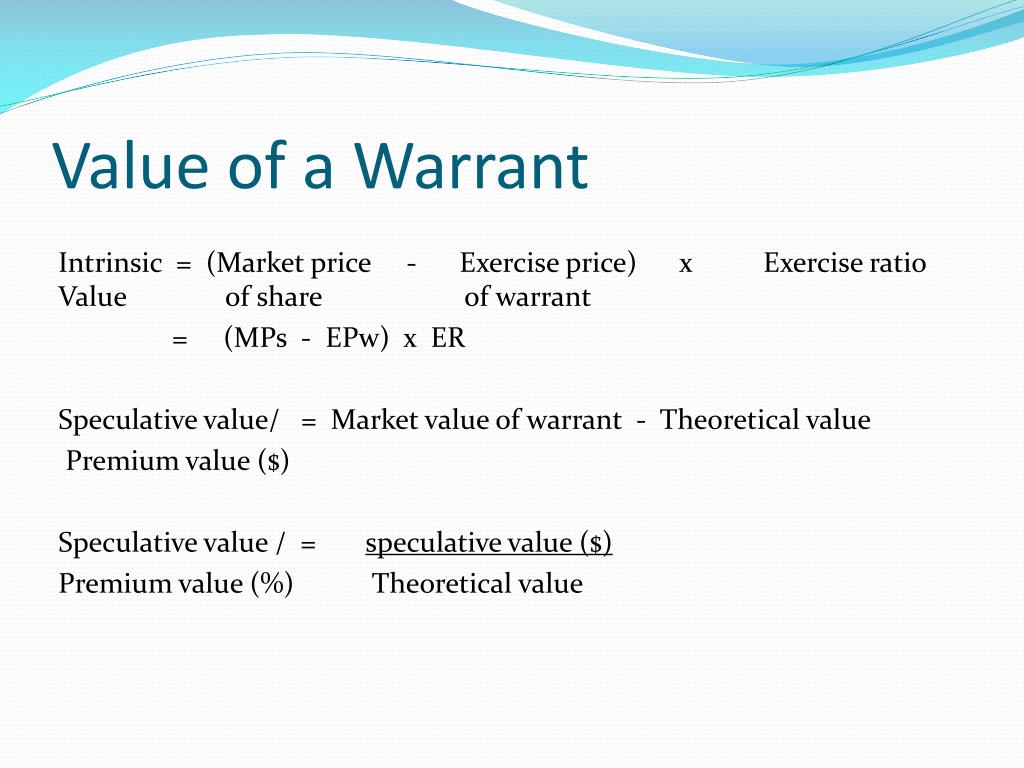

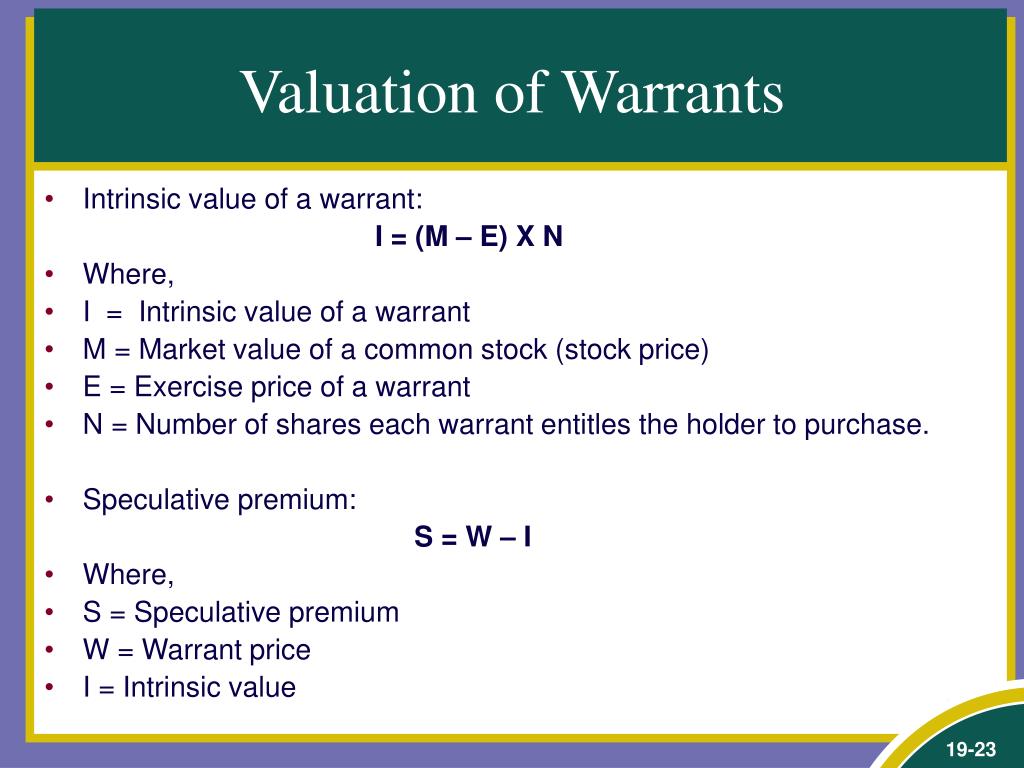

Valuing A Warrant - They will either go broke or be. If this is a moonshot type company (i.e. A stock warrant grants you the right to buy stock at a certain price on a specific date. The two main rules to account for stock warrants are that the issuer must recognize the fair value of the equity instruments issued. To value a warrant, it is crucial to consider several factors, including the underlying stock price, strike price, time to expiration,. Explore the essentials of warrant accounting and valuation, including key components, methods, and financial reporting. To determine the value of a warrant, you must. There's not going to be a perfect answer for this. To calculate the warrant value, subtract the strike price from the current market price to determine the intrinsic value (if positive), then add the.

The two main rules to account for stock warrants are that the issuer must recognize the fair value of the equity instruments issued. If this is a moonshot type company (i.e. There's not going to be a perfect answer for this. To determine the value of a warrant, you must. They will either go broke or be. Explore the essentials of warrant accounting and valuation, including key components, methods, and financial reporting. A stock warrant grants you the right to buy stock at a certain price on a specific date. To value a warrant, it is crucial to consider several factors, including the underlying stock price, strike price, time to expiration,. To calculate the warrant value, subtract the strike price from the current market price to determine the intrinsic value (if positive), then add the.

If this is a moonshot type company (i.e. There's not going to be a perfect answer for this. A stock warrant grants you the right to buy stock at a certain price on a specific date. To calculate the warrant value, subtract the strike price from the current market price to determine the intrinsic value (if positive), then add the. Explore the essentials of warrant accounting and valuation, including key components, methods, and financial reporting. They will either go broke or be. To value a warrant, it is crucial to consider several factors, including the underlying stock price, strike price, time to expiration,. The two main rules to account for stock warrants are that the issuer must recognize the fair value of the equity instruments issued. To determine the value of a warrant, you must.

PPT Chapter 11 PowerPoint Presentation, free download ID3790721

A stock warrant grants you the right to buy stock at a certain price on a specific date. To determine the value of a warrant, you must. To calculate the warrant value, subtract the strike price from the current market price to determine the intrinsic value (if positive), then add the. The two main rules to account for stock warrants.

