Operating Leases On Balance Sheet - Especially when you have to sift through multiple financial statements to quantify its impact. An operating lease is different from a. An operating lease is a lease agreement in which the lessor provides the lessee with the right to use an asset for a short duration. Operating lease accounting can be confusing. What is an operating lease? Under the asc 840 standard, only accounting for capital leases were recorded on the balance sheet. As mentioned above, like other. By renting and not owning, operating leases enable companies to keep from recording an asset on their balance sheets by treating them as operating expenses. Are operating leases and leased assets on the balance sheet?

By renting and not owning, operating leases enable companies to keep from recording an asset on their balance sheets by treating them as operating expenses. Operating lease accounting can be confusing. What is an operating lease? An operating lease is a lease agreement in which the lessor provides the lessee with the right to use an asset for a short duration. An operating lease is different from a. Are operating leases and leased assets on the balance sheet? Under the asc 840 standard, only accounting for capital leases were recorded on the balance sheet. As mentioned above, like other. Especially when you have to sift through multiple financial statements to quantify its impact.

Are operating leases and leased assets on the balance sheet? As mentioned above, like other. An operating lease is different from a. By renting and not owning, operating leases enable companies to keep from recording an asset on their balance sheets by treating them as operating expenses. An operating lease is a lease agreement in which the lessor provides the lessee with the right to use an asset for a short duration. What is an operating lease? Operating lease accounting can be confusing. Under the asc 840 standard, only accounting for capital leases were recorded on the balance sheet. Especially when you have to sift through multiple financial statements to quantify its impact.

