Prepaid Rent On Balance Sheet - Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. In essence, there is no such account named “prepaid rent” on the balance sheet under the rules of asc 842. The pre paid rent account is a balance. Prepaid rent is a balance sheet account, and rent expense is an income statement account. When a business pays rent in advance, it is essentially. The business has paid the rent in advance and has the right to use the premises for the following three month period of april, may, and june. Prepaid rent typically represents multiple rent payments, while rent expense is a single. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using the facility to which the rent relates, and then.

In essence, there is no such account named “prepaid rent” on the balance sheet under the rules of asc 842. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using the facility to which the rent relates, and then. The pre paid rent account is a balance. Prepaid rent typically represents multiple rent payments, while rent expense is a single. Prepaid rent is a balance sheet account, and rent expense is an income statement account. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. The business has paid the rent in advance and has the right to use the premises for the following three month period of april, may, and june. When a business pays rent in advance, it is essentially.

When a business pays rent in advance, it is essentially. Prepaid rent typically represents multiple rent payments, while rent expense is a single. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. The pre paid rent account is a balance. In essence, there is no such account named “prepaid rent” on the balance sheet under the rules of asc 842. Prepaid rent is a balance sheet account, and rent expense is an income statement account. The business has paid the rent in advance and has the right to use the premises for the following three month period of april, may, and june. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using the facility to which the rent relates, and then.

Free Prepaid Expense Schedule Excel Template Web Prepayments And

The business has paid the rent in advance and has the right to use the premises for the following three month period of april, may, and june. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using the facility to which the rent relates, and then. When.

Where Is Prepaid Rent On The Balance Sheet LiveWell

Prepaid rent is a balance sheet account, and rent expense is an income statement account. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. The pre paid rent account is a balance. When a business pays rent in advance, it is essentially. The business has paid the rent in.

What type of account is prepaid rent? Financial

In essence, there is no such account named “prepaid rent” on the balance sheet under the rules of asc 842. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using the facility to which the rent relates, and then. Prepaid rent is a balance sheet account, and.

Prepaid Expenses In Balance Sheet Analysis Template Ipsas 20 Financial

Prepaid rent typically represents multiple rent payments, while rent expense is a single. When a business pays rent in advance, it is essentially. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. In short, store a prepaid rent payment on the balance sheet as an asset until the month.

How Are Prepaid Expenses Recorded on the Statement?

Prepaid rent typically represents multiple rent payments, while rent expense is a single. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using the facility to which the rent relates, and then. When a business pays rent in advance, it is essentially. In essence, there is no.