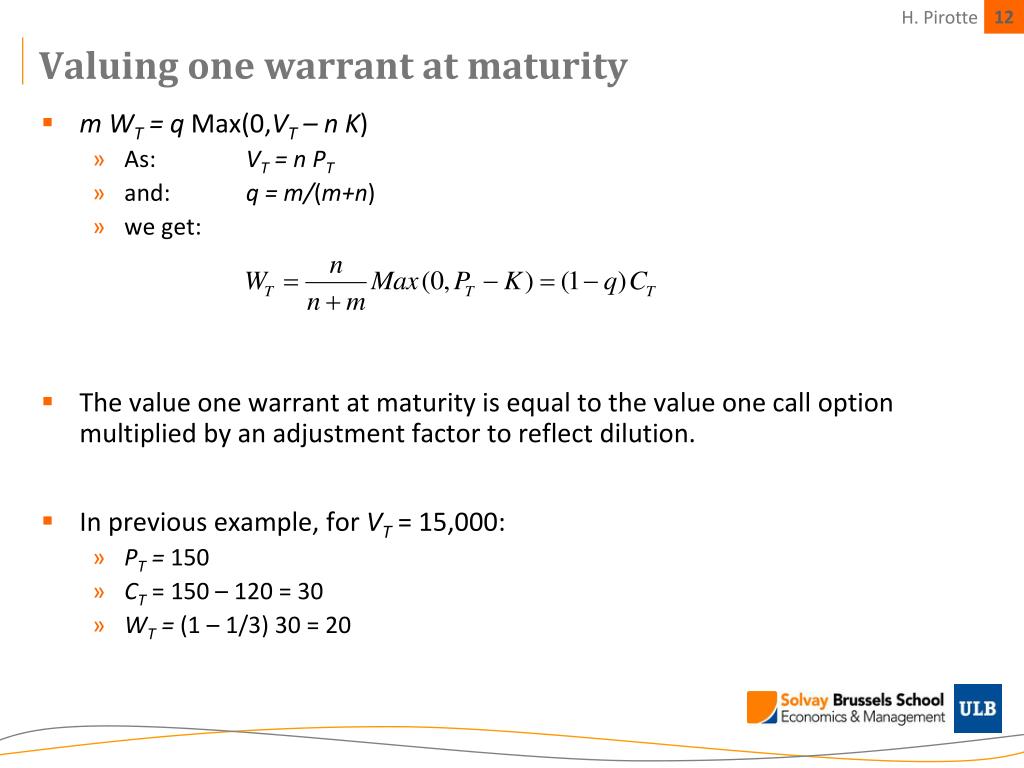

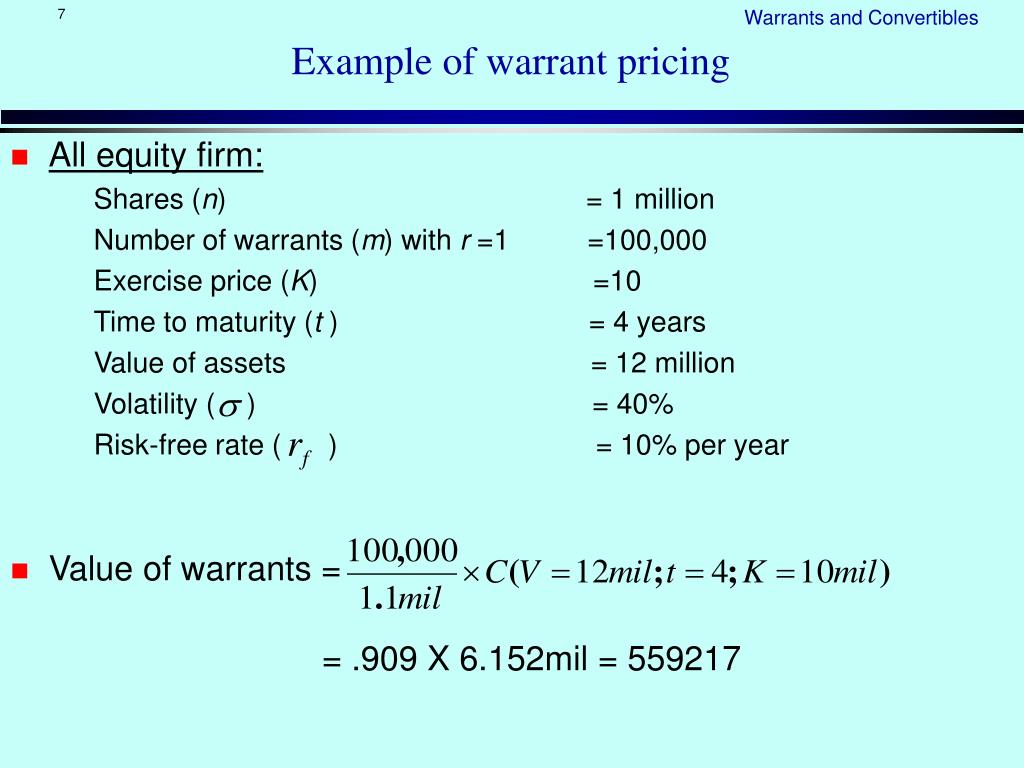

PPT Corporate Valuation and Financing PowerPoint Presentation, free

Explore the essentials of warrant accounting and valuation, including key components, methods, and financial reporting. A stock warrant grants you the right to buy stock at a certain price on a specific date. To determine the value of a warrant, you must. To value a warrant, it is crucial to consider several factors, including the underlying stock price, strike price,.

Learning Objectives Calculate the conversion value of a convertible

To calculate the warrant value, subtract the strike price from the current market price to determine the intrinsic value (if positive), then add the. The two main rules to account for stock warrants are that the issuer must recognize the fair value of the equity instruments issued. If this is a moonshot type company (i.e. Explore the essentials of warrant.