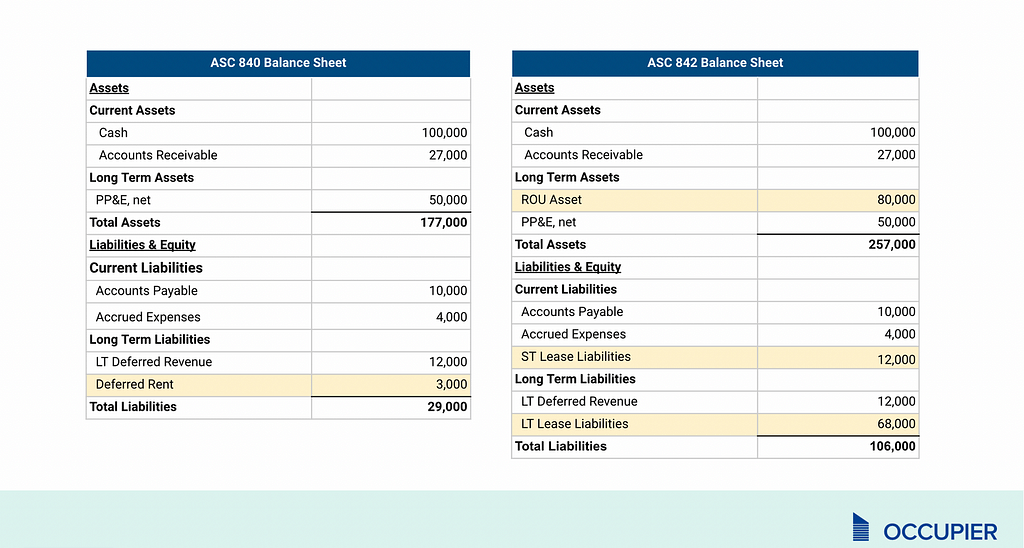

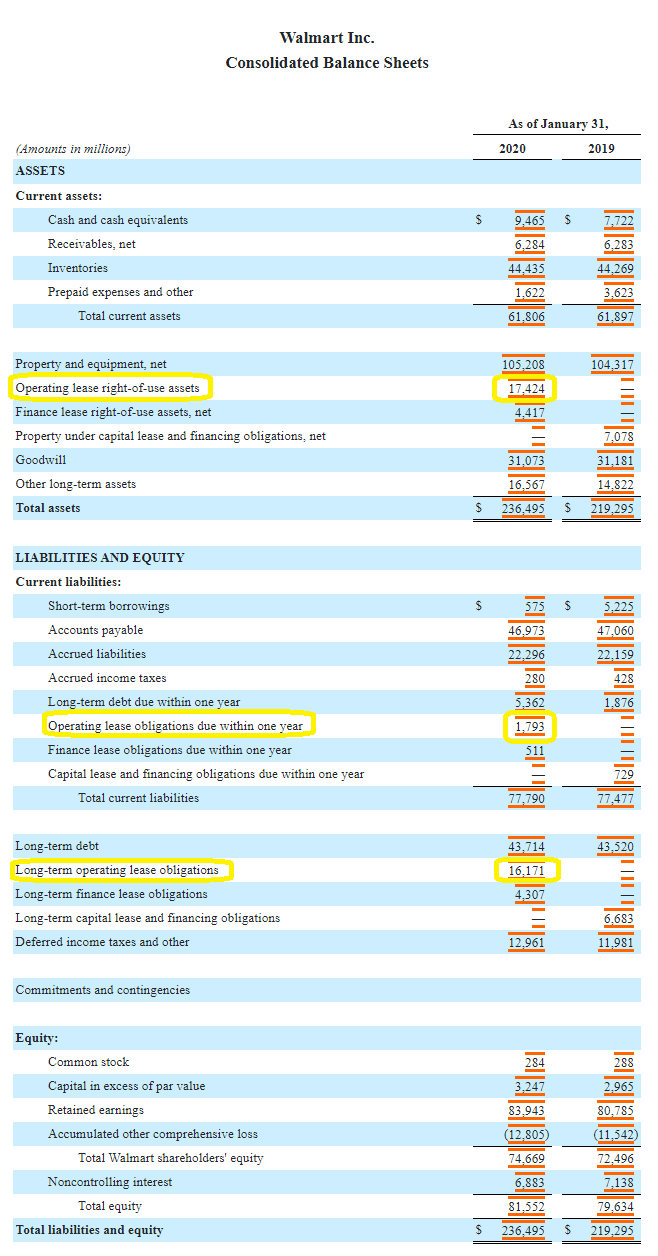

Lease Liabilities The balance sheet impact Occupier

As mentioned above, like other. Especially when you have to sift through multiple financial statements to quantify its impact. What is an operating lease? By renting and not owning, operating leases enable companies to keep from recording an asset on their balance sheets by treating them as operating expenses. An operating lease is a lease agreement in which the lessor.

