Vanguard 2065 Fund Fact Sheet - Vanguard target retirement 2065 fund is one of a series of vanguard funds that use a targeted maturity approach as a simplified way to meet. The fund s investment objective is to achieve an increase in value and, consistent with a gradually changing asset allocation, hold investments. Vanguard target retirement 2065 fund seeks to provide capital appreciation and current income consistent with its current asset allocation. The year in the fund name refers to the approximate year 2065 when an investor in the fund would retire and leave the workforce. The fund invests in a mix of vanguard mutual funds (underlying funds) according to an asset allocation strategy designed for investors. The fund invests in a mix of vanguard mutual funds according to an asset allocation strategy designed for investors planning to retire and. The fund’s investment objective is to achieve an increase in value and, consistent with a gradually changing asset allocation, hold.

Vanguard target retirement 2065 fund seeks to provide capital appreciation and current income consistent with its current asset allocation. The fund’s investment objective is to achieve an increase in value and, consistent with a gradually changing asset allocation, hold. The fund invests in a mix of vanguard mutual funds according to an asset allocation strategy designed for investors planning to retire and. The fund s investment objective is to achieve an increase in value and, consistent with a gradually changing asset allocation, hold investments. The year in the fund name refers to the approximate year 2065 when an investor in the fund would retire and leave the workforce. Vanguard target retirement 2065 fund is one of a series of vanguard funds that use a targeted maturity approach as a simplified way to meet. The fund invests in a mix of vanguard mutual funds (underlying funds) according to an asset allocation strategy designed for investors.

Vanguard target retirement 2065 fund seeks to provide capital appreciation and current income consistent with its current asset allocation. The year in the fund name refers to the approximate year 2065 when an investor in the fund would retire and leave the workforce. The fund invests in a mix of vanguard mutual funds (underlying funds) according to an asset allocation strategy designed for investors. The fund’s investment objective is to achieve an increase in value and, consistent with a gradually changing asset allocation, hold. The fund s investment objective is to achieve an increase in value and, consistent with a gradually changing asset allocation, hold investments. Vanguard target retirement 2065 fund is one of a series of vanguard funds that use a targeted maturity approach as a simplified way to meet. The fund invests in a mix of vanguard mutual funds according to an asset allocation strategy designed for investors planning to retire and.

Vanguard Target Retirement Fund Review

The fund’s investment objective is to achieve an increase in value and, consistent with a gradually changing asset allocation, hold. The fund s investment objective is to achieve an increase in value and, consistent with a gradually changing asset allocation, hold investments. The year in the fund name refers to the approximate year 2065 when an investor in the fund.

Vanguard Target Retirement Funds Blind Faith In Market Efficiency

The fund invests in a mix of vanguard mutual funds (underlying funds) according to an asset allocation strategy designed for investors. The fund invests in a mix of vanguard mutual funds according to an asset allocation strategy designed for investors planning to retire and. Vanguard target retirement 2065 fund seeks to provide capital appreciation and current income consistent with its.

Invested (ex employer’s) 457(b) in vanguard target fund 2065. Fact

The fund invests in a mix of vanguard mutual funds (underlying funds) according to an asset allocation strategy designed for investors. The fund s investment objective is to achieve an increase in value and, consistent with a gradually changing asset allocation, hold investments. Vanguard target retirement 2065 fund seeks to provide capital appreciation and current income consistent with its current.

