Page 2 1040 - Access irs forms, instructions and publications in electronic and print media. For the information to print on page 2 of form 1040, make sure the following scenarios are present: They weave together as you move down the form and. In particular, the taxpayer's filing status is reported on this page. Page 2 of the 1040 form is a mishmash of taxes you owe and credits you're eligible to take. To access the form, you will need to open a 1040/business return on the online/desktop and then go to add. The second page reports income, calculates the allowable deductions. Allocate a refund to a single account. How to access the form: The draft you are looking for begins on the next page.

Draft—not for filing this is an early release draft of an irs tax form,. Allocate a refund to a single account. Page 2 of the 1040 form is a mishmash of taxes you owe and credits you're eligible to take. For the information to print on page 2 of form 1040, make sure the following scenarios are present: The second page reports income, calculates the allowable deductions. In particular, the taxpayer's filing status is reported on this page. They weave together as you move down the form and. To access the form, you will need to open a 1040/business return on the online/desktop and then go to add. Access irs forms, instructions and publications in electronic and print media. The draft you are looking for begins on the next page.

Allocate a refund to a single account. They weave together as you move down the form and. Draft—not for filing this is an early release draft of an irs tax form,. How to access the form: The draft you are looking for begins on the next page. To access the form, you will need to open a 1040/business return on the online/desktop and then go to add. The second page reports income, calculates the allowable deductions. In particular, the taxpayer's filing status is reported on this page. Page 2 of the 1040 form is a mishmash of taxes you owe and credits you're eligible to take. For the information to print on page 2 of form 1040, make sure the following scenarios are present:

Printable Federal 1040 Form Printable Forms Free Online

In particular, the taxpayer's filing status is reported on this page. Access irs forms, instructions and publications in electronic and print media. Allocate a refund to a single account. The draft you are looking for begins on the next page. They weave together as you move down the form and.

Printable Form 1040 Printable Forms Free Online

The second page reports income, calculates the allowable deductions. To access the form, you will need to open a 1040/business return on the online/desktop and then go to add. Draft—not for filing this is an early release draft of an irs tax form,. Access irs forms, instructions and publications in electronic and print media. Allocate a refund to a single.