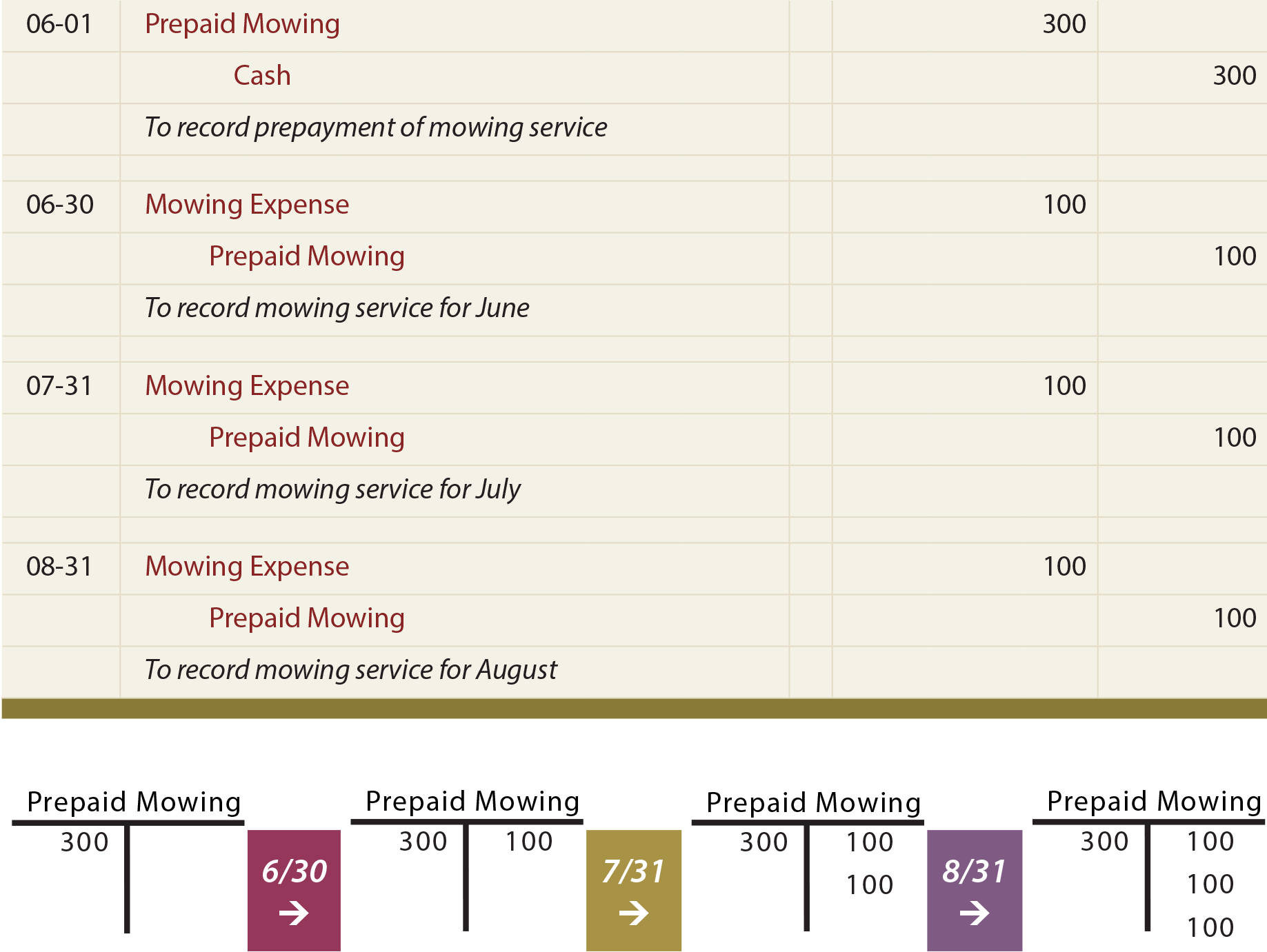

The Adjusting Process And Related Entries laacib

When a business pays rent in advance, it is essentially. Prepaid rent is a balance sheet account, and rent expense is an income statement account. In essence, there is no such account named “prepaid rent” on the balance sheet under the rules of asc 842. Prepaid rent typically represents multiple rent payments, while rent expense is a single. In short,.