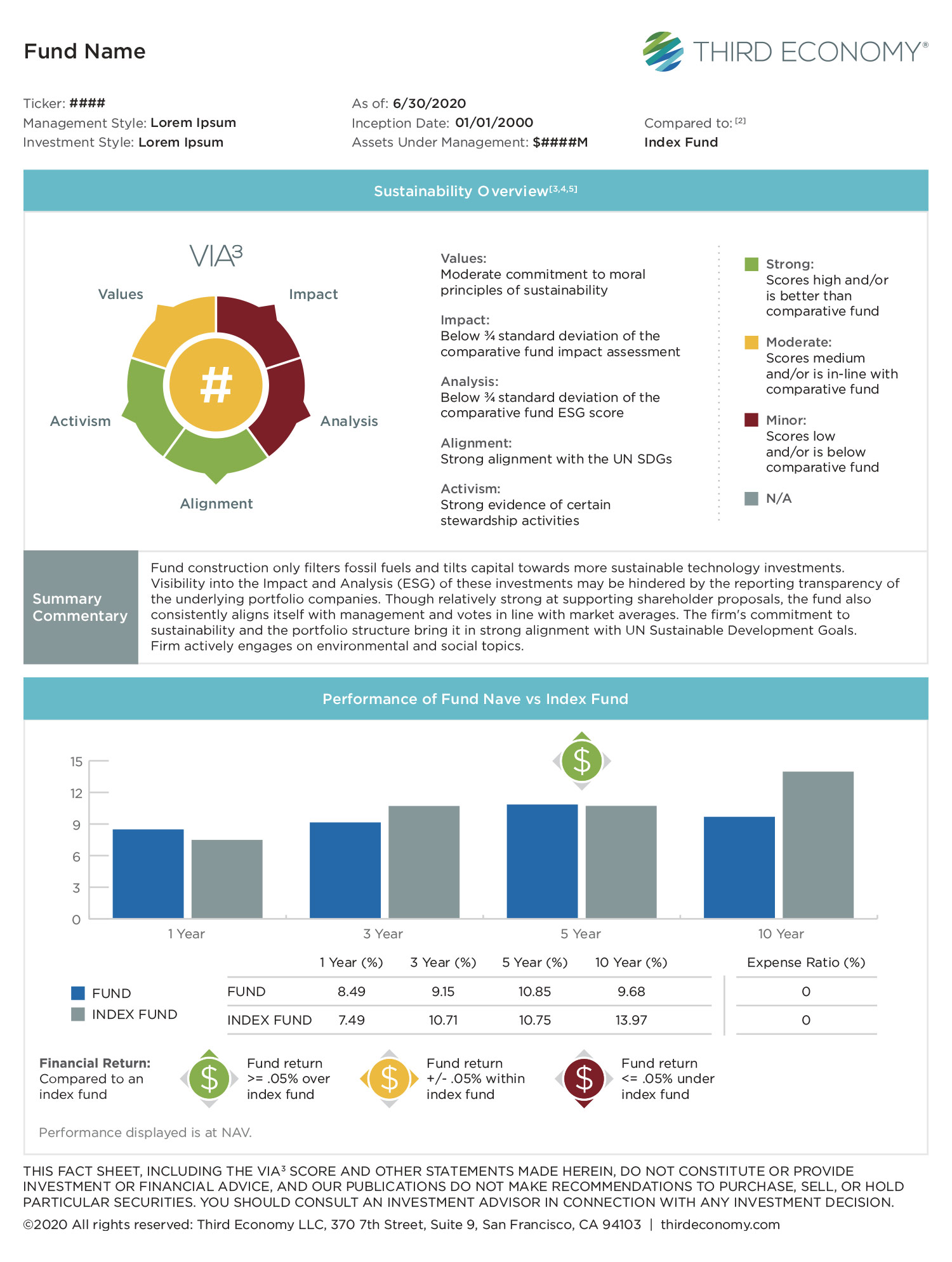

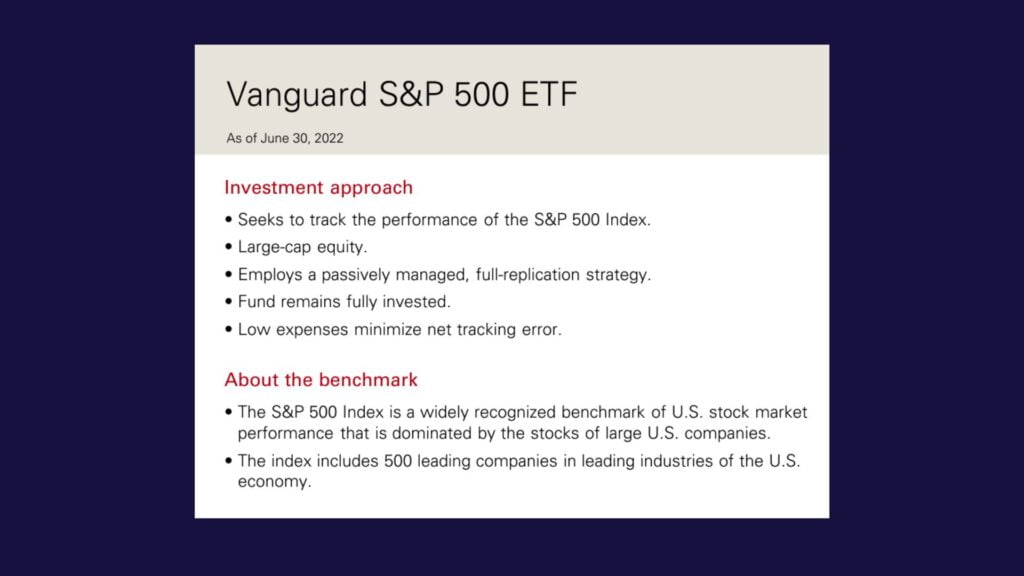

How To Read An ETF Fact Sheet Easily (2024) New Money Blog

The fund invests in a mix of vanguard mutual funds (underlying funds) according to an asset allocation strategy designed for investors. The fund invests in a mix of vanguard mutual funds according to an asset allocation strategy designed for investors planning to retire and. The fund’s investment objective is to achieve an increase in value and, consistent with a gradually.