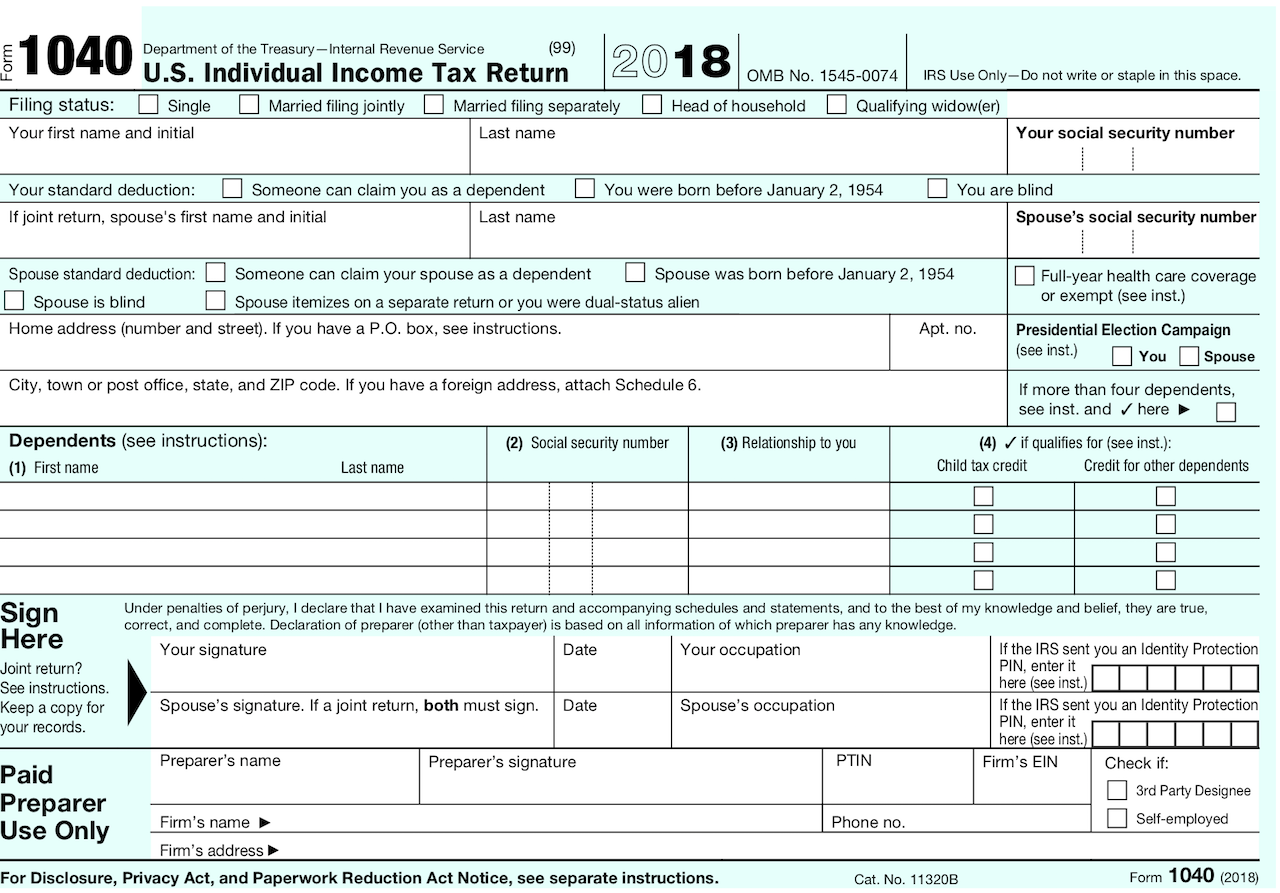

Form 1040 for Tax Return

The second page reports income, calculates the allowable deductions. For the information to print on page 2 of form 1040, make sure the following scenarios are present: How to access the form: The draft you are looking for begins on the next page. Page 2 of the 1040 form is a mishmash of taxes you owe and credits you're eligible.

