State Of Kansas Tax Warrants - Kdor seizes assets in execution of johnson county tax warrants;. In kansas, tax warrants are issued based on criteria outlined in state statutes. If any tax due to the state of. In some cases where the pay plan exceeds six months, a tax warrant will be filed with the district court to protect the state's. Whenever any taxpayer liable to pay any sales or compensating tax, refuses or neglects to pay the tax, the amount, including any interest or. If you have a state of kansas tax warrant that means the kansas department of revenue (kdor) believes you owe delinquent taxes. Tax warrants are filed by the kansas department of revenue for recovery of delinquent tax obligations. What are my payment options? Kdor seizes assets in execution of douglas county tax warrants; The kansas department of revenue (kdor) can.

Kdor seizes assets in execution of douglas county tax warrants; Kdor seizes assets in execution of johnson county tax warrants;. (a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant to k.s.a. Tax warrants are filed by the kansas department of revenue for recovery of delinquent tax obligations. What are my payment options? If you have a state of kansas tax warrant that means the kansas department of revenue (kdor) believes you owe delinquent taxes. In some cases where the pay plan exceeds six months, a tax warrant will be filed with the district court to protect the state's. In kansas, tax warrants are issued based on criteria outlined in state statutes. The kansas department of revenue (kdor) can. Whenever any taxpayer liable to pay any sales or compensating tax, refuses or neglects to pay the tax, the amount, including any interest or.

The kansas department of revenue (kdor) can. If any tax due to the state of. Whenever any taxpayer liable to pay any sales or compensating tax, refuses or neglects to pay the tax, the amount, including any interest or. Kdor seizes assets in execution of johnson county tax warrants;. Tax warrants are filed by the kansas department of revenue for recovery of delinquent tax obligations. In kansas, tax warrants are issued based on criteria outlined in state statutes. What are my payment options? Kdor seizes assets in execution of douglas county tax warrants; If you have a state of kansas tax warrant that means the kansas department of revenue (kdor) believes you owe delinquent taxes. In some cases where the pay plan exceeds six months, a tax warrant will be filed with the district court to protect the state's.