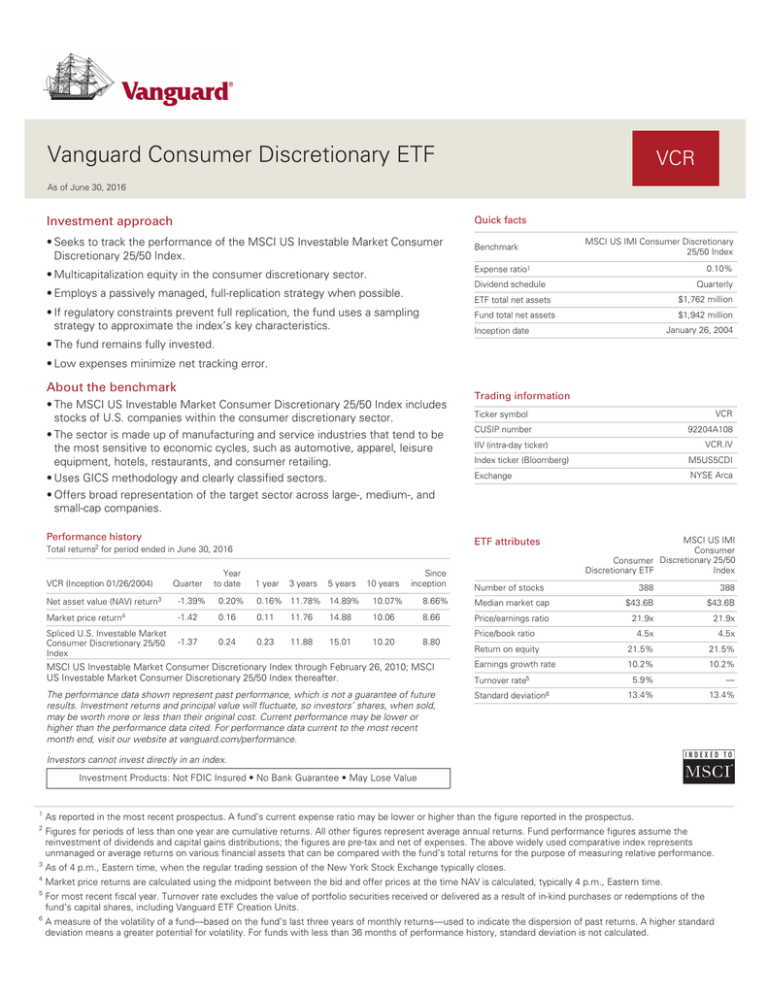

Vanguard Consumer Discretionary ETF Fact Sheet

The fund invests in a mix of vanguard mutual funds according to an asset allocation strategy designed for investors planning to retire and. Vanguard target retirement 2065 fund seeks to provide capital appreciation and current income consistent with its current asset allocation. The fund invests in a mix of vanguard mutual funds (underlying funds) according to an asset allocation strategy.