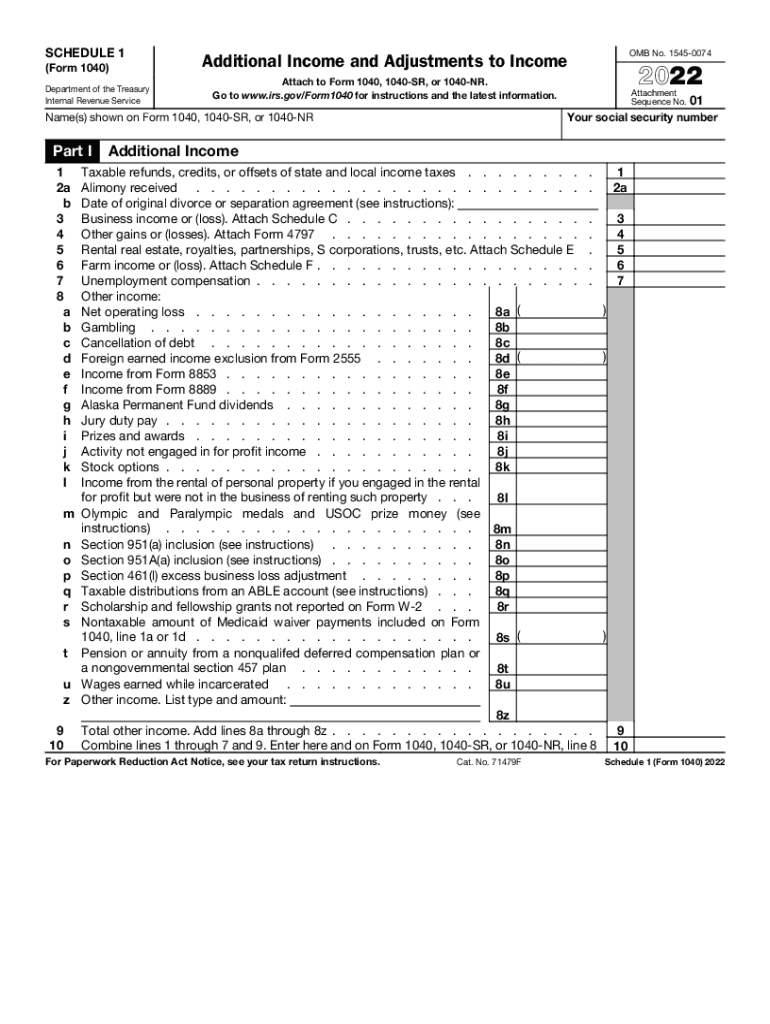

Schedule 1 1040 2025 Tax Form Jean S. Pagan

Access irs forms, instructions and publications in electronic and print media. They weave together as you move down the form and. Page 2 of the 1040 form is a mishmash of taxes you owe and credits you're eligible to take. For the information to print on page 2 of form 1040, make sure the following scenarios are present: Allocate a.

