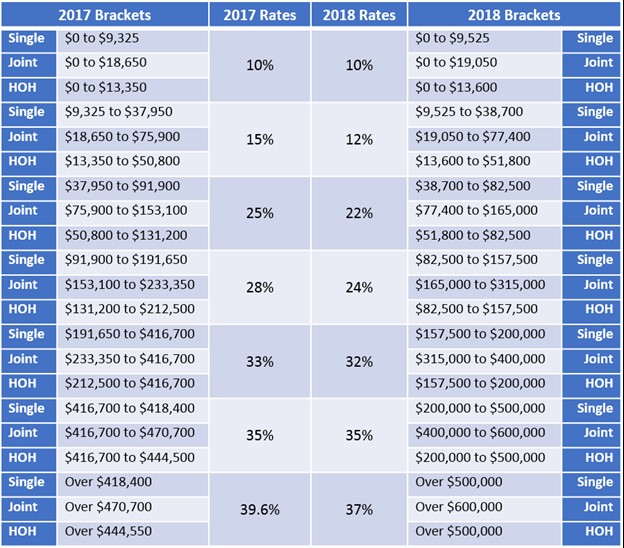

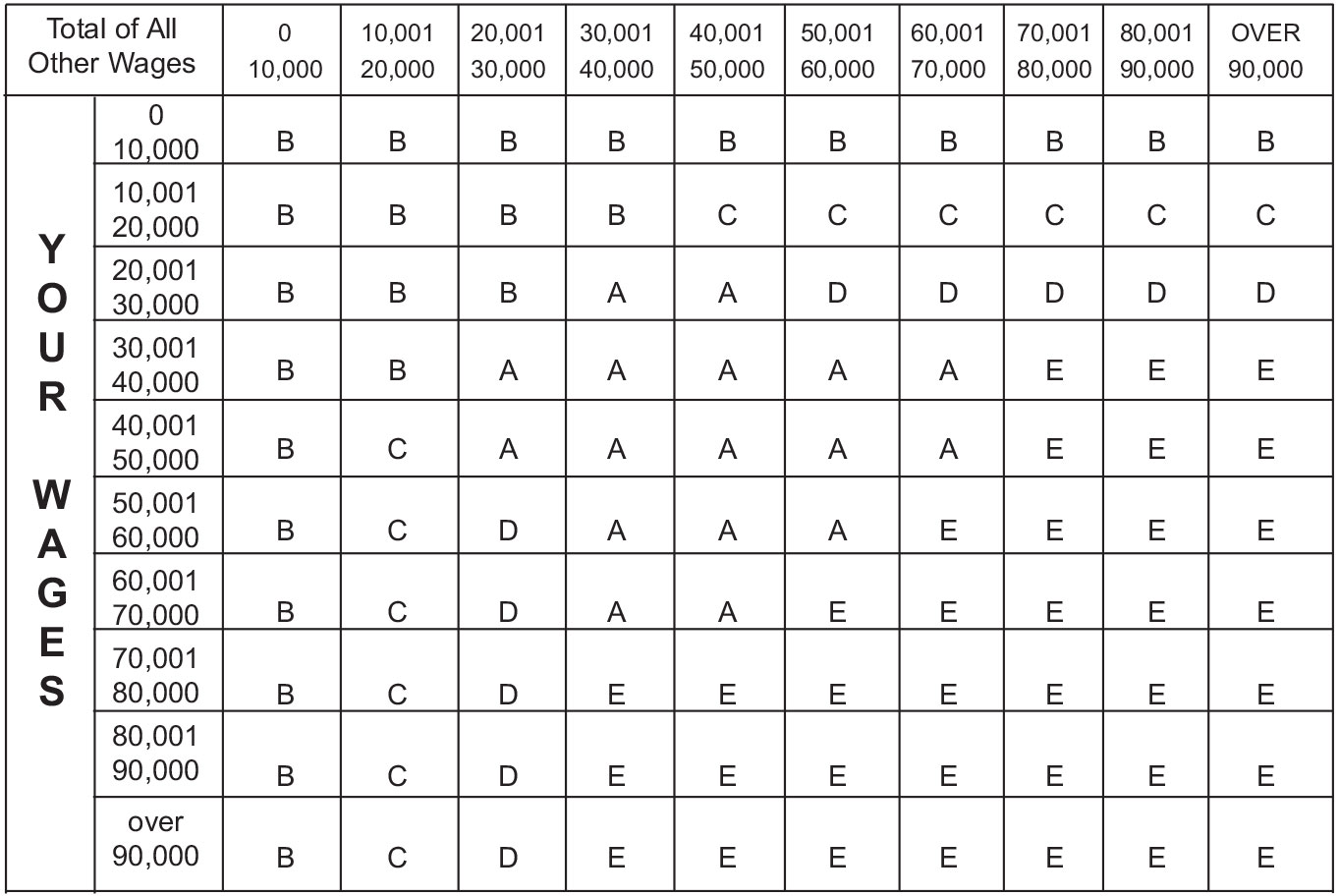

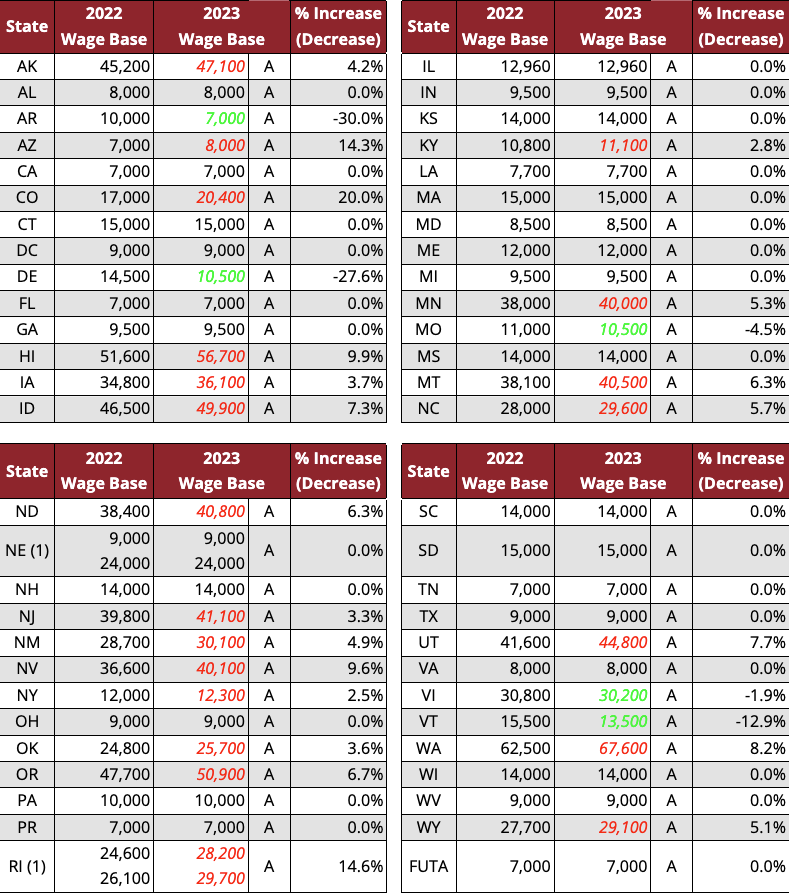

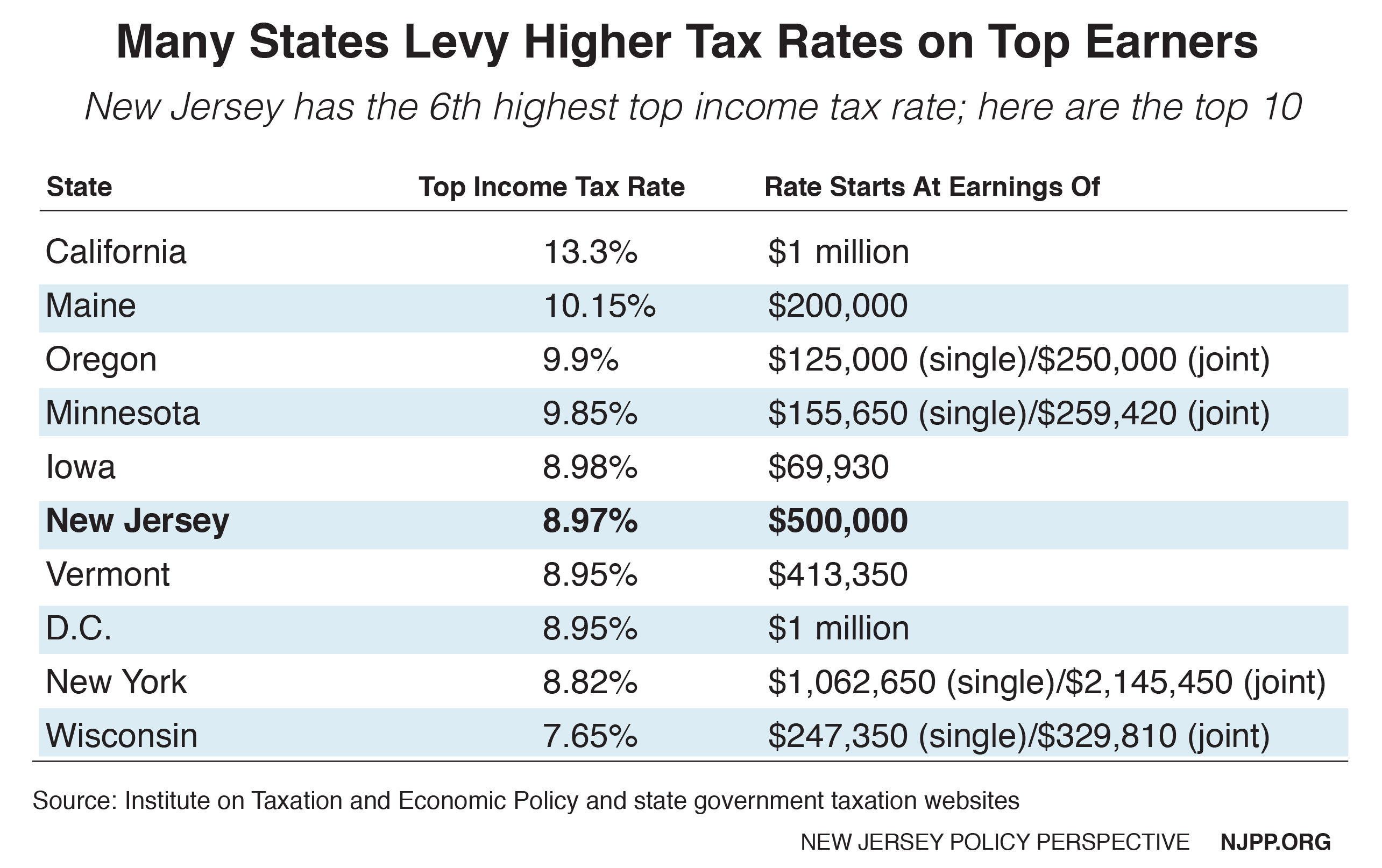

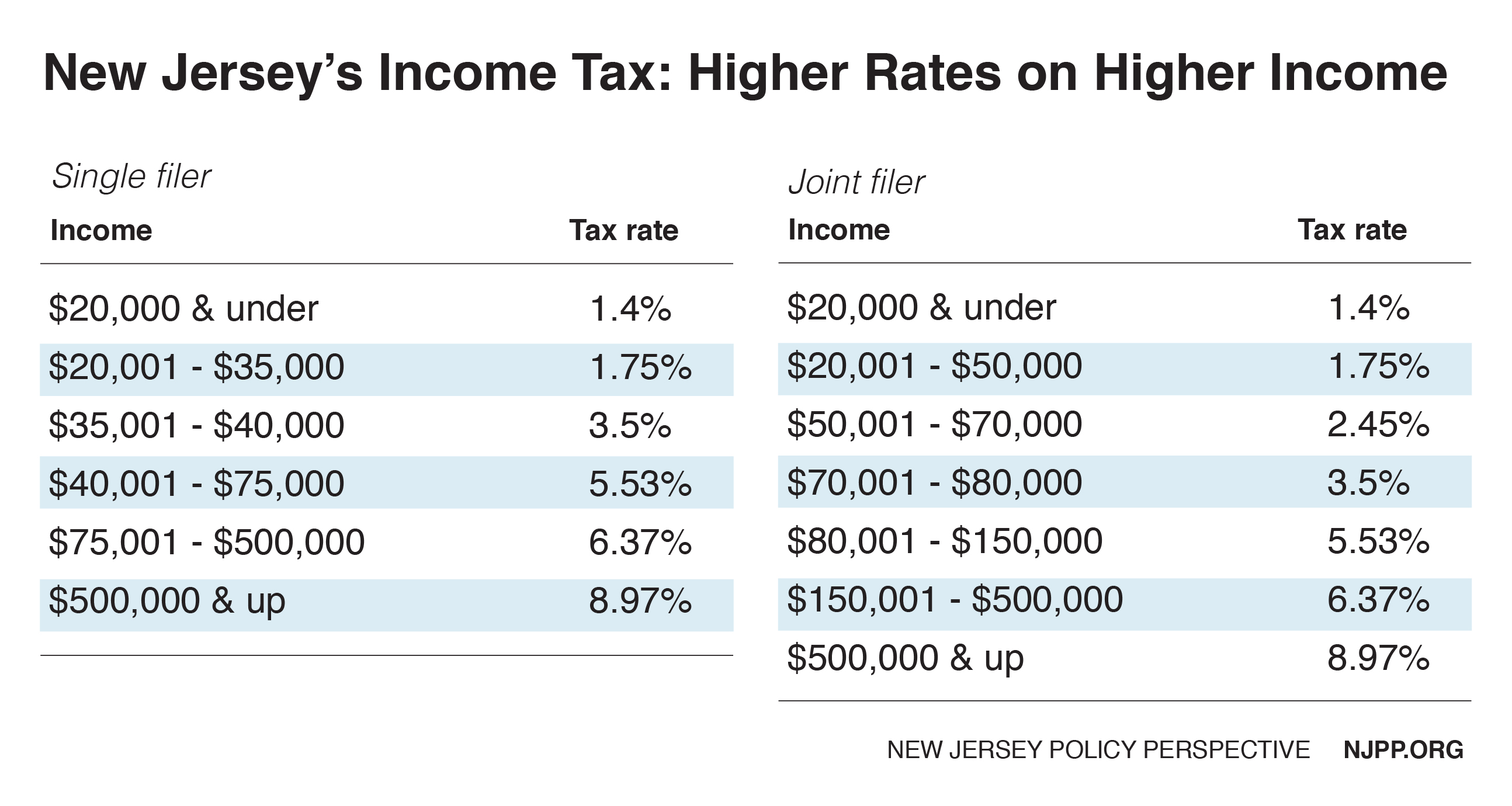

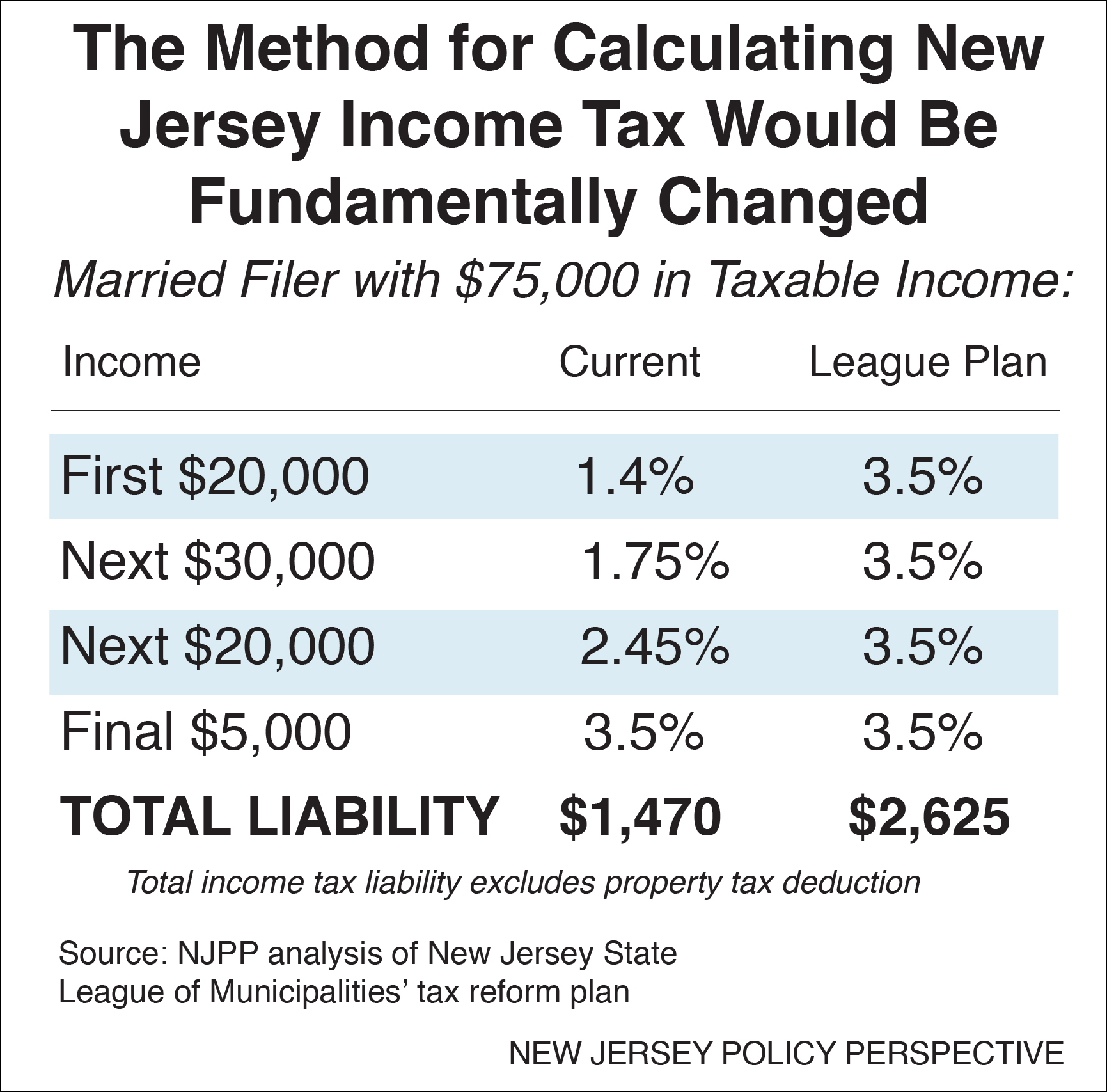

Nj Tax Table Page 52 - Find the income tax withholding rates for different payroll periods and allowances in new jersey. Use this table if your new jersey taxable income on line 39 is less than $100,000. Use this table if your new jersey taxable income on line 40 is less than $100,000. The pdf file shows the tables for percentage. We'll cover the basics, like who needs to file, what. If your taxable income is $100,000 or more, you must use the. This page is designed to help you understand new jersey state income tax. The credit reduces your new jersey tax based on the percentage of income that was taxed by other jurisdictions. New jersey has a graduated income tax rate, which means it imposes a higher tax rate the higher the income. If your taxable income is $100,000 or more, you must use the.

Use this table if your new jersey taxable income on line 40 is less than $100,000. Find the income tax withholding rates for different payroll periods and allowances in new jersey. New jersey has a graduated income tax rate, which means it imposes a higher tax rate the higher the income. The credit reduces your new jersey tax based on the percentage of income that was taxed by other jurisdictions. This page is designed to help you understand new jersey state income tax. If your taxable income is $100,000 or more, you must use the. The pdf file shows the tables for percentage. We'll cover the basics, like who needs to file, what. If your taxable income is $100,000 or more, you must use the. Use this table if your new jersey taxable income on line 39 is less than $100,000.