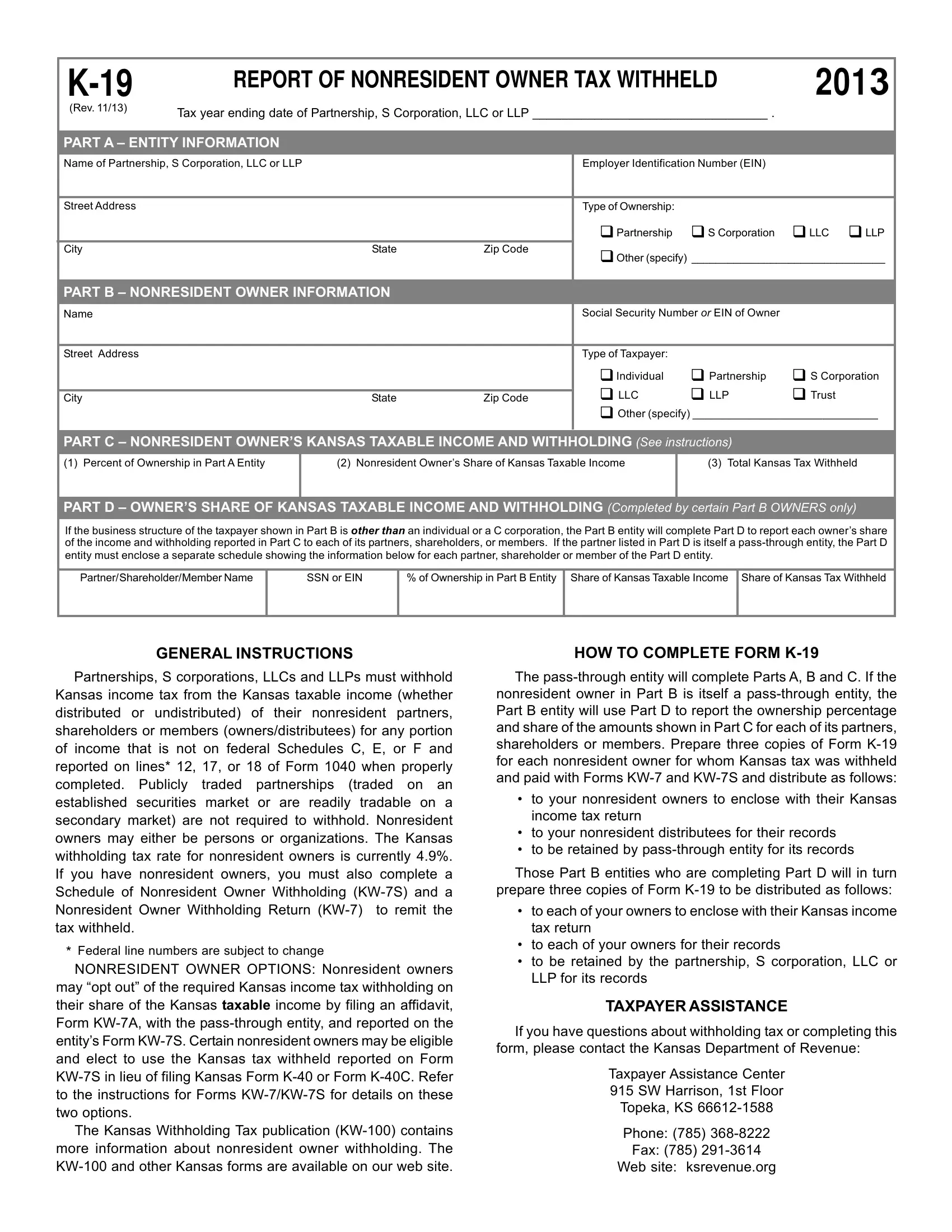

Kansas Form K 19 ≡ Fill Out Printable PDF Forms Online

The kansas department of revenue (kdor) can. (a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant to k.s.a. In kansas, tax warrants are issued based on criteria outlined in state statutes. If you have a state of kansas tax warrant that means the kansas department of revenue (kdor) believes you owe delinquent taxes. Tax warrants.