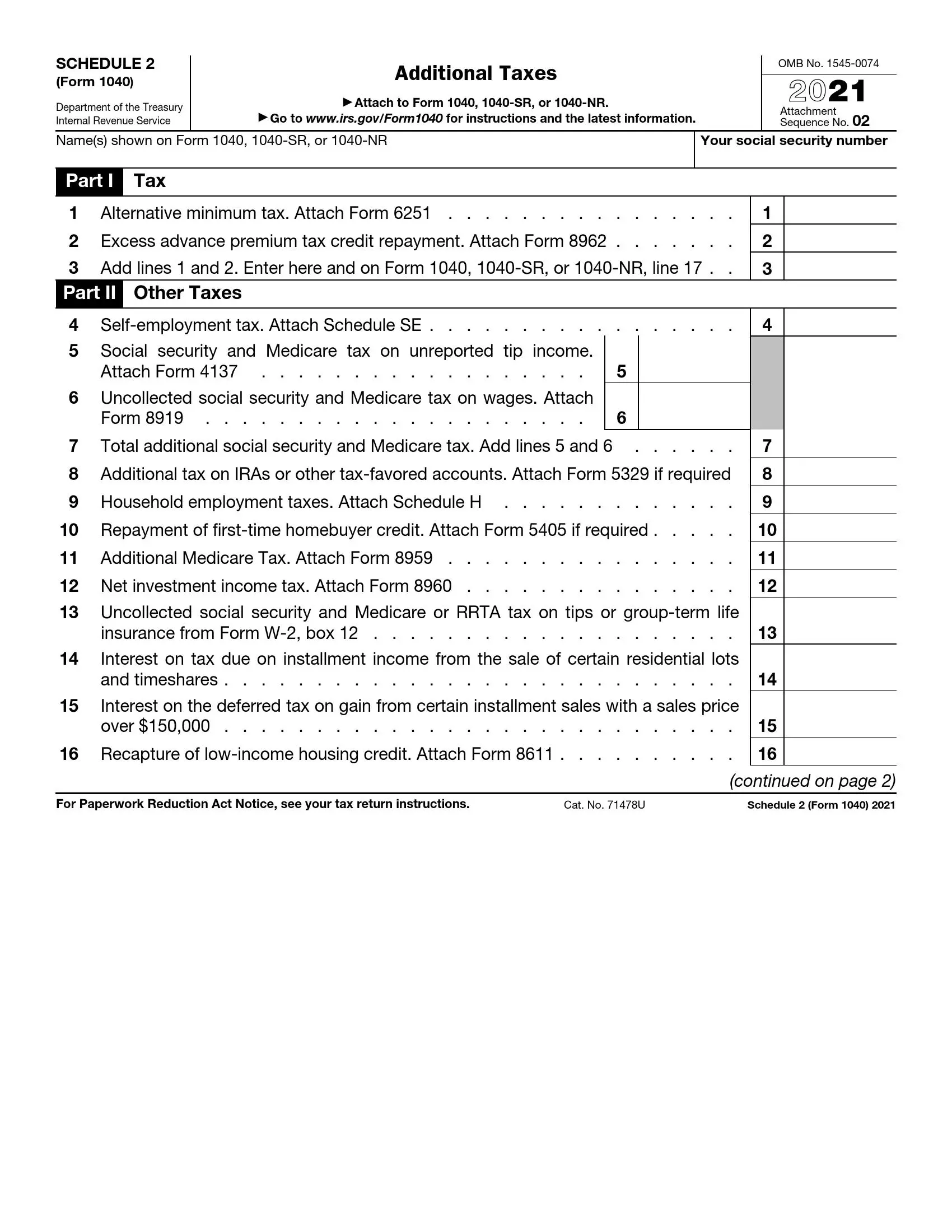

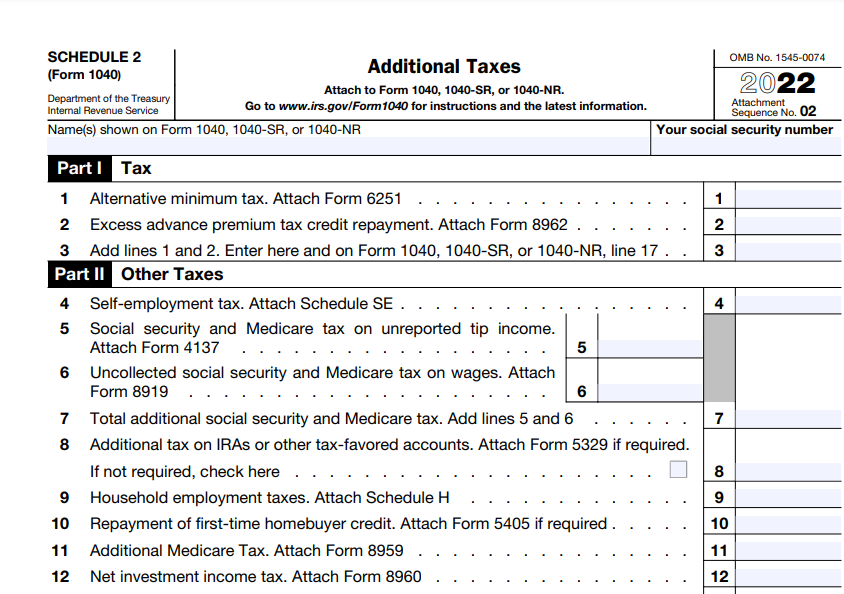

IRS Schedule 2 Form 1040 or 1040SR ≡ Fill Out Printable PDF Forms

The second page reports income, calculates the allowable deductions. Access irs forms, instructions and publications in electronic and print media. To access the form, you will need to open a 1040/business return on the online/desktop and then go to add. The draft you are looking for begins on the next page. How to access the form:

IRS Form 1040NR ≡ Fill Out Printable PDF Forms Online, 47 OFF

Draft—not for filing this is an early release draft of an irs tax form,. Allocate a refund to a single account. Access irs forms, instructions and publications in electronic and print media. Page 2 of the 1040 form is a mishmash of taxes you owe and credits you're eligible to take. How to access the form:

1040 Form 2023

They weave together as you move down the form and. Draft—not for filing this is an early release draft of an irs tax form,. Page 2 of the 1040 form is a mishmash of taxes you owe and credits you're eligible to take. How to access the form: The second page reports income, calculates the allowable deductions.