How Long Does It Take for a Warrant To Be Issued? Criminal Lawyer News

There's not going to be a perfect answer for this. To calculate the warrant value, subtract the strike price from the current market price to determine the intrinsic value (if positive), then add the. The two main rules to account for stock warrants are that the issuer must recognize the fair value of the equity instruments issued. A stock warrant.

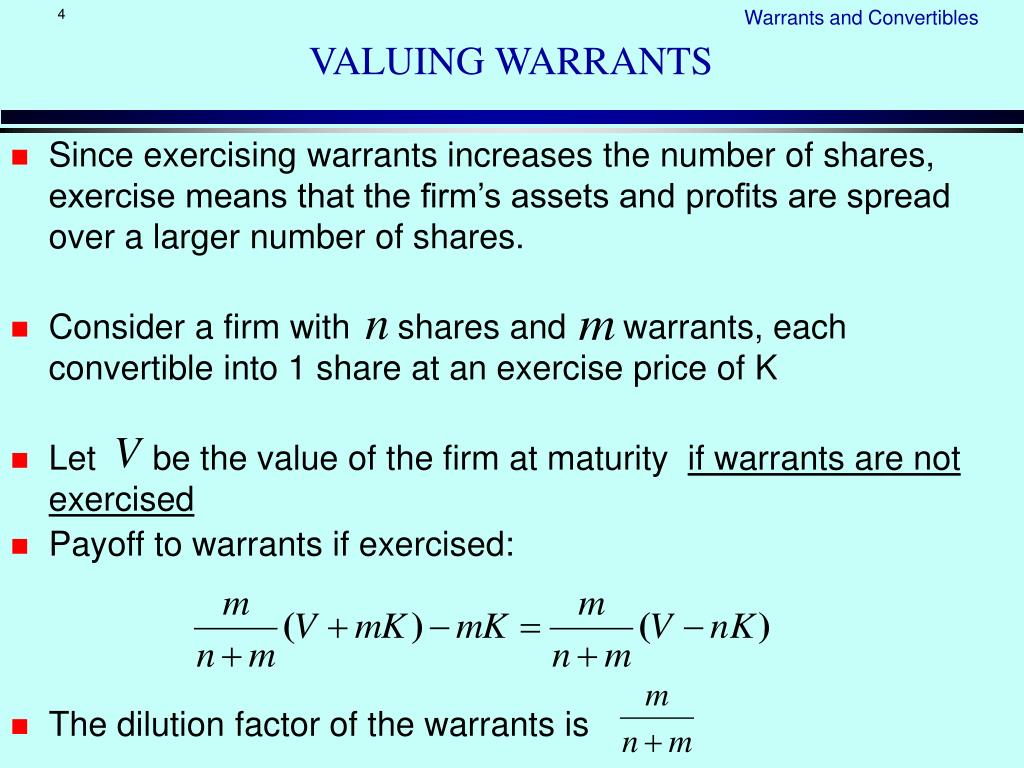

PPT Warrants and Convertibles PowerPoint Presentation, free download

To calculate the warrant value, subtract the strike price from the current market price to determine the intrinsic value (if positive), then add the. There's not going to be a perfect answer for this. They will either go broke or be. To determine the value of a warrant, you must. The two main rules to account for stock warrants are.