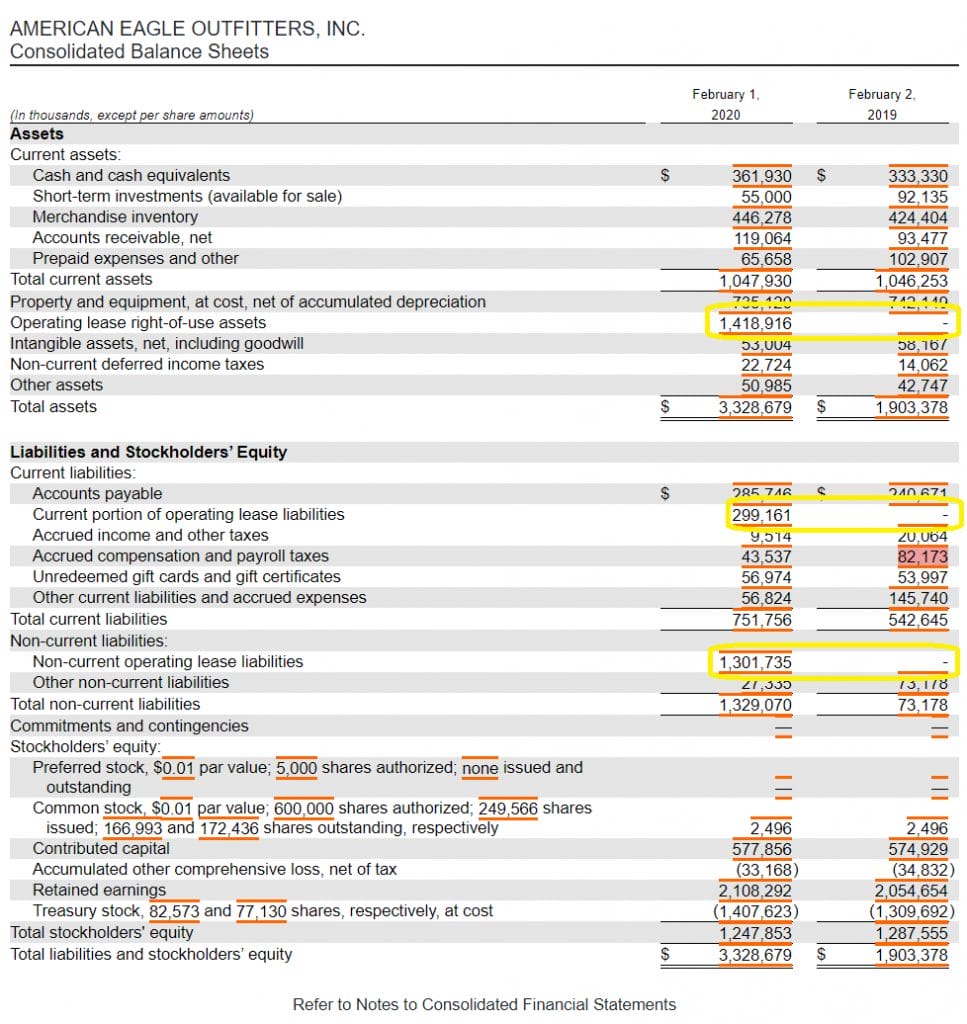

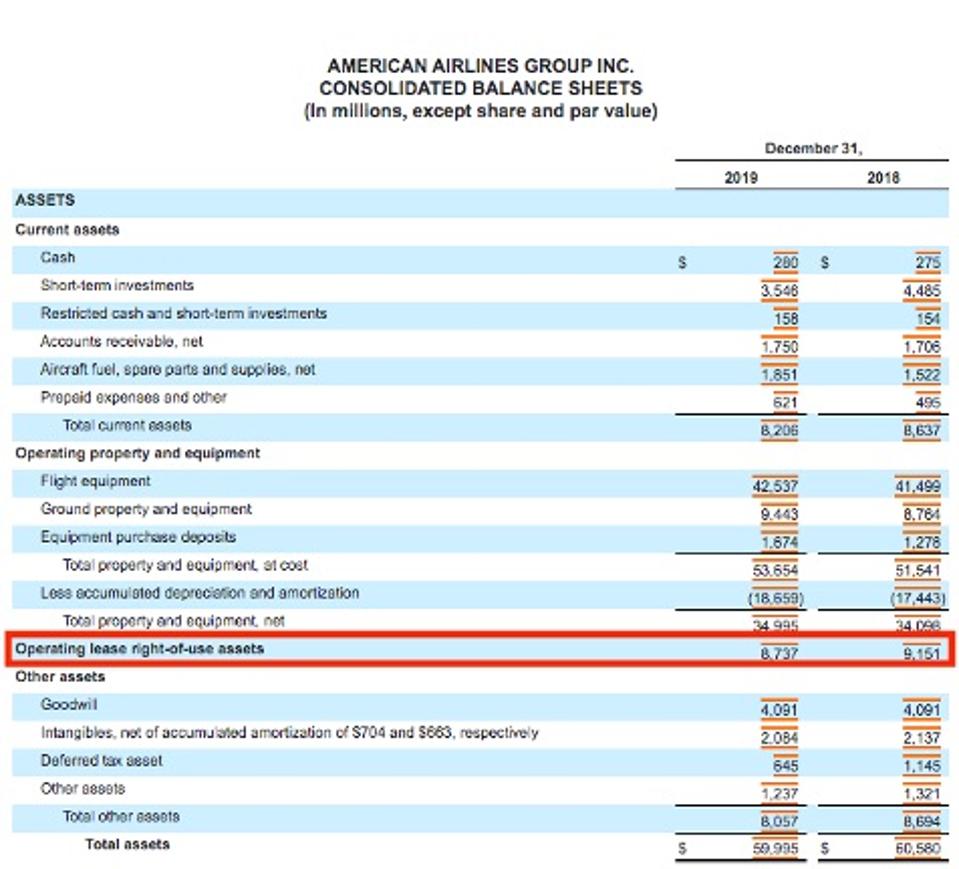

Financing and Operating Leases in Valuation Analyzing Alpha

Are operating leases and leased assets on the balance sheet? Operating lease accounting can be confusing. As mentioned above, like other. Especially when you have to sift through multiple financial statements to quantify its impact. An operating lease is different from a.

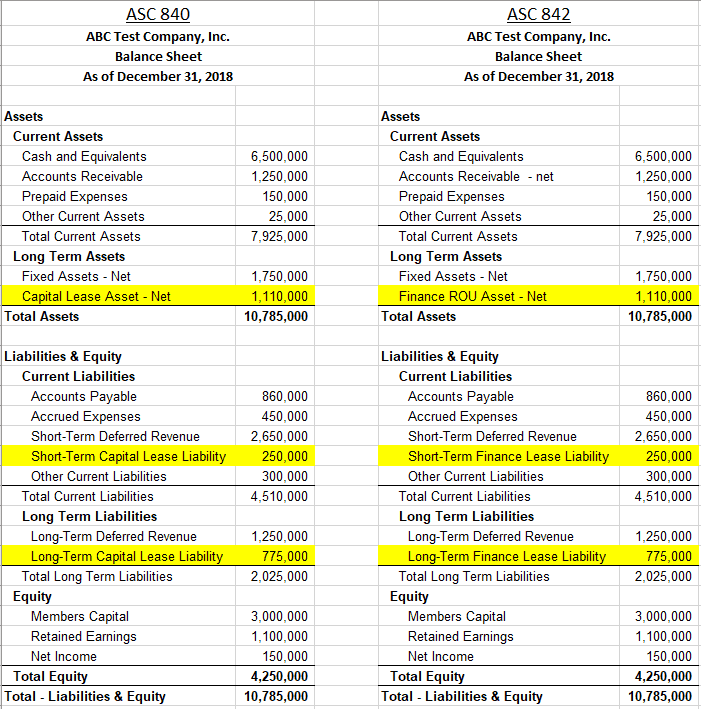

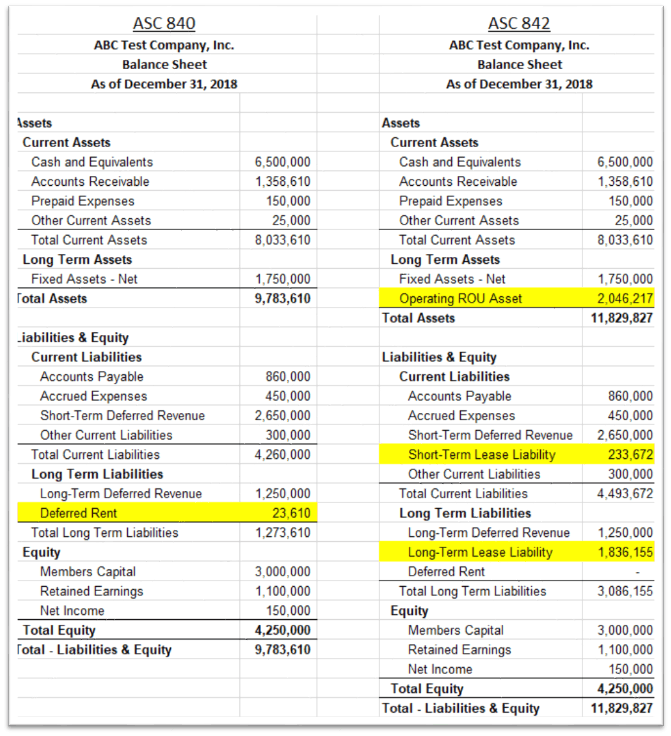

ASC 842 Balance Sheet Guide with Examples Visual Lease

An operating lease is a lease agreement in which the lessor provides the lessee with the right to use an asset for a short duration. An operating lease is different from a. By renting and not owning, operating leases enable companies to keep from recording an asset on their balance sheets by treating them as operating expenses. Are operating leases.

Accounting for Operating Leases in the Balance Sheet Simply Explained

By renting and not owning, operating leases enable companies to keep from recording an asset on their balance sheets by treating them as operating expenses. Operating lease accounting can be confusing. Are operating leases and leased assets on the balance sheet? What is an operating lease? An operating lease is different from a.