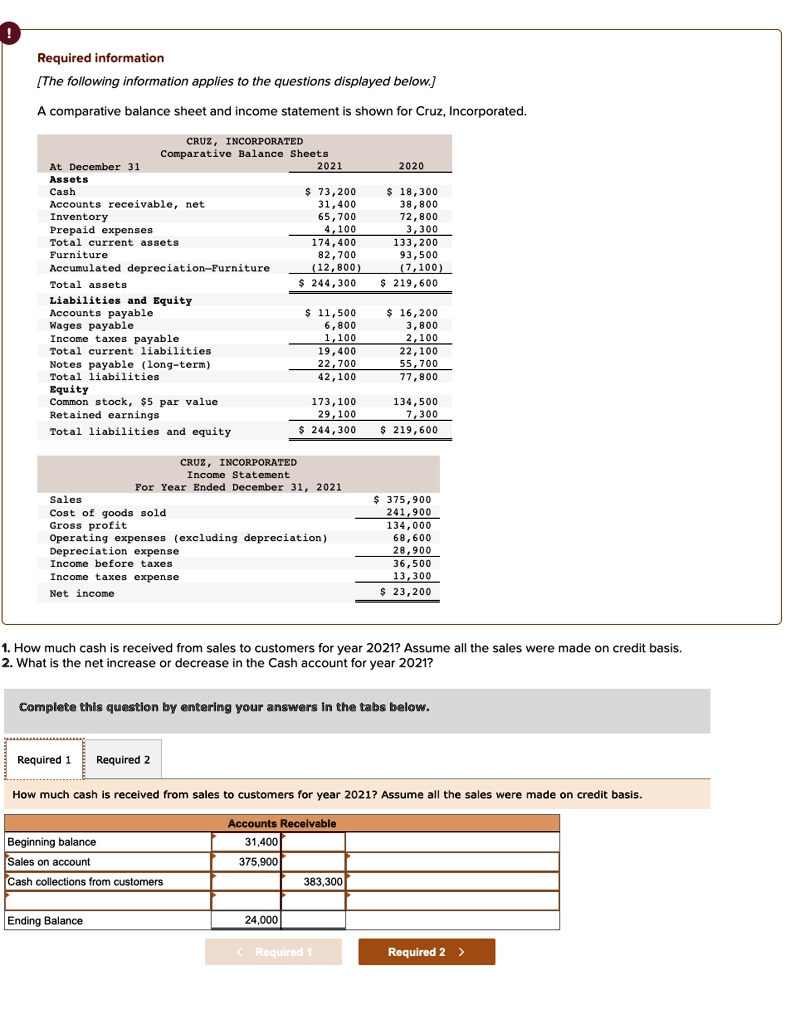

2011 Financial Discussion

In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using the facility to which the rent relates, and then. Prepaid rent is a balance sheet account, and rent expense is an income statement account. When a business pays rent in advance, it is essentially. The business has.

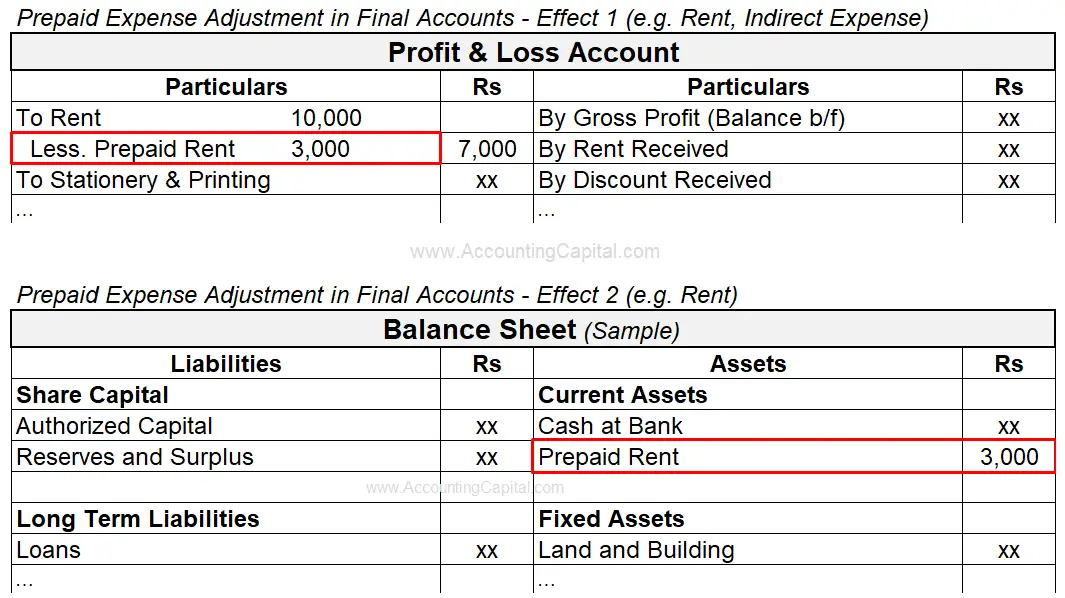

Prepaid Expenses Meaning Example Entry Quiz & More..

The pre paid rent account is a balance. When a business pays rent in advance, it is essentially. In essence, there is no such account named “prepaid rent” on the balance sheet under the rules of asc 842. Prepaid rent typically represents multiple rent payments, while rent expense is a single. Prepaid rent, often classified as a current asset on.