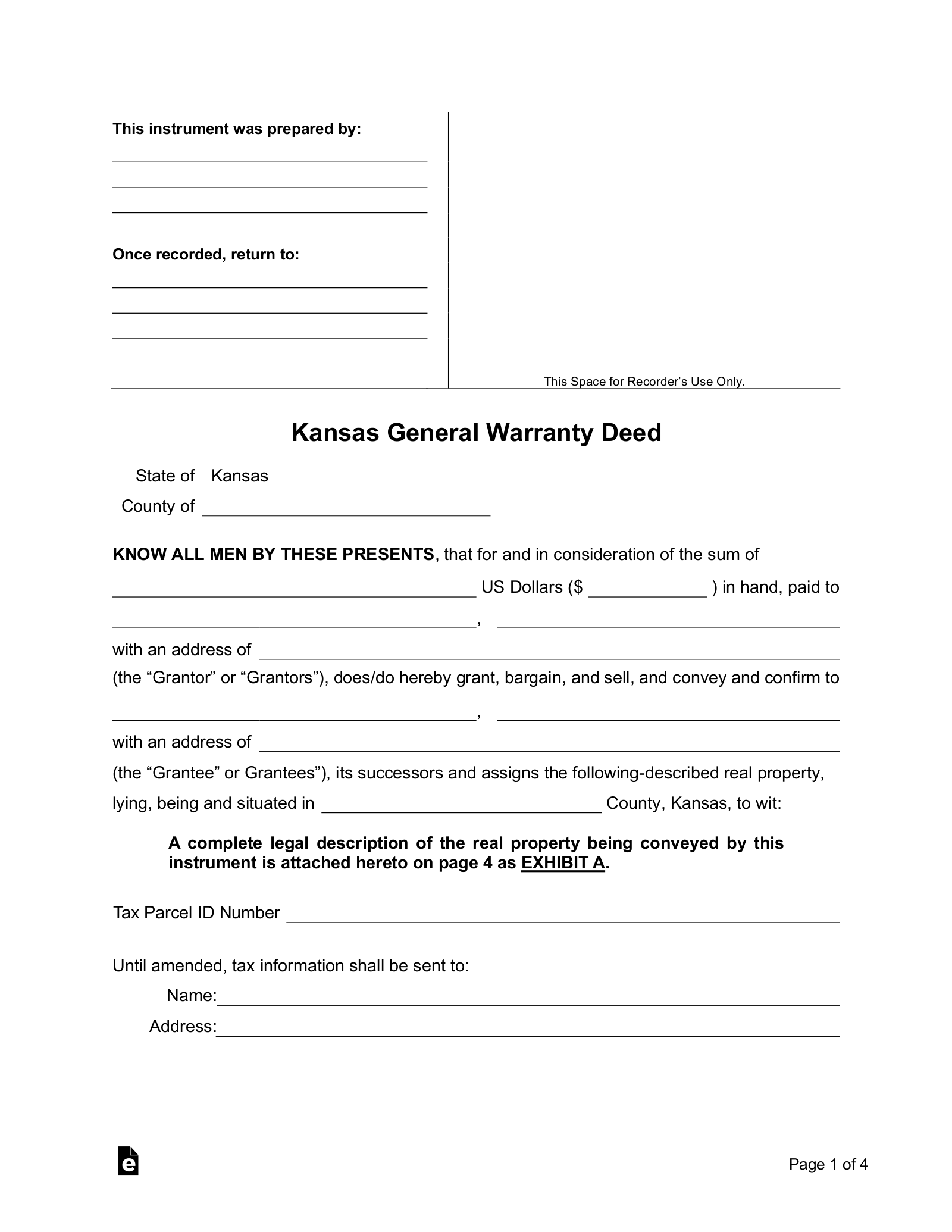

Sample Kansas Warranty Deed Template » Forms 2025

Kdor seizes assets in execution of johnson county tax warrants;. If any tax due to the state of. Tax warrants are filed by the kansas department of revenue for recovery of delinquent tax obligations. In kansas, tax warrants are issued based on criteria outlined in state statutes. What are my payment options?

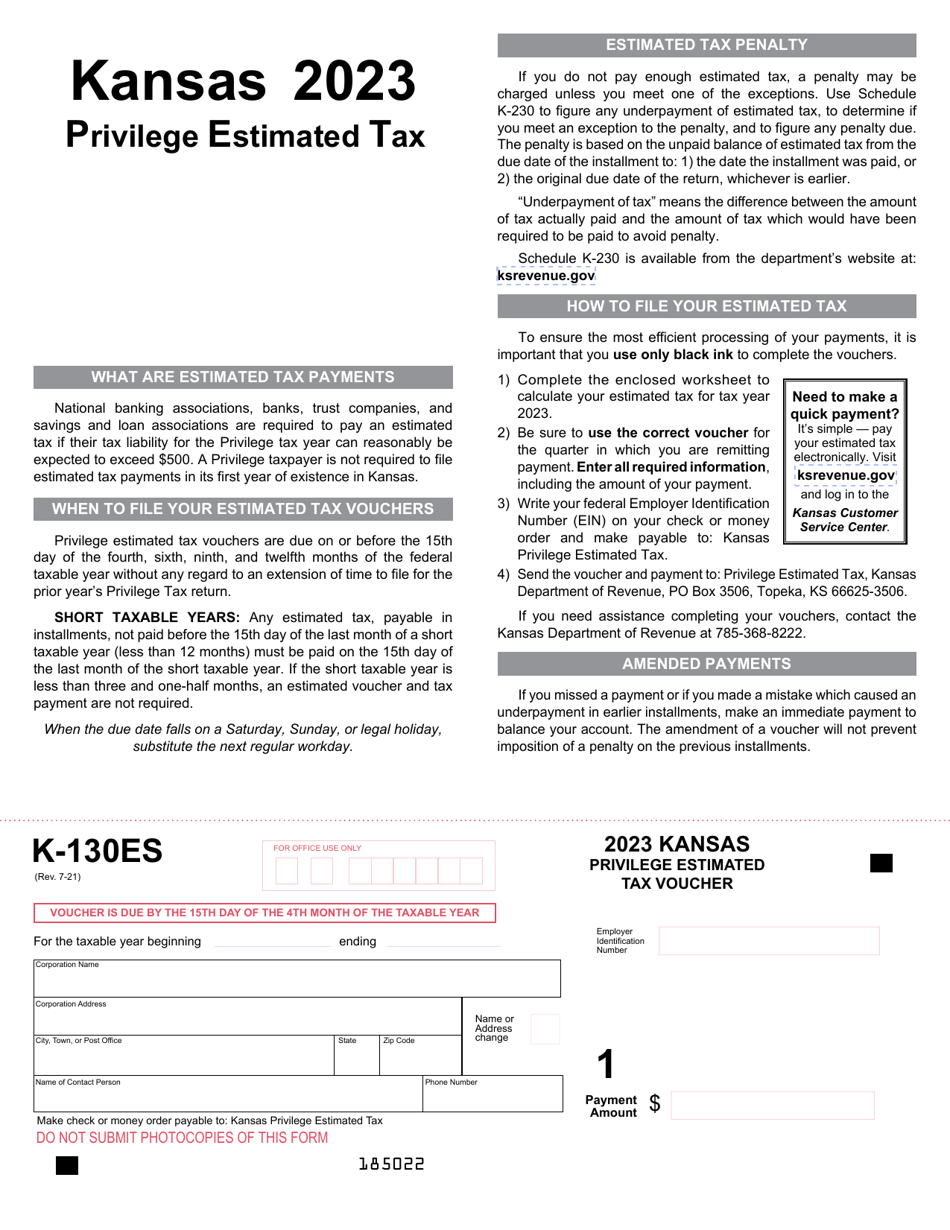

Form K130ES 2023 Fill Out, Sign Online and Download Fillable PDF

What are my payment options? Kdor seizes assets in execution of douglas county tax warrants; In kansas, tax warrants are issued based on criteria outlined in state statutes. If you have a state of kansas tax warrant that means the kansas department of revenue (kdor) believes you owe delinquent taxes. Tax warrants are filed by the kansas department of revenue.

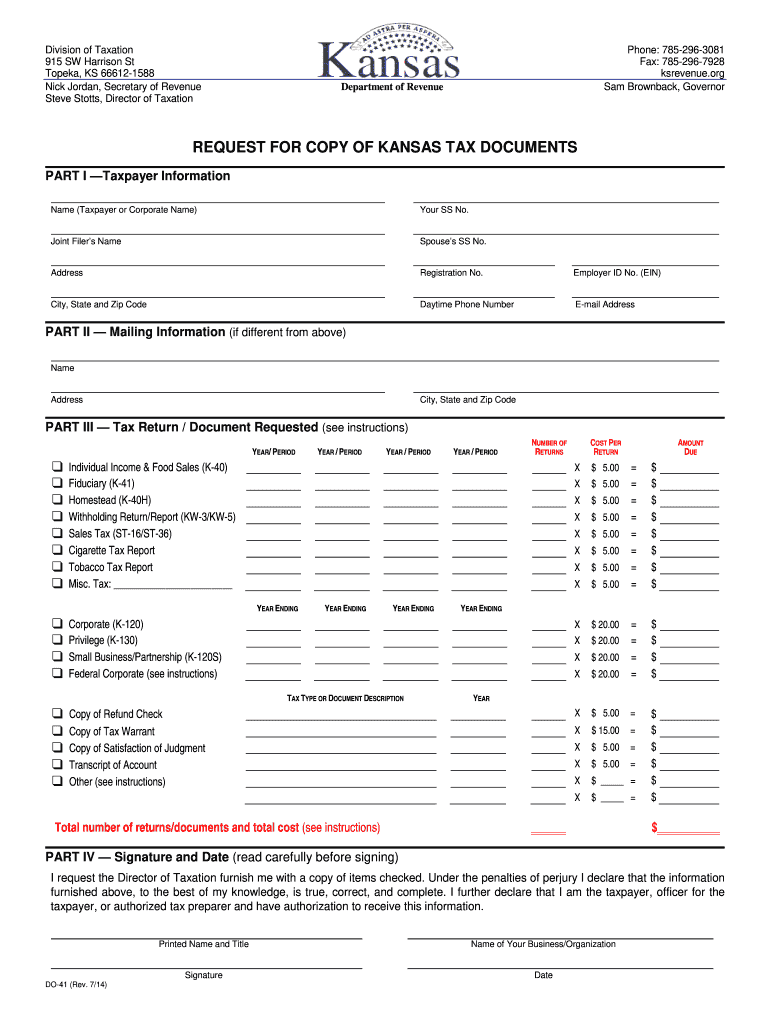

DO 41 Request for Copy of Kansas Tax Documents or Access Rev 7 14 Copy

If you have a state of kansas tax warrant that means the kansas department of revenue (kdor) believes you owe delinquent taxes. If any tax due to the state of. Kdor seizes assets in execution of johnson county tax warrants;. The kansas department of revenue (kdor) can. In some cases where the pay plan exceeds six months, a tax warrant.

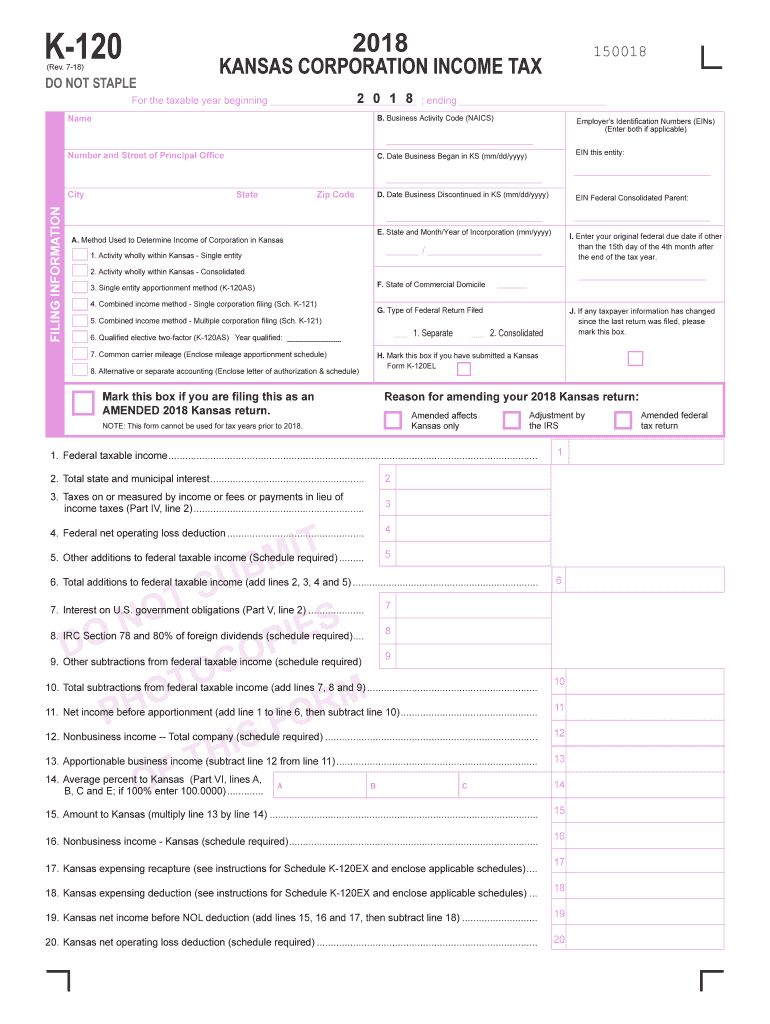

K 120s Instructions 20182025 Form Fill Out and Sign Printable PDF

In some cases where the pay plan exceeds six months, a tax warrant will be filed with the district court to protect the state's. Tax warrants are filed by the kansas department of revenue for recovery of delinquent tax obligations. If any tax due to the state of. What are my payment options? Kdor seizes assets in execution of johnson.

Kansas Department of Revenue KW100 Kansas withholding Tax Guide

Kdor seizes assets in execution of johnson county tax warrants;. In kansas, tax warrants are issued based on criteria outlined in state statutes. Whenever any taxpayer liable to pay any sales or compensating tax, refuses or neglects to pay the tax, the amount, including any interest or. If any tax due to the state of. If you have a state.

Kansas Department of Revenue KW100 Kansas withholding Tax Guide

Whenever any taxpayer liable to pay any sales or compensating tax, refuses or neglects to pay the tax, the amount, including any interest or. Kdor seizes assets in execution of douglas county tax warrants; What are my payment options? (a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant to k.s.a. Tax warrants are filed by.

Free Kansas General Warranty Deed Form PDF Word eForms

Kdor seizes assets in execution of douglas county tax warrants; In some cases where the pay plan exceeds six months, a tax warrant will be filed with the district court to protect the state's. If any tax due to the state of. The kansas department of revenue (kdor) can. Kdor seizes assets in execution of johnson county tax warrants;.