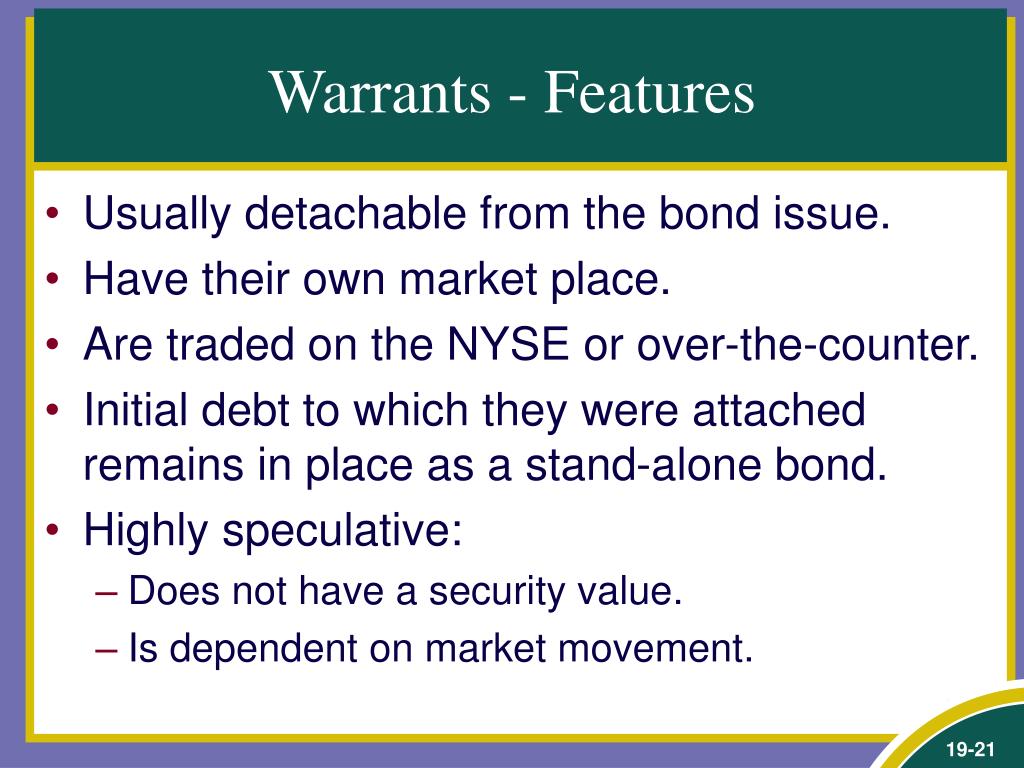

PPT Convertibles, Warrants, and Derivatives PowerPoint Presentation

To value a warrant, it is crucial to consider several factors, including the underlying stock price, strike price, time to expiration,. To determine the value of a warrant, you must. If this is a moonshot type company (i.e. To calculate the warrant value, subtract the strike price from the current market price to determine the intrinsic value (if positive), then.

PPT Convertibles, Warrants, and Derivatives PowerPoint Presentation

To value a warrant, it is crucial to consider several factors, including the underlying stock price, strike price, time to expiration,. To determine the value of a warrant, you must. To calculate the warrant value, subtract the strike price from the current market price to determine the intrinsic value (if positive), then add the. A stock warrant grants you the.

