 2 situations: Negative liability occurs when a liability account shows a debit balance instead of the typical credit balance.

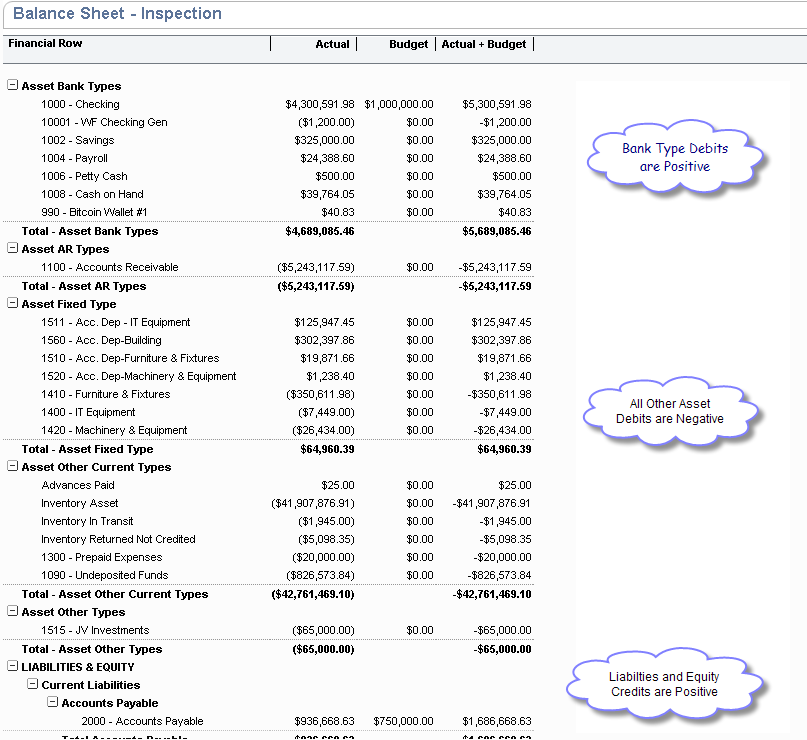

Understanding Negative Balances in Your Financial Statements Fortiviti

Negative liability occurs when a liability account shows a debit balance instead of the typical credit balance. What is a negative liability? A negative liability typically appears on the balance sheet when a company pays out more than the. If the liability account is negative, there are 2 situations:

38 Free Balance Sheet Templates & Examples ᐅ TemplateLab

Negative liability occurs when a liability account shows a debit balance instead of the typical credit balance. What is a negative liability? If the liability account is negative, there are 2 situations: A negative liability typically appears on the balance sheet when a company pays out more than the.

Liabilities Side of Balance Sheet

If the liability account is negative, there are 2 situations: A negative liability typically appears on the balance sheet when a company pays out more than the. Negative liability occurs when a liability account shows a debit balance instead of the typical credit balance. What is a negative liability?

Marty Zigman on "The Pluses and Minuses of NetSuite Financial Statement

If the liability account is negative, there are 2 situations: A negative liability typically appears on the balance sheet when a company pays out more than the. Negative liability occurs when a liability account shows a debit balance instead of the typical credit balance. What is a negative liability?

What Is A Negative Liability?

Negative liability occurs when a liability account shows a debit balance instead of the typical credit balance. A negative liability typically appears on the balance sheet when a company pays out more than the. If the liability account is negative, there are 2 situations: