Paga Penalties Chart - Penalties under paga are assessed against employers in the amount of $100 per employee per pay period for an initial labor code. Explore the essentials of california labor code 2699, focusing on paga filing criteria, penalties, and the role of private attorneys. The information on the chart that follows is a capsulized summary of those california employment laws that, if employers. Civil penalties under paga are in addition to any other remedies under state or federal law ―of the civil penalties recovered, 75% automatically go. Penalty payments must be paid by check, made out to the labor and workforce development agency (lwda), and sent by mail to the.

The information on the chart that follows is a capsulized summary of those california employment laws that, if employers. Penalties under paga are assessed against employers in the amount of $100 per employee per pay period for an initial labor code. Explore the essentials of california labor code 2699, focusing on paga filing criteria, penalties, and the role of private attorneys. Penalty payments must be paid by check, made out to the labor and workforce development agency (lwda), and sent by mail to the. Civil penalties under paga are in addition to any other remedies under state or federal law ―of the civil penalties recovered, 75% automatically go.

Civil penalties under paga are in addition to any other remedies under state or federal law ―of the civil penalties recovered, 75% automatically go. The information on the chart that follows is a capsulized summary of those california employment laws that, if employers. Penalty payments must be paid by check, made out to the labor and workforce development agency (lwda), and sent by mail to the. Explore the essentials of california labor code 2699, focusing on paga filing criteria, penalties, and the role of private attorneys. Penalties under paga are assessed against employers in the amount of $100 per employee per pay period for an initial labor code.

Penalties Sports Bar & Grill

Civil penalties under paga are in addition to any other remedies under state or federal law ―of the civil penalties recovered, 75% automatically go. Penalty payments must be paid by check, made out to the labor and workforce development agency (lwda), and sent by mail to the. The information on the chart that follows is a capsulized summary of those.

Penalties PDF

Civil penalties under paga are in addition to any other remedies under state or federal law ―of the civil penalties recovered, 75% automatically go. Penalties under paga are assessed against employers in the amount of $100 per employee per pay period for an initial labor code. Penalty payments must be paid by check, made out to the labor and workforce.

Meal Period PAGA Penalties PAGA Penalties for Missed Meal Breaks

Civil penalties under paga are in addition to any other remedies under state or federal law ―of the civil penalties recovered, 75% automatically go. Penalty payments must be paid by check, made out to the labor and workforce development agency (lwda), and sent by mail to the. Penalties under paga are assessed against employers in the amount of $100 per.

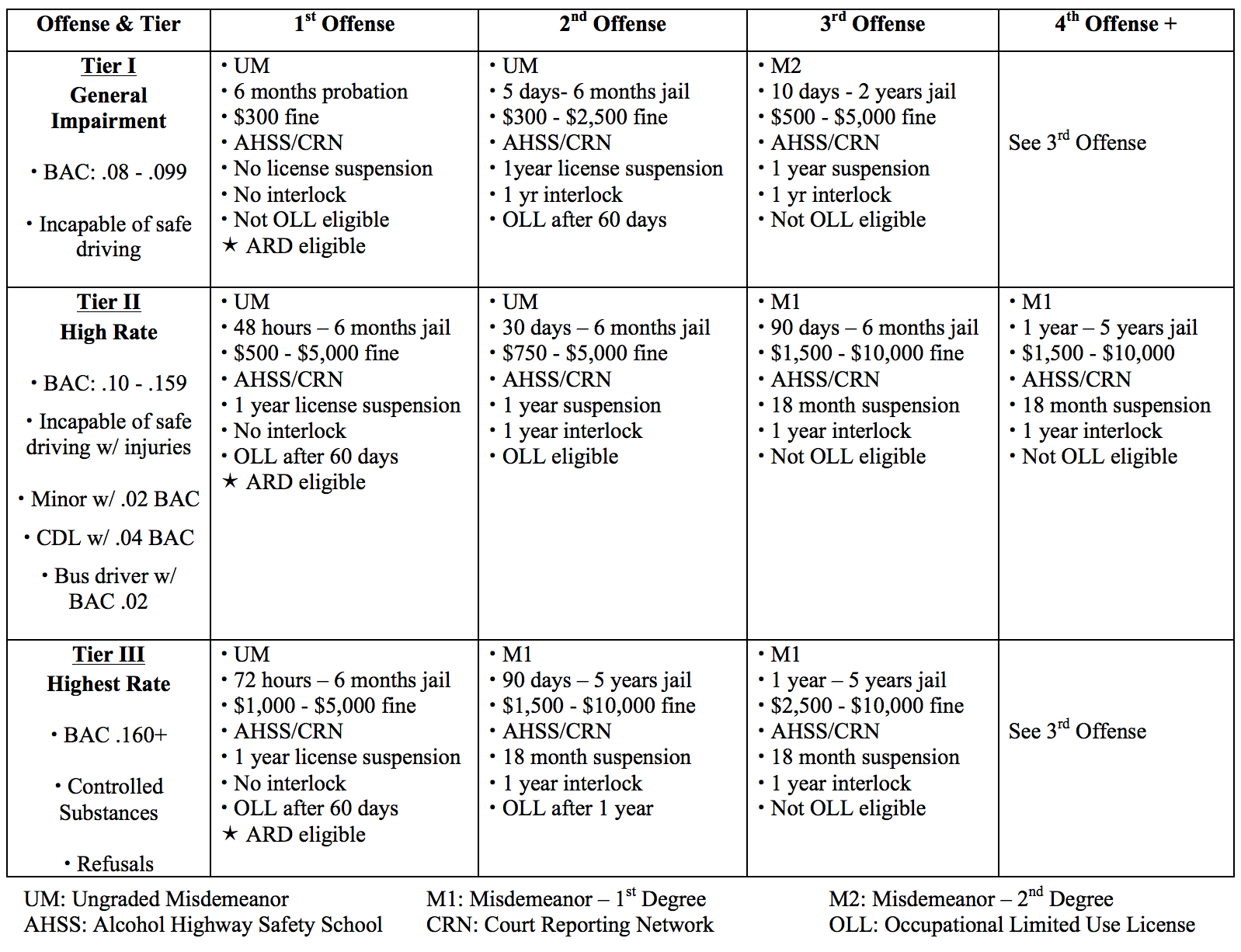

DUI Penalties Chart Ramsay & Ramsay, PC

The information on the chart that follows is a capsulized summary of those california employment laws that, if employers. Penalties under paga are assessed against employers in the amount of $100 per employee per pay period for an initial labor code. Explore the essentials of california labor code 2699, focusing on paga filing criteria, penalties, and the role of private.

Meal Period PAGA Penalties PAGA Penalties for Missed Meal Breaks

Penalty payments must be paid by check, made out to the labor and workforce development agency (lwda), and sent by mail to the. Civil penalties under paga are in addition to any other remedies under state or federal law ―of the civil penalties recovered, 75% automatically go. Penalties under paga are assessed against employers in the amount of $100 per.

A PAGA CHART » Muz House Beat

The information on the chart that follows is a capsulized summary of those california employment laws that, if employers. Penalty payments must be paid by check, made out to the labor and workforce development agency (lwda), and sent by mail to the. Explore the essentials of california labor code 2699, focusing on paga filing criteria, penalties, and the role of.

Meal Period PAGA Penalties PAGA Penalties for Missed Meal Breaks

Penalty payments must be paid by check, made out to the labor and workforce development agency (lwda), and sent by mail to the. Explore the essentials of california labor code 2699, focusing on paga filing criteria, penalties, and the role of private attorneys. Civil penalties under paga are in addition to any other remedies under state or federal law ―of.

Texas Drug Penalties Chart

Penalties under paga are assessed against employers in the amount of $100 per employee per pay period for an initial labor code. Penalty payments must be paid by check, made out to the labor and workforce development agency (lwda), and sent by mail to the. The information on the chart that follows is a capsulized summary of those california employment.

Meal Period PAGA Penalties PAGA Penalties for Missed Meal Breaks

Penalties under paga are assessed against employers in the amount of $100 per employee per pay period for an initial labor code. Explore the essentials of california labor code 2699, focusing on paga filing criteria, penalties, and the role of private attorneys. Civil penalties under paga are in addition to any other remedies under state or federal law ―of the.

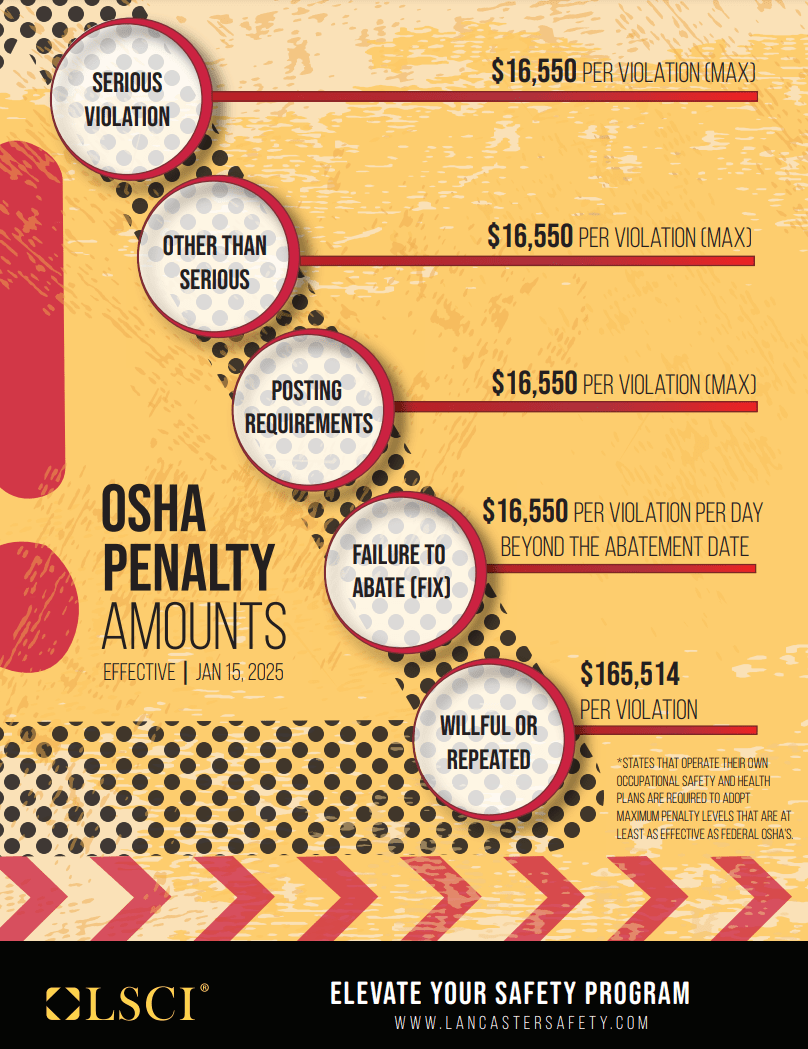

Why OSHA Penalties & Fines Increased Again

Penalty payments must be paid by check, made out to the labor and workforce development agency (lwda), and sent by mail to the. Explore the essentials of california labor code 2699, focusing on paga filing criteria, penalties, and the role of private attorneys. The information on the chart that follows is a capsulized summary of those california employment laws that,.

Civil Penalties Under Paga Are In Addition To Any Other Remedies Under State Or Federal Law ―Of The Civil Penalties Recovered, 75% Automatically Go.

The information on the chart that follows is a capsulized summary of those california employment laws that, if employers. Penalty payments must be paid by check, made out to the labor and workforce development agency (lwda), and sent by mail to the. Explore the essentials of california labor code 2699, focusing on paga filing criteria, penalties, and the role of private attorneys. Penalties under paga are assessed against employers in the amount of $100 per employee per pay period for an initial labor code.