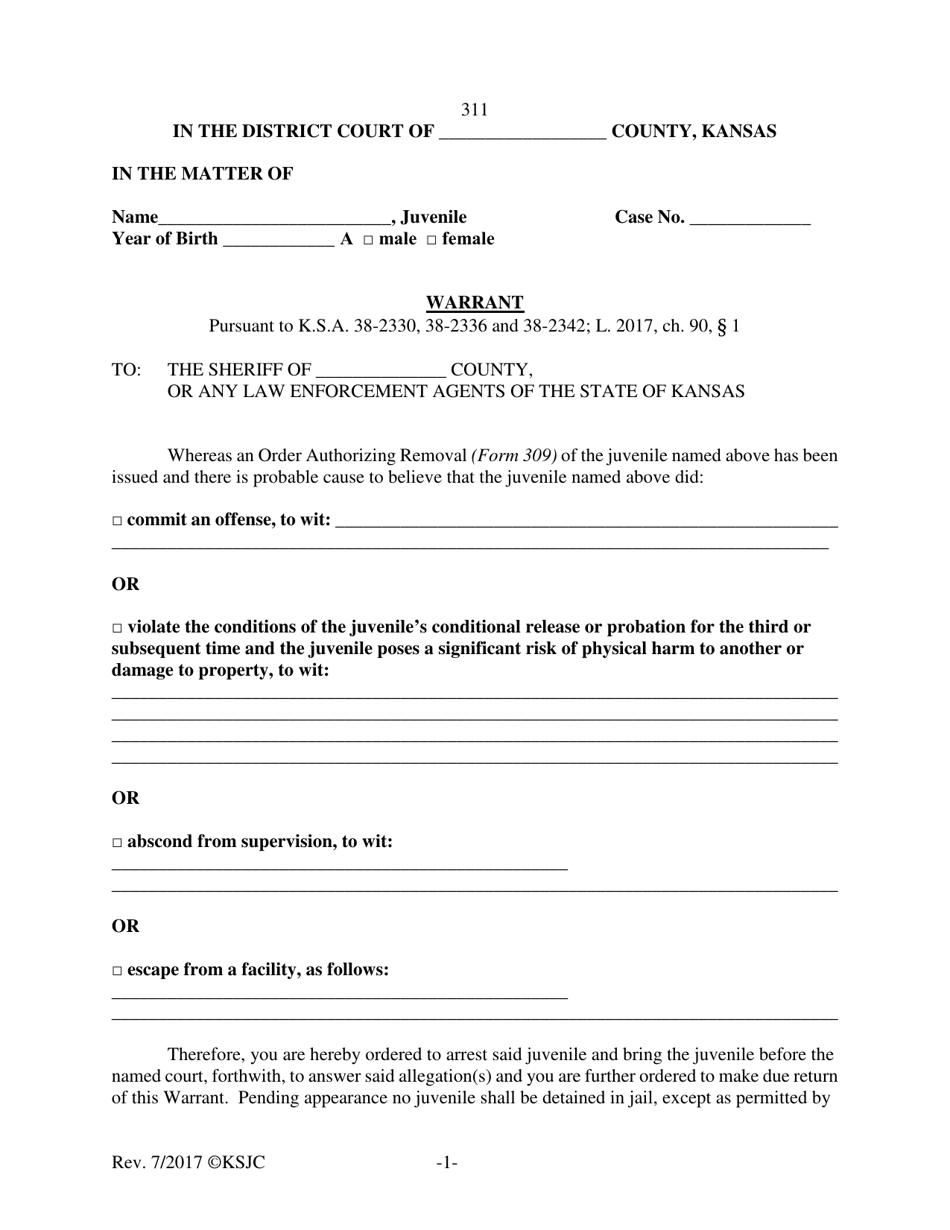

Form 311 Fill Out, Sign Online and Download Printable PDF, Kansas

Kdor seizes assets in execution of douglas county tax warrants; Tax warrants are filed by the kansas department of revenue for recovery of delinquent tax obligations. (a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant to k.s.a. Whenever any taxpayer liable to pay any sales or compensating tax, refuses or neglects to pay the tax,.

How To Check For Warrants In Wichita, Kansas? YouTube

Tax warrants are filed by the kansas department of revenue for recovery of delinquent tax obligations. Kdor seizes assets in execution of douglas county tax warrants; The kansas department of revenue (kdor) can. Kdor seizes assets in execution of johnson county tax warrants;. What are my payment options?

Kdor Seizes Assets In Execution Of Douglas County Tax Warrants;

(a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant to k.s.a. In kansas, tax warrants are issued based on criteria outlined in state statutes. In some cases where the pay plan exceeds six months, a tax warrant will be filed with the district court to protect the state's. If you have a state of kansas tax warrant that means the kansas department of revenue (kdor) believes you owe delinquent taxes.

The Kansas Department Of Revenue (Kdor) Can.

What are my payment options? Whenever any taxpayer liable to pay any sales or compensating tax, refuses or neglects to pay the tax, the amount, including any interest or. Kdor seizes assets in execution of johnson county tax warrants;. If any tax due to the state of.