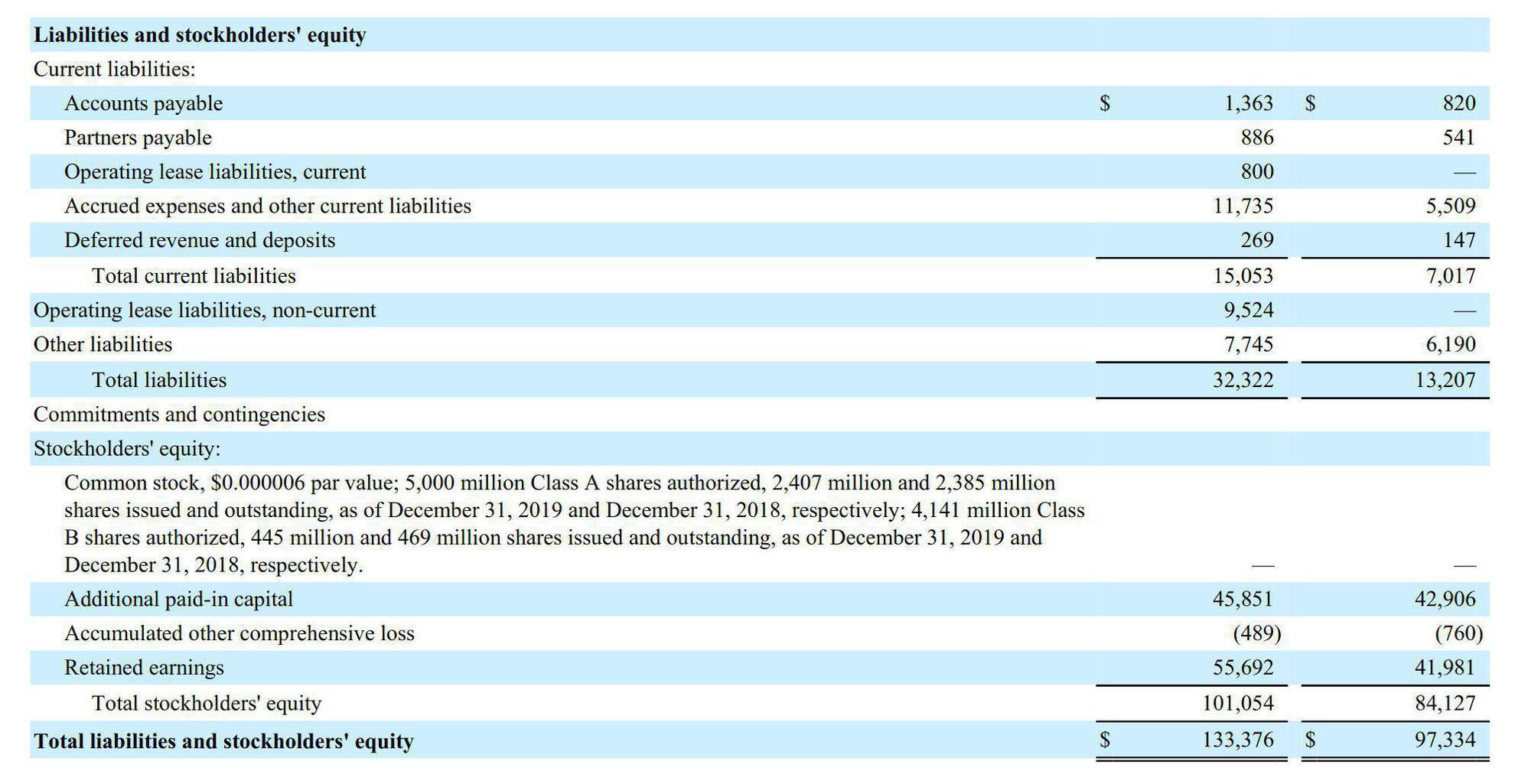

ASC 842 Summary of Balance Sheet Changes for 2020

By renting and not owning, operating leases enable companies to keep from recording an asset on their balance sheets by treating them as operating expenses. Especially when you have to sift through multiple financial statements to quantify its impact. As mentioned above, like other. Operating lease accounting can be confusing. An operating lease is different from a.