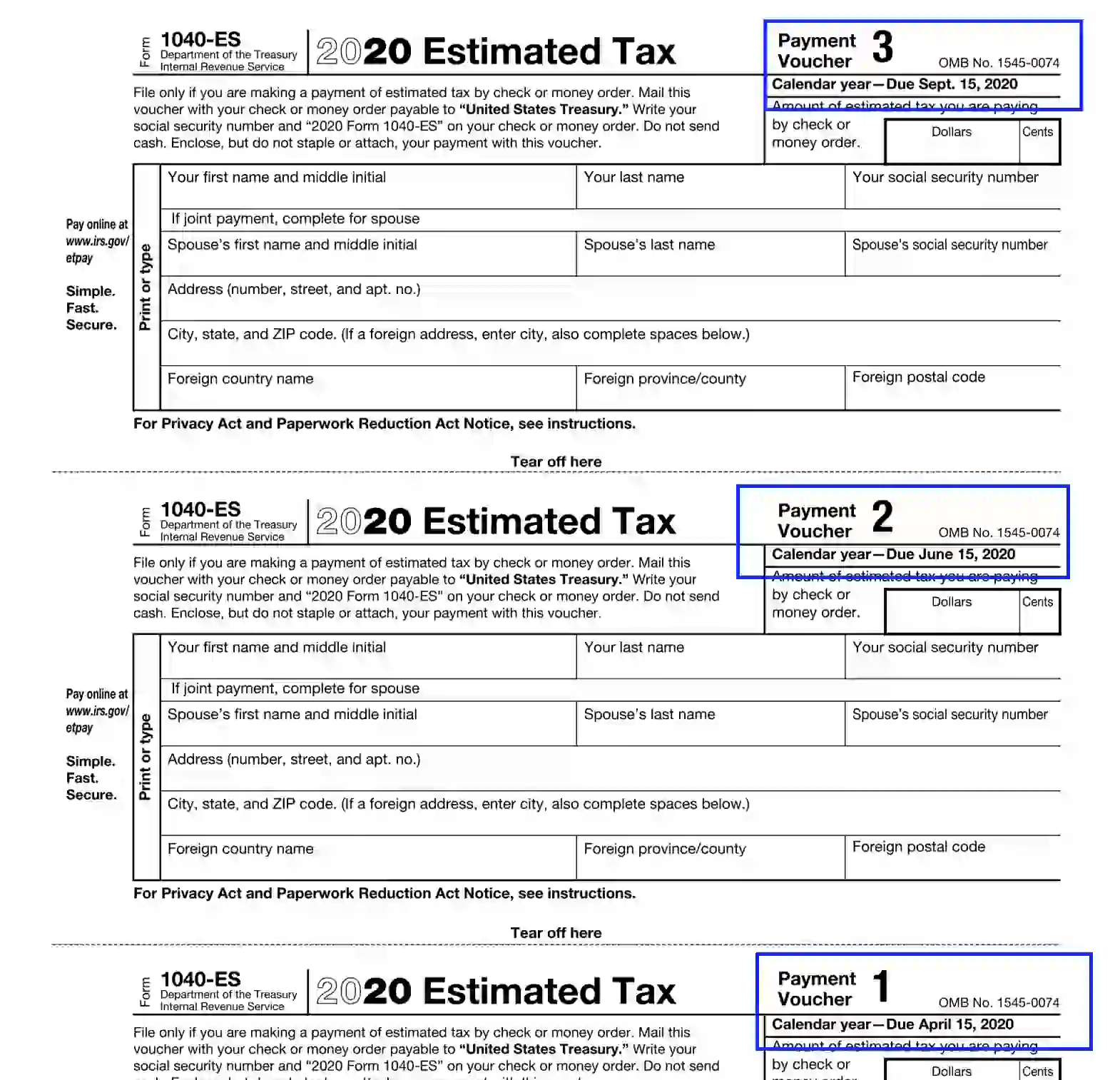

Form 1040 Es 2023 Printable Forms Free Online

Allocate a refund to a single account. How to access the form: The second page reports income, calculates the allowable deductions. Page 2 of the 1040 form is a mishmash of taxes you owe and credits you're eligible to take. Access irs forms, instructions and publications in electronic and print media.

Describes new Form 1040, Schedules & Tax Tables

Page 2 of the 1040 form is a mishmash of taxes you owe and credits you're eligible to take. Draft—not for filing this is an early release draft of an irs tax form,. How to access the form: Allocate a refund to a single account. The second page reports income, calculates the allowable deductions.

A1O04 Form 1040 Schedule A Itemized Deductions

Draft—not for filing this is an early release draft of an irs tax form,. In particular, the taxpayer's filing status is reported on this page. To access the form, you will need to open a 1040/business return on the online/desktop and then go to add. Allocate a refund to a single account. The draft you are looking for begins on.

Access Irs Forms, Instructions And Publications In Electronic And Print Media.

How to access the form: The draft you are looking for begins on the next page. For the information to print on page 2 of form 1040, make sure the following scenarios are present: Allocate a refund to a single account.

Page 2 Of The 1040 Form Is A Mishmash Of Taxes You Owe And Credits You're Eligible To Take.

They weave together as you move down the form and. Draft—not for filing this is an early release draft of an irs tax form,. The second page reports income, calculates the allowable deductions. To access the form, you will need to open a 1040/business return on the online/desktop and then go to add.