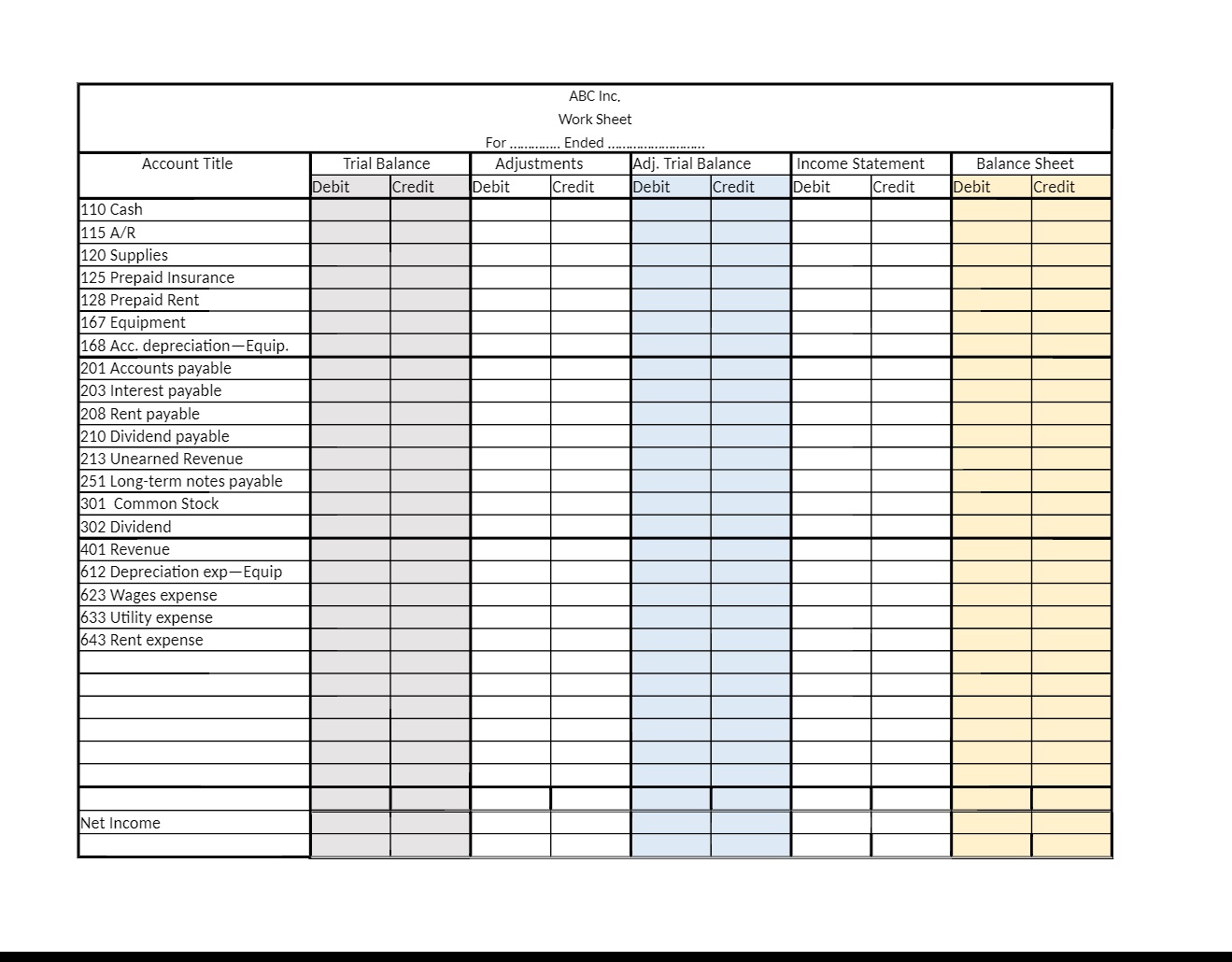

What Is The Basic Accounting Equation Explain With Suitable Example

Prepaid rent typically represents multiple rent payments, while rent expense is a single. Prepaid rent is a balance sheet account, and rent expense is an income statement account. The business has paid the rent in advance and has the right to use the premises for the following three month period of april, may, and june. When a business pays rent.

Prepaid Assets on Balance Sheet Quant RL

The business has paid the rent in advance and has the right to use the premises for the following three month period of april, may, and june. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. Prepaid rent is a balance sheet account, and rent expense is an income.

Prepaid Rent Typically Represents Multiple Rent Payments, While Rent Expense Is A Single.

In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using the facility to which the rent relates, and then. The pre paid rent account is a balance. When a business pays rent in advance, it is essentially. In essence, there is no such account named “prepaid rent” on the balance sheet under the rules of asc 842.

Prepaid Rent Is A Balance Sheet Account, And Rent Expense Is An Income Statement Account.

Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. The business has paid the rent in advance and has the right to use the premises for the following three month period of april, may, and june.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-04-59546336082445fa8db2dd9bbfcf58cb.jpg)