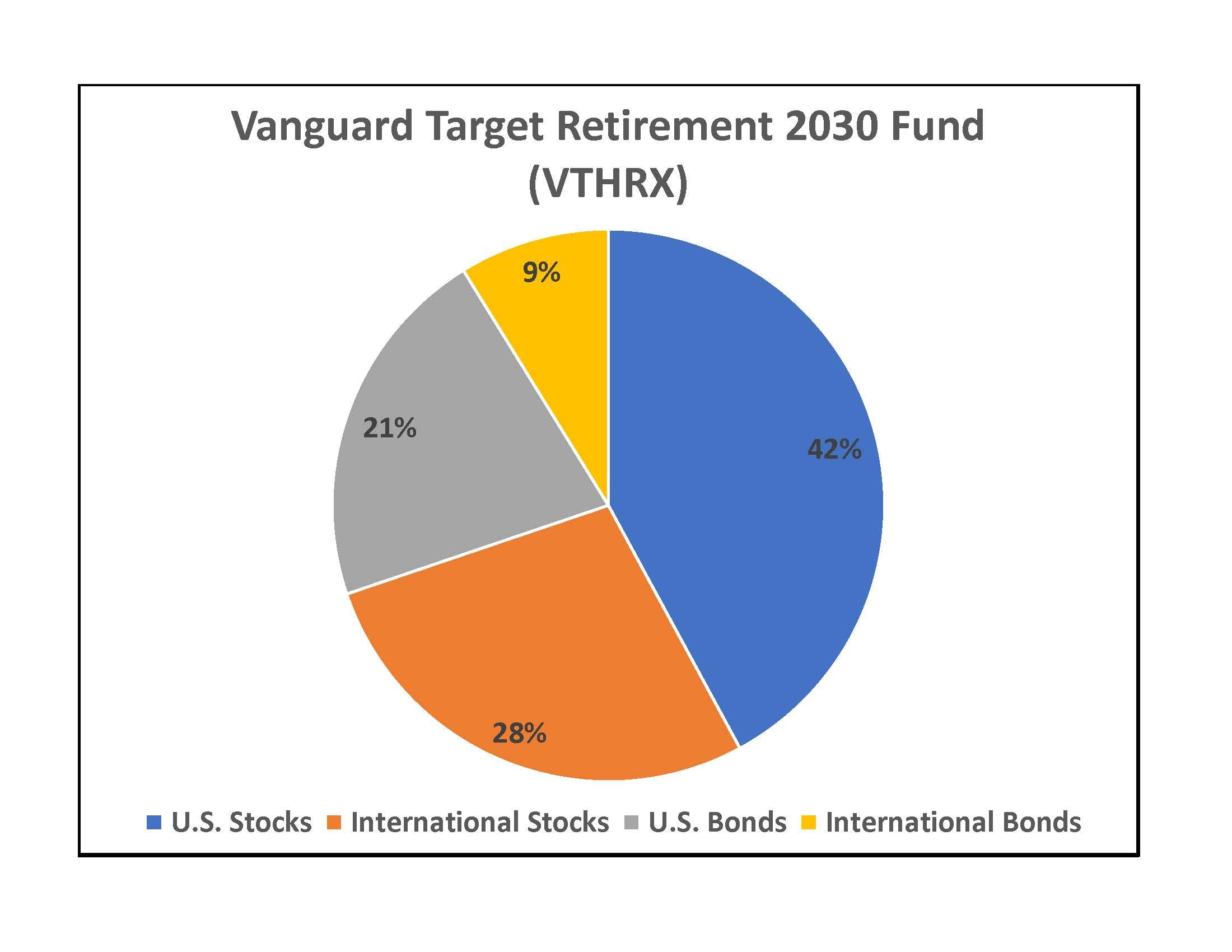

Vanguard LifeStrategy or Target Date Retirement Funds Which is The

The fund s investment objective is to achieve an increase in value and, consistent with a gradually changing asset allocation, hold investments. Vanguard target retirement 2065 fund seeks to provide capital appreciation and current income consistent with its current asset allocation. Vanguard target retirement 2065 fund is one of a series of vanguard funds that use a targeted maturity approach.

Asset Allocation What You Need To Know — Financial Tortoise

Vanguard target retirement 2065 fund seeks to provide capital appreciation and current income consistent with its current asset allocation. The fund s investment objective is to achieve an increase in value and, consistent with a gradually changing asset allocation, hold investments. The fund invests in a mix of vanguard mutual funds according to an asset allocation strategy designed for investors.

Vmlux Fact Sheet

Vanguard target retirement 2065 fund seeks to provide capital appreciation and current income consistent with its current asset allocation. The fund s investment objective is to achieve an increase in value and, consistent with a gradually changing asset allocation, hold investments. The year in the fund name refers to the approximate year 2065 when an investor in the fund would.

A CrossExamination of LifeCycle Funds

Vanguard target retirement 2065 fund seeks to provide capital appreciation and current income consistent with its current asset allocation. Vanguard target retirement 2065 fund is one of a series of vanguard funds that use a targeted maturity approach as a simplified way to meet. The fund invests in a mix of vanguard mutual funds (underlying funds) according to an asset.

How to read a fund fact sheet Monevator

The fund s investment objective is to achieve an increase in value and, consistent with a gradually changing asset allocation, hold investments. The fund invests in a mix of vanguard mutual funds (underlying funds) according to an asset allocation strategy designed for investors. Vanguard target retirement 2065 fund seeks to provide capital appreciation and current income consistent with its current.

Vanguard Target Retirement 2065 Fund Seeks To Provide Capital Appreciation And Current Income Consistent With Its Current Asset Allocation.

The fund invests in a mix of vanguard mutual funds (underlying funds) according to an asset allocation strategy designed for investors. Vanguard target retirement 2065 fund is one of a series of vanguard funds that use a targeted maturity approach as a simplified way to meet. The year in the fund name refers to the approximate year 2065 when an investor in the fund would retire and leave the workforce. The fund’s investment objective is to achieve an increase in value and, consistent with a gradually changing asset allocation, hold.

The Fund Invests In A Mix Of Vanguard Mutual Funds According To An Asset Allocation Strategy Designed For Investors Planning To Retire And.

The fund s investment objective is to achieve an increase in value and, consistent with a gradually changing asset allocation, hold investments.

.png)