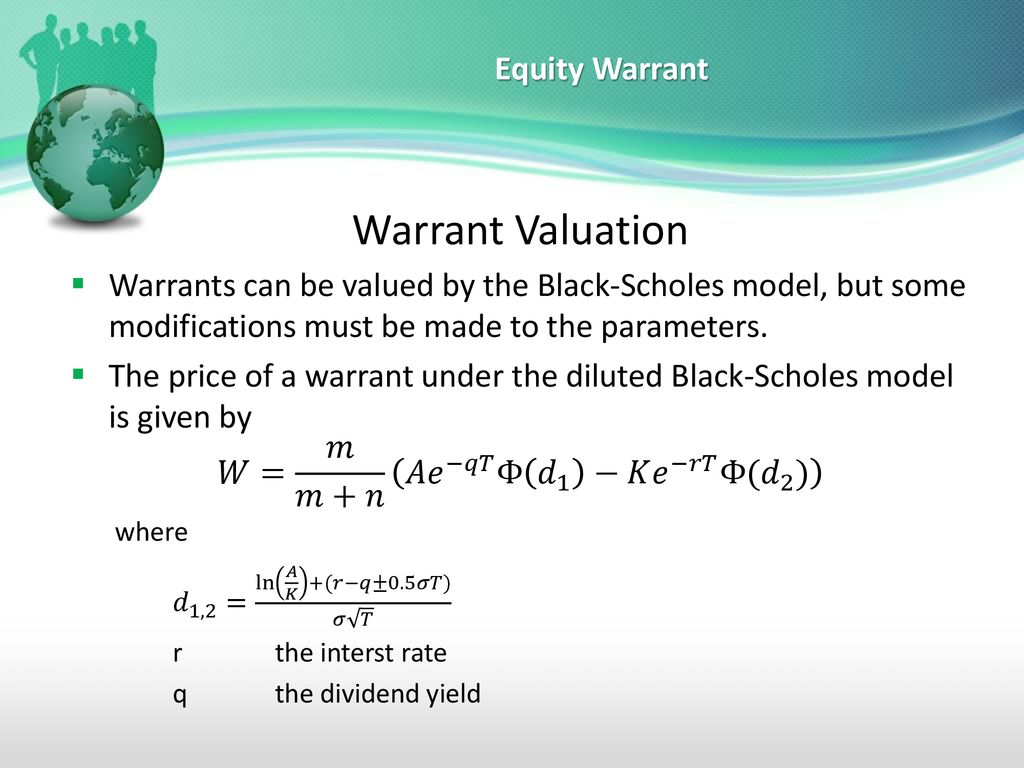

Equity Warrant Difinitin and Pricing Guide ppt download

There's not going to be a perfect answer for this. To determine the value of a warrant, you must. They will either go broke or be. Explore the essentials of warrant accounting and valuation, including key components, methods, and financial reporting. To calculate the warrant value, subtract the strike price from the current market price to determine the intrinsic value.

PPT Warrants and Convertibles PowerPoint Presentation, free download

If this is a moonshot type company (i.e. Explore the essentials of warrant accounting and valuation, including key components, methods, and financial reporting. To value a warrant, it is crucial to consider several factors, including the underlying stock price, strike price, time to expiration,. The two main rules to account for stock warrants are that the issuer must recognize the.

Equity Warrant Difinitin and Pricing Guide ppt download

There's not going to be a perfect answer for this. To calculate the warrant value, subtract the strike price from the current market price to determine the intrinsic value (if positive), then add the. Explore the essentials of warrant accounting and valuation, including key components, methods, and financial reporting. A stock warrant grants you the right to buy stock at.

There's Not Going To Be A Perfect Answer For This.

A stock warrant grants you the right to buy stock at a certain price on a specific date. They will either go broke or be. Explore the essentials of warrant accounting and valuation, including key components, methods, and financial reporting. To determine the value of a warrant, you must.

To Value A Warrant, It Is Crucial To Consider Several Factors, Including The Underlying Stock Price, Strike Price, Time To Expiration,.

The two main rules to account for stock warrants are that the issuer must recognize the fair value of the equity instruments issued. If this is a moonshot type company (i.e. To calculate the warrant value, subtract the strike price from the current market price to determine the intrinsic value (if positive), then add the.

+x+N.jpg)

.jpg)