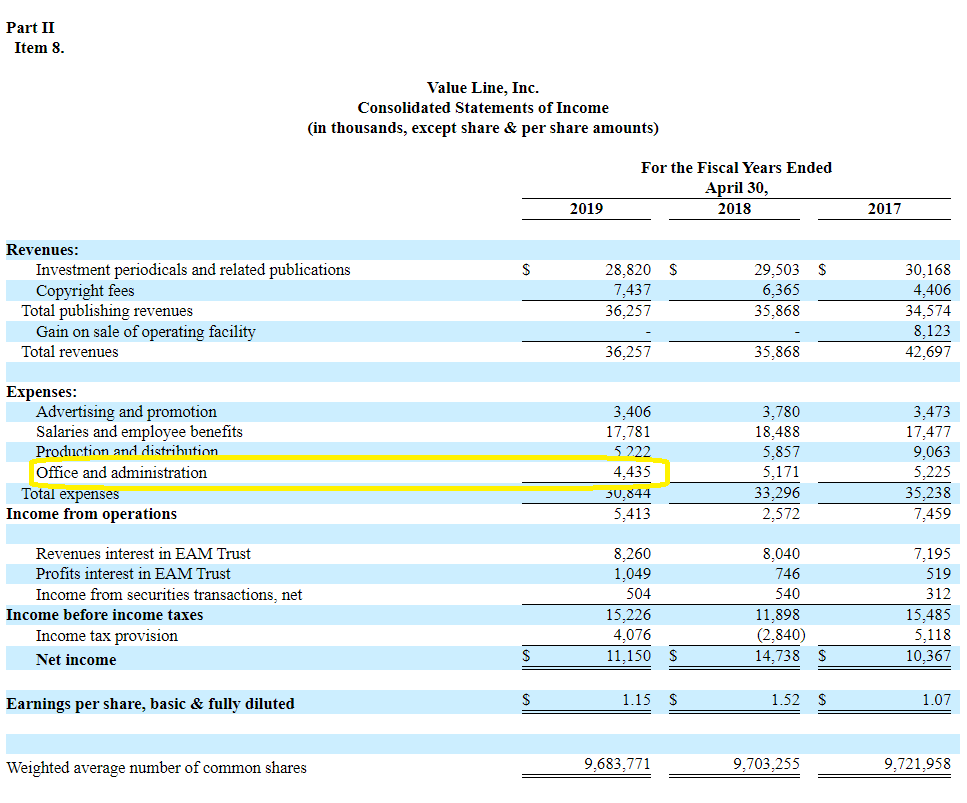

The Potential Impact of Lease Accounting on Equity Valuation The CPA

An operating lease is a lease agreement in which the lessor provides the lessee with the right to use an asset for a short duration. Operating lease accounting can be confusing. Especially when you have to sift through multiple financial statements to quantify its impact. By renting and not owning, operating leases enable companies to keep from recording an asset.

New Operating Lease Disclosures The Good, The Bad & The

Especially when you have to sift through multiple financial statements to quantify its impact. By renting and not owning, operating leases enable companies to keep from recording an asset on their balance sheets by treating them as operating expenses. What is an operating lease? An operating lease is a lease agreement in which the lessor provides the lessee with the.

Accounting for Operating Leases in the Balance Sheet Simply Explained

An operating lease is different from a. What is an operating lease? An operating lease is a lease agreement in which the lessor provides the lessee with the right to use an asset for a short duration. As mentioned above, like other. Operating lease accounting can be confusing.

Accounting for Operating Leases in the Balance Sheet Simply Explained

Under the asc 840 standard, only accounting for capital leases were recorded on the balance sheet. Operating lease accounting can be confusing. What is an operating lease? Especially when you have to sift through multiple financial statements to quantify its impact. By renting and not owning, operating leases enable companies to keep from recording an asset on their balance sheets.

Accounting for Operating Leases in the Balance Sheet Simply Explained

Are operating leases and leased assets on the balance sheet? By renting and not owning, operating leases enable companies to keep from recording an asset on their balance sheets by treating them as operating expenses. Especially when you have to sift through multiple financial statements to quantify its impact. An operating lease is a lease agreement in which the lessor.

Especially When You Have To Sift Through Multiple Financial Statements To Quantify Its Impact.

Operating lease accounting can be confusing. An operating lease is different from a. Under the asc 840 standard, only accounting for capital leases were recorded on the balance sheet. Are operating leases and leased assets on the balance sheet?

By Renting And Not Owning, Operating Leases Enable Companies To Keep From Recording An Asset On Their Balance Sheets By Treating Them As Operating Expenses.

An operating lease is a lease agreement in which the lessor provides the lessee with the right to use an asset for a short duration. As mentioned above, like other. What is an operating lease?