Find the income tax withholding rates for different payroll periods and allowances in new jersey. This page is designed to help you understand new jersey state income tax. The pdf file shows the tables for percentage. If your taxable income is $100,000 or more, you must use the. Use this table if your new jersey taxable income on line 39 is less than $100,000. New jersey has a graduated income tax rate, which means it imposes a higher tax rate the higher the income. Use this table if your new jersey taxable income on line 40 is less than $100,000. We'll cover the basics, like who needs to file, what. The credit reduces your new jersey tax based on the percentage of income that was taxed by other jurisdictions. If your taxable income is $100,000 or more, you must use the.

Nj Tax Rates 2025 Richard Shumate

If your taxable income is $100,000 or more, you must use the. The credit reduces your new jersey tax based on the percentage of income that was taxed by other jurisdictions. Use this table if your new jersey taxable income on line 39 is less than $100,000. The pdf file shows the tables for percentage. This page is designed to.

Nj Tax Form 2024 Leena Giustina

New jersey has a graduated income tax rate, which means it imposes a higher tax rate the higher the income. If your taxable income is $100,000 or more, you must use the. If your taxable income is $100,000 or more, you must use the. We'll cover the basics, like who needs to file, what. This page is designed to help.

Tax Rates 2024 Nj Tabby Krystal

New jersey has a graduated income tax rate, which means it imposes a higher tax rate the higher the income. Use this table if your new jersey taxable income on line 40 is less than $100,000. This page is designed to help you understand new jersey state income tax. Use this table if your new jersey taxable income on line.

Nj Tax Rates 2024 Ally Lulita

The pdf file shows the tables for percentage. If your taxable income is $100,000 or more, you must use the. We'll cover the basics, like who needs to file, what. Use this table if your new jersey taxable income on line 39 is less than $100,000. If your taxable income is $100,000 or more, you must use the.

Tax Brackets 2025 Explained Nj Aziza Wren

The credit reduces your new jersey tax based on the percentage of income that was taxed by other jurisdictions. Use this table if your new jersey taxable income on line 39 is less than $100,000. If your taxable income is $100,000 or more, you must use the. New jersey has a graduated income tax rate, which means it imposes a.

Nj Tax Rates 2024 Dido Myriam

Use this table if your new jersey taxable income on line 39 is less than $100,000. Find the income tax withholding rates for different payroll periods and allowances in new jersey. We'll cover the basics, like who needs to file, what. The credit reduces your new jersey tax based on the percentage of income that was taxed by other jurisdictions..

Tax In Nj 2024 Brenn Clarice

The credit reduces your new jersey tax based on the percentage of income that was taxed by other jurisdictions. The pdf file shows the tables for percentage. New jersey has a graduated income tax rate, which means it imposes a higher tax rate the higher the income. We'll cover the basics, like who needs to file, what. Find the income.

Nj Tax Brackets 2024 Taffy Federica

We'll cover the basics, like who needs to file, what. If your taxable income is $100,000 or more, you must use the. New jersey has a graduated income tax rate, which means it imposes a higher tax rate the higher the income. If your taxable income is $100,000 or more, you must use the. Find the income tax withholding rates.

Nj tax refund status 2010 fecolassistant

Use this table if your new jersey taxable income on line 40 is less than $100,000. The pdf file shows the tables for percentage. Use this table if your new jersey taxable income on line 39 is less than $100,000. This page is designed to help you understand new jersey state income tax. We'll cover the basics, like who needs.

Nj Tax Rates 2025 John Wu

Find the income tax withholding rates for different payroll periods and allowances in new jersey. If your taxable income is $100,000 or more, you must use the. This page is designed to help you understand new jersey state income tax. Use this table if your new jersey taxable income on line 39 is less than $100,000. Use this table if.

Use This Table If Your New Jersey Taxable Income On Line 40 Is Less Than $100,000.

If your taxable income is $100,000 or more, you must use the. The pdf file shows the tables for percentage. If your taxable income is $100,000 or more, you must use the. The credit reduces your new jersey tax based on the percentage of income that was taxed by other jurisdictions.

This Page Is Designed To Help You Understand New Jersey State Income Tax.

Use this table if your new jersey taxable income on line 39 is less than $100,000. Find the income tax withholding rates for different payroll periods and allowances in new jersey. We'll cover the basics, like who needs to file, what. New jersey has a graduated income tax rate, which means it imposes a higher tax rate the higher the income.